Problem Statement

Introduction

This research paper critically illustrates the perceptions and attitudes of the WTO membership connecting the socioeconomic responses in the Gulf Arab region and factors touching the motivation and exploration of the GCC policymakers within the existing practice of necessary reformations suggested by WTO that emerged and experienced by the economic indicators of Saudi Arabia. The prescriptions and regulations issued by the WTO up to till, all the GCC member states have integrated most of them, but there is no remarkable evidence to establish any sustainable improvement in the non-oil sector for international trade and even failed to meet the local market demand, this paper has organized to address these issues.

Background of the problem

The GCC member states had decided to implement a single currency with a common market without birder barriers among them by 2010, but their engagement to meet the requirements of legislative and local market reformation for WTO membership has delayed the establishment of the single monetary authority such as GCC central bank. The Al Watan Daily (2011, p.1) reported that the foreign ministers of GCC urged that it would not be possible for GCC to implement the single currency with common customs and monetary union until 2015, although the process of establishing the GCC Central Bank at the final stage. Such delay in establishing the strong single currency would make the member countries continue their international trade transactions through the US dollar which is a significant dilemma to achieve competitive advantages by the member states as the falling US dollar price in the international market would impose an extra burden in this region.

IMF (2003, p.1) reported that the prescription of WTO kept full pressure to open the service sector of GCC at 100% foreign ownership and encouraging private sector development for which the GCC members are required to introduce new legislation amending the existing investment regulations. Moreover, the GCC countries have scares for the local labor force and are mostly dependent on the overseas working force from Asian countries, and the population growth rate is very low where no significant indication to achieve local human resources for economic activity and no significant progress for diversification of the regional economy.

Under the above scenario, the academia, business communities, and leaders of GCC are more than ever concerned with ratifying their concurrent policy for simultaneous progress of GCC monetary union implementation and to meet the WTO guidance for reformation, which is a vicious circle for the regional alliance to immediate resolute. However, the governing rules and concurrent practice of legislative reformation and WTO integration in Saudi Arabia and GCC have been going through an unstable situation facing different challenges along with huge complications with financial institutions, their management, and regulation while the unified monetary union could only be a preventing measure to safeguarding the GCC from the risk of volatility.

With this background problem, the author of this paper has regarded to conduct a study with the emergence to scrutinize the impact of WTO membership on the GCC countries especially on the Kingdom of Saudi Arabia and considered that the research would assist the legislators of GCC to come out from the existing dilemmas of WTO integration with a suitable solution.

Rationale for the research

Many scholars tried to find out the solution to the question of how the GCC countries would accelerate their implication process of WTO negotiation to gain competitive advantage in the international trade and to ensure diversification in the economy. In addition, there are also some other researchers who kept their keen attention to analyzing the impact of WTO on the GCC countries in the context of the other WTO member countries in the global index of different economic parameters. Most of the contemporary authors have concentrated measure WTO impact in the GCC region in the context of the global financial crisis, but no pragmatic research agenda has not yet been proposed to assess the WTO impact in the context of GCC’s own competitiveness to organize regional alliance for common customs and monetary union.

Schreuer (2001, p.1) pointed out that the international economic law introduced by the WTO and the traditional practice of international law has long debate science Bretton Woods era, more difficult scenario appears while the sovereign states are questioned if they are influenced by the external forces of the World Trade Organization and its negotiation. The GCC nations have their regional cooperation with long historical perspective through their regional treaties and agreements without any compromise with the individual sovereignty of the states, but to having the WTO membership in different time all the GCC counties were bound to amend the local law and regulation with particular focus to endorse all relevant WTO regulation and directives.

Although the inspiration worked for being a WTO member was interpreted as achieving more competitiveness in the international trades and economic development, it is suspected that the real reason for having WTO membership was totally a political agenda of WTO and its allies. Thus, it is essential for the GCC member states to have an appropriate analysis of the impact of WTO membership in the Gulf Cooperation Council Member Countries to address further policy for regional development with a case study of Saudi Arabia that would ultimately contribute the countries with better understanding and insights for international trade.

The rationale of this research is to analyze the roles of the WTO membership of GCC the member states experience by observing the real scenario of Saudi Arabia to evaluate to what extent the existing practice of WTO trade regulations has influenced the GCC objectives to attain the single currency and common monetary union. Moreover, this research has aimed to escalate the responsiveness of the GCC legislators to take control over the external influences while the most current wave of ‘Arab Spring’ already socked the Middle East Arab countries with political unrest by regional integration.

Research Question and Objectives

This research paper has aimed to investigate with the research question, do the WTO membership and its trade regulation would hamper the GCC objectives to gain single currency, common customs, and strong monetary authority regional cooperation with their historical perspectives of regional trade among the GCC member states? With the economic data of Saudi Arabia, the answer to the question would facilitate the readers with great insights while the legislators and the governments of the GCC countries would inspire to organize the policy with greater motivation for increased confidence for regional cooperation.

Literature Review

The Gulf Cooperation Council

Alasfoor (2007, p.29) pointed out that the idea of collective collaboration in the Middle East region historically urged by Iran, Iraq and Saudi Arabia following the British departure form the Gulf in 1968, but due to suspicion that such integration would increase Iranian or Iraqi domination and lack of willingness within the small countries the process prolonged until 1975. In 1975 the imitative to establish Arab industries organization was failed, but Saudi Arabia persistent its effort to establish a political framework and in 1976 it resulted a low profile arrangement for intelligence and security information exchange and the GOIC (Gulf Organization for Industrial Consultancy) was established including Iraq.

The conception of Gulf common market and economic integration has introduced following the year after that, but in eighties quick political and foreign policy shifts in this region including Iranian revolution and Iraq Iran conflict bought vulnerability and insecurity in this region and the process of establishing GCC has delayed. In 1979, the Arab Summit in Amman the Kuwaiti representative proposed to establish a union among themselves, in Abu Dhabi at the next foreign ministers meeting in 1981 the proposal was confirmed by the members Kuwait, Bahrain, Oman, Qatar, Saudi Arabia, and UAE and GCC started its journey for greater cooperation in the Gulf region.

The World Bank (2010, p.16) further added that with the common social and geopolitical backgrounds the GCC countries agreed to extend their cooperation for promoting facilities for religious, linguistic, and historical ties including travel and trade with mutual understanding on the official and public levels although the countries historically enjoyed bilateral or trilateral cooperation in the past. The strong economy, wider reserve of global oil resources, and importance of the geographic location placed the GCC countries at the focal point of western countries while aggression of the global powers in the name of fight against terrorism, and western influenced wave of ‘Arab Spring’ prolonged with serious threat for GCC counties for sustainable development.

Under such vulnerable situation the GCC functions with a Ministerial Council of the Foreign Ministers of the GCC and a secretariat following the structure and functional extents of European Union along with a number of dedicated bodies to designing and implementing the procedural standards of trade and commerce including the responsibility of commercial arbitration, patents and copyrights and so on.

In 2003, GCC members signed another agreement to establish common customs union, in 2008, it extended efforts for common market status with unobstructed rights of property ownership, equity, movement of capital, along with unified tax treatment for all, and in 2010, it proclaimed to introduce common currency for all member states formulating GCC Monetary Council. During the last two decades of foundation of GCC evidenced to coordinate free movement of labor and capital, duty free access of most commodities and cut down the customs procedures for the member states including hindrance free travel among nations along with economic agreement for investment and common strategy to encounter with the globalization and integration of WTO membership.

Integration with WTO through Commodity and Services Trade

WTO (2010, p.29-30) added that all the GCC countries have become members of the WTO where Kingdom Saudi Arabia is the late entry among the GCC member states and joined in 2005, due to time variant entry in the WTO the internal coordination and trade reformations within the members are not at a same level. The six members of GCC have six different commitments at WTO membership while KSA (Kingdom Saudi Arabia) and Oman are aggregately the bulky importers of services with most widespread commitments in the GATS connecting 37 and 31 sectors and as a bigger service exporter get Bahrain lower commitments and this difference indicates differential treatment of GCC members.

Meanwhile the GCC member states attained substantial progress for harmonized and combined anti-dumping policy, the foremost aspirations of establishing customs union is to coordinate policies on remedies, matching rules of origin, identifying tariff and non-tariff barriers within the member states, standardized customs valuation complying with the guidance where differential anti-trust policies are evidenced in the practice of some counties.

Under the collaboration of GCC member states in 2007, a technical authority to identifying and report on the harmful trade performance with intention to unifying the process of negotiating trade conflicts and this authority would ensures reliability and validity of compliance with WTO agreements linking with anti-dumping, subsidies, along with protective measures to safeguarding both parties. The integration of GCC members with the WTO by commodity and services trade are evidenced with some extent of complication while the trading partners are not WTO members, in such circumstances dispute resolution turn into further difficulties due to absence of appropriate guidance, mutually agreed regulation and even nonappearance of reciprocally trusted negotiator.

Commodity Trade Integration with WTO

WTO (2010, p18) argued the economic data of GCC countries demonstrated the trade flows comparatively little in spite of well-built growth in the contemporary years although the ostensible value of intraregional trade has enlarged around 30% per year which sustained with growth of 6% during the preceding years and share of oil and non-oil sector remained unchanged. Such growth rate of international trade is lower in relation to the other regional economic alliances like EU, NAFTA, and ASEAN those gained 57%, 41%, and 23% growth respectively, the poor performance of GCC trade gain either indicates weak compliance with WTO guidance or historical backdrops of the economy in this region.

On the other hand, the WTO integration initiatives in the GCC along with the commitments under WTO have grounded with minor non-tariff barriers and the technical authority organized under GCC secretariat has successfully gained standard harmonization procedure for around 3000 commodities with remarkable reduction of complexities for customs procedure to clearing shipments at their ports.

At the same time, the international trades among the GCC member states have gained enough flexibility with further opportunities for the remaining non-tariff barriers by means of privileged policies connecting with the public procurement scheme along with backward linkage to the manufacturing industries while the customs border controls for shipments by road prevailed with tangible costs for GCC member countries. Thus, the regional trading relationship among the GCC states would gain more improvement due to infrastructural expansion along with condensed border controls, the construction of fanatical trade passages connecting through railways within the member states would prop up trade opportunities in this region.

There are also scopes to come into arrangement for withdrawal of remaining border barriers by endorsing tariff revenue-sharing system among member countries while further economic reformation and trade liberalization with the GCC would attract investors and encourage increasingly FDI inflow along with labor mobility in this region.

Service Trade Integration with WTO

ITC (2012, p.1) reported that economy of KSA is gradually becoming more reliant on international trade while the share of merchandising and service trading contributed to GDP accounted 89% during 2005 and jumped at top 105% during 2008 and stabilized at 97% at the year ended 2010 and the country placed at twelfth position export. The country also placed at twenty-first in the global ranking for its commodity export and placed at eleventh and thirty-third for service import and export respectively along with a service trade deficit of US$ 50 billion per year from 2005 to 2010.

The World Bank (2010, p.19) mentioned that the GCC has gained remarkable advancement to let-up its intraregional boundaries for service sector and the alliance is gradually executing the common market agreement among its members that facilitated citizens for hindrance movement among the member states. GCC nations also ensured free flow of labor force within the region by withdrawing working visa requirement for the foreign workers having valid visa in any of the member state.

Moreover, the member countries of GCC are gradually increasing the inventory of direct investment opportunities for GCC nationals for whom the citizens of any state would be capable to do retailing or wholesaling of any commodity or service trade or cultural exchanges in any of the member state that they prefer without any restricting. The process of liberalization continued from restricted sector to the permitted areas, although all the regulatory measures necessitate to ensuring cross-border participation are not yet established but aimed organize step-by-step in every possible sectors and the situation evidence positive implication by increasing number of business license granting including enhanced private property and stock ownership.

GCC also aimed to liberalizing the service sector by overcoming concerned technical, political difficulties while the restriction on foreign ownership of financial, physical assets are under process to liberalize, and within very near future this sector would gain international standard.

The extent of services trading are very dissimilar due to their degree of consumption, marketability and mode of entry, but the business environment of GCC would require to bring perfect competition in the service trading to enhance market growth for which the regulatory reformation is required. It is also necessary to amend the existing rule of defining the service sector and its workforce including liberalization of licensing boundaries for both local and foreign entries, harmonization of regulatory standard and practice to increasing scope for foreign entries where capabilities and effectiveness of regularity authorizes would be questioned. Moreover, to bring strapping competition in the service trading market of GCC, it is essential introduce strong competition laws and patronize to develop human capital to support to establish a stronger backbone of service trading that would ultimately enhance FDI inflow with the region.

Financial and Monetary Integration

Sturm and Siegfried (2005, p.64) explored that Saudi Arabia including all other GCC countries has already gained outstanding progress towards monetary integration although the fiscal integration lingered with backwardness with few disputes in the area of fiscal policy incorporation, but their highest efforts to establish a common currency bring them to pursue advanced level of infrastructural convergence. It has evidenced that the GCC members are highly inspired to formulate monetary union with sound economic growth in the oil sector, but less diversification in non-oil sector where their institutional integration would urge for a supranational institution both for fiscal and monetary integration.

The course of action for economic integration in the GCC region has aimed to establishing a free trade zone, a custom union along with a monetary union and the expected deadline settled for common by market 2007 and for common currency by 2010, and to attain prospective benefits the member states are eager to ample within the desired period. In this regard, the intergovernmental communication and understanding among the member states needed to be more dynamic and faster to execute an inseparable monetary policy with a single exchange rate policy in this region as the existing national monetary policy of the members are not workable for single currency in the GCC countries.

From the theoretical perspectives, the principle of indivisibility of the member states in a monetary union is not supportive while an array of firm exchange rate at individual level would not assist for harmonization the national monetary policies and would hamper the process of gaining single currency, but it is required a unified monetary and exchange policy for all members. To implement such a unified monetary policy, it is required to establish a strong supranational institution for decision making that would gear up the economic integrity along with monetary and financial environment capable to function under the common condition of the monetary union.

For a long time, the member states of the GCC have been continuing their bilateral trade in exchange of US dollar the evidenced higher level of exchange rate stability although each of them have strong own currency with less inflation rates and almost stable interest rate and it helped gaining remarkable progress for monetary integration.

The fiscal integration process within the GCC has remained insufficient and sustained as a significant challenge and distinguished by the degree of budget balance-to-GDP ratios along with public debt difference among the members’ countries. To ensure a sustainable fiscal integration in GCC it is essential to introduce disciplined fiscal policies strengthen the stability-oriented monetary agenda that may drive to adverse spillover effects among the member countries where numerous options for suitable fiscal criteria are required to integrate, but the member states are most likely to emphasis on fiscal policy for oil sector.

At the same time, strong political commitment of the GCC leaders towards common currency and single market along with unified fiscal and monetary policy for all member states would be the basic accord to establishing sustainable monetary union that would shift the monetary sovereignty of the member states to the supranational level rather than the individual central banks.

Role of WTO on Dispute Settlement

Grimmett (2006, p.4) explained that the dispute resolution process of WTO is handled by the special body DSU (Dispute Settlement Understanding) that works to uphold all the regulations and measures mentioned in the WTO agreements where DSU endow with the consultations among the disputing parties, the process also integrated with panels and appeals along with the provision of compensation or retribution. The dispute resolution process also incorporated with automatic foundation of panels, preparing reports and its implication, endorsement of requests to retaliate, fixed deadlines for different events with the aim to execute WTO obligations, which is more mechanical rather than humanitarian manner of practice with a speedy and effectual scheme than the members long evidenced with the GATT.

Busch and Reinhardt (2003, p.1) added that the long evidence of WTO dispute settlement by the DSU has evidenced that the dispute settlement process of WTO is not enough easy-going and there are absences of lawyers interested to work with WTO regulation of dispute resolution while data of the cases evidenced very lower success rate of parties from developing countries. Close observation in this regard predicts that power regime of developed countries in the dispute resolution process is very high for which the chance of developing countries to win is very difficult than the GATT era and the underlying assumption is that developing countries are particularly ill served by WTO diplomacy.

Pfitzer and Sabune (2009 p.7) further added that the jurisprudence of WTO in regard to the dispute settlement adopts burden of proof on the disputing party, which is linked with ignorance with the process where illumination is necessary to set up the “prima facie” verification that lets a dispute to go ahead. Under such provision, any complainant would be unable to assemble the ‘prima facie’ that leads that to failure, attorneys with strong experience at common law identifies this requirement as a disturbing and ill practice while the WTO panels are not limited to allowing the realistic evidence that the parties have in hand.

The DSU has not integrated any open standard for evaluation of what are the criteria of commencing ‘prima facie confirmation and there is no explanation about the implementation of their ruling that looks almost bogus term to execute illogical panel decision without any authentic analysis.

Hertog (2008) added that Saudi Arabia is a most resourceful country with open economic environment along with free capital flow and convertible currency in the GCC region, but its membership in the WTO has influenced by the political pressure of the United States and other development partners to overcome some formal restrictions tariffs in the global communities. The major development of KSA has been centered on the oil resources where WTO urged for diversification of the economy in the non-oil sector that inspired the country considering that such diversification would generate more enhanced foreign investment and generate huge employment opportunities for the young generation.

At the same time, Saudi Arabia has a long trading relationship with the GCC member states they are familiar with each other had prolonged a traditional dispute resolution process by their practice, which is less complicated and less time-consuming in comparison to the WTO Dispute settlement process. Thus, in the context of dispute resolution, Saudi Arabia along with GCC member states have the opportunity to strengthen their institutional infrastructure to settle their regional trade dispute without bothering for the complicated process of WTO.

Positive and Negative Influence of WTO

Niblock and Ramady (2011) argued that the impact of WTO membership of Saudi Arabia and other GCC member states have both negative and positive on the socio-economic development of this region, although GCC has a stronger economic base prior to having WTO integration. Although GCC has very substantial economic growth, there are some lacking for effectual operation and proficient management for both public and private sector that influenced the domestic economies and has significantly influenced while WTO prescribed to restructure their internal coordination of the economic activities like other countries of the world.

WTO (2011, p.1) pointed out that KSA has gained tremendous progress following its WTO membership in 2005 with an advanced level of diversification in the non-oil sector that evidenced from the overall GDP growth of 23 %, public revenue growth of 91% and export growth 86% without any major shock of a financial downturn due to appropriate development policy prescribed by WTO. The liberalization processes enhanced FDI inflow, health, and education improvement along with a suitable business environment that resulted in positive economic performance with an inflation rate of 4.6 % per annum with resilient macroeconomic stability in the country.

KSA regulated sustainable diversification for which the number of foreign workers is increasing greater than ever and the most recent demographic data indicated that the country consist of 31 % foreign workers out of its 27 million population in 2010. The currency of the country has gained ever strength that it prolonged at SAR 1 = US$ 3.75 for more than an era for which the country dare to establish a monetary union, in this connection WTO is continuously providing technical support with authentic Data analysis. The most significant positive outcome of WTO in Saudi Arabia is that the country has gained remarkable progress in international trade and it has resulted in a 105% GDP growth positioning itself at the 12th place for its export and 8th largest recipient of FDI all over the world in 2010.

The ministry of commerce of KSA is responsible to coordinate with the WTO policy along with the other related ministries that generated remarkable dynamics in the economy by assisting to integrate information and communication technology, technical support for harmonization process, market liberalization with fiscal and monetary policy, and so on.

Al-Sultan and Davies (2005) argued that the integration of KSA with WTO negotiations would negatively influence the agricultural economy of the country in diverse conduct by reducing local support and incentives for agriculture along with condensed import support and financial backing, at the same time WTO policy responds towards the natural water resources have seriously injured. The WTO prescription suggested that the groundwater level of KSA has scare stage and forecasted that it would sustain for an upper limit to 25 years, with such guess of WTO, the water supply price raised highly with increasing demand in the local market that simultaneously affected the agricultural water needs along with fruit juice and beverage production.

The scenario of the market illustrates that there are huge products those local production seriously deteriorated for WTO negotiation and the local market turned to be dependent on import only and such policy would condense the job market and keep the extra burden on the foreign currency reserve due to raising import.

Research Methodology

Research Method

The main aim of the third chapter is to identify a proper research approach to discuss the impact of WTO membership in the Gulf Cooperation Council Member Countries particularly on KSA and the researcher of this study’s qualitative and descriptive research method.

Primary research

As the author of this research paper considered qualitative and descriptive research approach, observation was the fundamental and crucial method of primary data collection; therefore, it was important to prepare a questionnaire with open-ended questions on the impact of WTO on GCC countries. Cohen, Manion & Morrison (2007) and Saunders, Thornhill & Lewis (2006) stated that primary data is suitable to concentrate on the scrupulous dilemma; however, Malhotra (2009) pointed out that observations could be used systematically while these are often quite a fruitful source of analytic insights.

Secondary Research

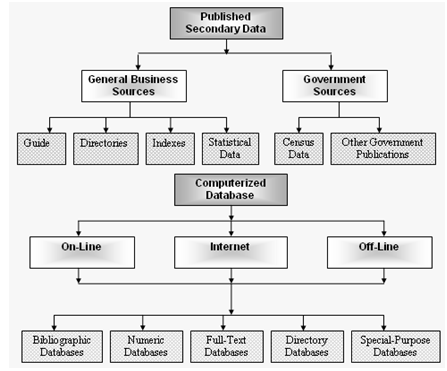

In order to discuss the impact of WTO on GCC countries particularly KSA, the author of this research paper has considered a number of secondary sources, such as the forty-sixth annual report of SAMA, report of Saudi Industrial Development Fund (SIDF), scholarly articles, journal publications, and so on.

Data Collection Process

The author of this paper would particularly concentrate on the internet databases since it is one of the most cost-effective and familiar ways of collecting processed data; however, the subsequent figure demonstrates the secondary data collection method more elaborately to understand the process –

Data Analysis Process

The researcher of the paper would carefully study the existing documents, online journals, books and other sources to find out useful data and other information; however, after studying the previous works, the present researcher would analyze these data in this research paper considering the demand of the topic.

Limitation of the Study

- Limited words were the main problem to organizing this research paper since the topic “impact of WTO membership in the GCC Member Countries: A Case Study of Saudi Arabia’ is a vast area of research and it should discuss too many relevant factors in this regard;

- In addition, the deadline was not sufficient to formulate the study while it was essential to address many issues within a short period.

- Additionally, there were too many secondary data sources regarding the impact of WTO membership, but there were few outstanding and relevant papers that were useful to get fruitful outcomes from research;

- This research is only based on secondary data due to a lack of word limit; therefore, it is not possible to know the opinion of the mass people regarding this issue.

Discussion & Findings

Positive Impacts Locally

KSA’s accession with WTO positively influenced the Saudi economy in many ways, for instance, it created a fully open market for foreign investors, and established Supreme Economic Council, increased the employment rate, developed the industrial sector and the government enacted a number of regulations to harmonize the local market in accordance with the agreements with this organization. However, the following points describe positive factors more elaborately –

- SIDF (2006, p.1) stated that WTO membership gives the opportunity to the exporters to expand their business in the global market and generates more profits. However, WTO membership would help the businessmen to save themselves from the foreign investment policy of other countries, for instance, unilateral measures, anti-dumping duties, and biased commercial policies of foreign nations;

- SIDF (2006) further addressed that Customers of the local market would get the opportunity to purchase high-quality products at competitive prices and they get an opportunity to select products from the diversified product lines. On the other hand, local companies are now more conscious about the quality of the products; therefore, the management of these companies concentrate on the efficient employees to face the challenges of open market economy and to compete with foreign companies;

- SAMA (2010) pointed out that the government tried to maintain a stable regulatory system and considered international financial standards to upgrade the banking segment.

- SAMA (2010) SIDF (2006, p.1) argued that WTO membership would encourage the policymakers to change current fiscal policy and investment plans to strengthen the national economy;

- SIDF (2006) stated that execution of the investment-related agreement will create a favorable environment to attract investment inflows; however, WTO (2011) reported that KSA is the top recipient of FDI in the GCC member states;

- Moreover, foreign and national business organizations must enjoy better flexibilities and scopes, for instance, getting the access of monetary assets, accruing greater competitive advantage, meeting objectives, sharing of modern technologies along with raw materials of the other companies, achieving of economies of scale through size facility, providing preemptive competition, influencing policymakers, and so on

Oil and Gas Sectors

Aljarallah (2010, p.65) and SAMA (2010) pointed out that KSA is the largest oil producer and a key supplier to the global oil market therefore, the economic structure of this country is oil-based, for example, oil revenues constituted 85.2% of total revenues in 2009. In addition, KSA has more than 110 oil and natural gas fields and above 1,500 wells, and it has already discovered about 21% of the world oil reserves or possessed about 264.10 billion barrels; however, Al-Ghawar is the world’s greatest onshore oil field, which accounts for more than 50% of the Kingdom’s total oil production capacity (Aljarallah 2010, p.65). However, the performance and development of the industrial sectors of this country largely depend on the revenues from the oil sector while statistics related to the Involvement of economic segments to GDP in 2009 demonstrated that 48.1% of GDP came from the oil segment (SAMA 2010, p.125). However, the following figure provides more information about oil and gas sectors –

WTO has pressured Saudi authorities to develop a guiding principle to help the foreign companies to work together with local oil companies to boost production. Aljarallah (2010, p.72) stated that KSA has experienced stable growth in the natural gas sector by properly using 15% of its total gas reserves, but it would be possible to increase the gas production if the oil production is increased gradually; however, following figure shows natural gas production capacity –

In addition, Aljarallah conducted a survey to assess the impact of WTO on the oil economy, and according to the respondent’s view, about 50% of respondents stated that oil-producing countries including KSA had not enjoyed any particular advantages though 20% of respondents provided different statements; however, the subsequent figure shows the survey results –

Petrochemical Sectors

SABIC is the prime petrochemical producer in the Middle East, which accumulate value to the hydrocarbon wealth of KSA since byproducts of oil and gas have no direct consumption or market value, but left as waste; SABIC had developed its technological infrastructure due to accession of WTO like it integrates advanced PP Ziegler-Natta catalyst (TiNo) in polymer plant in 2009. At the same time, WTO assists the petrochemical industry in many other ways, for instance, the management of this company had taken α-SABLIN® technology from Germany and SABIC acquired a 100% stake in Huntsman Petrochemicals (UK) Ltd by $685m in cash to penetrate the UK market with the diversified product line. However, the following points illustrate the influence of Saudi membership in WTO on the petrochemical industry –

- Al-Sadoun (2008, p.1) stated that the removal of trade barriers because of WTO regulation particularly help the petrochemical producers to export at lower prices in the tariff-protected zone, such as Europe, America, and Japan;

- Moreover, local companies have increased production realizing the demand of external market since EU reduced from 12.5% to 6.5% tariff on polymers;

- Numerous WTO regulations on chemical tariffs and other related agreements both positively and negatively affected this industry, such as HS (Harmonized Commodity Description and Coding System) provided the list of product categories, and uniform tariff classification system to collect duty and tax.

- After WTO accession, top management of the companies tried to decrease production and operation cost, develop skill level and so on;

- Aljarallah (2010) conducted a survey and reported that about 80% of respondents said WTO membership has a positive impact on the Saudi Petrochemical industry though 20% seemed that WTO membership would increase competition in the local market;

- At the same time, 95% of the respondents mentioned that WTO accession will help the country to increase the exports of petrochemical products, and only 5% of respondents said that it has no significant impact on this industry; however, the following figure shows the survey result –

- SABIC generates over 85% of total sales revenue from the international petrochemical market; in addition, had signed a contract with Sinopec Corporation to form a 50:50 equal share joint-venture company to enter into the Chinese market;

- Aljarallah (2010, p.108) pointed out that the government of KSA would adopt growth strategies to strengthen the petrochemical sector. According to the survey report of Aljarallah, about 65% of the respondents believed that higher entrance to foreign market will help the Petrochemical industry of KSA to expand and gain competitive advantage, but 25% of respondents opposed this view, as the impact on this industry is ambiguous while WTO offered no particular concession in this sector;

- The Doha ministers-initiated negotiations intended to open trade of chemicals;

- More than 20 nations have signed CTHA (The Uruguay Round Chemical Tariff Harmonization Agreement), which is based on a chemical industry proposal and some countries implemented the provisions of the agreement intended to decrease tariff rates below the harmonization stage, or eliminate total tariffs.

Industrial Sector

Industrial sectors of KSA had influenced by subsequent ways-

- Industries of this country have really experienced administrative facilities and competitive advantages in case of exporting product in the foreign countries market, such as Petrochemical industries of KSA has the prospect to hold large shares international market because of having the availability of hydrocarbon materials from oil and gas;

- Since the local industry has to face intense competition, they had already taken measures to offer higher quality products at a competitive price and achieve certificates for focusing on international standards.

- At the same time, the agreement with WTO has increased industrial investment to improve expertise, produce import-substitution products, and increase exports to compete with the global industrial segment;

- In addition, the administration of Saudi Arabia has already taken some initiatives in order to encourage and increase FDI inflow in the industrial sectors; however, the policymakers should also focus on some other issues related to infrastructure development and security concerns;

- Finally, the construction industry of KSA has enjoyed many advantages, for instance, multi-national companies can penetrate in the local market only by purchasing a minority portion of shares; however, foreign companies like to joint venture with local companies because the land price is lower for local companies, minimal rates of utility services, and no duties attributable for exporting construction materials, and other machinery.

Service Sectors

Negative Impacts Locally

The negative influences on the different segments are –

- Local organizations have to face serious barriers with their products since it would be easy for the foreign organizations to penetrate the Saudi Market because of the agreement with WTO; consequently, a lot of small companies in the local market would be bound to stop their operation under intense pressure and multinational organizations would offer quality products at a competitive price;

- Aljarallah (2010, p.49) pointed out some negative effects on health and human lives, such as, WTO has given to the pharmaceutical companies ‘right to profit’ while the aim of the government is to protect their people’ health by giving lifesaving medications;

- The provisions of non-agricultural market access are vague to some extent;

- Considering the political and economic condition of this country, its agreement with WTO will permit it to work alongside other countries possessing similar interests (emerging economies are primary amid them); in this circumstance, the government of this country should use economic strength to change the movements to gain advantages to the extent that is possible;

Oil Sector

SAMA (2010, p.26) pointed out that KSA experienced momentous development despite, the global financial crisis; however, the reduction of the oil price in the global market was one of the main reasons to decrease daily average oil production by 9.20 million barrels for every day; however, oil sector of KSA had not affected by the WTO.

Conflicting Areas of WTO Negotiations in Saudi Arabia

Aljarallah (2010, p.47) conducted landmark research with the WTO impact on Saudi Arabia industries and pointed out that the policies of the WTO seriously flourish shock at most of the area of social, political and economic sectors of a nation while the organization itself has not any democratic practice and sustained without any transparency and accountability. The regulations that WTO presented to the members had totally written by the US business communities in the way that they wish to facilitate for international trade and protect the interest of their business people and placed by the WTO for negotiation and approval by the member states.

While the inputs placed for negotiation, the consumers find that their rights are not protected, labor organizations identified that their rights to trade union has deteriorated, social activists identified that the negotiation terms also facilitated to rich counties to create environmental hazards and scope to violate human rights; as a result, the protest against WTO negotiation mobilized strongly.

The different professional groups, civil society, and NGOs urged that there is no logical ground to endorse WTO trade regulations without protecting the rights of poor countries. In fact, WTO is eager to establish a secret global government over all national governments to establish the rule of EU and US business communities that aimed to administer and control national governments where the duty of national governments would be to ensure easy access of EU and US business communities in the developing countries by amending their legislation. Saudi Arabia delayed to endorse WTO negotiation up to 2005, but the Saudi monarchy compromised with the US pressure due to lack of people’s support towards monarchy and the current undemocratic government of Saudi Arabia considered that if they endorse WTO negotiations, then the US would not create pressure for democratization

The ancestors of WTO propagate that the organization is working hard to generate free trade to ensure global peace and worthiness, but the real scenario is the opposite, due to political and economic strength, the corporations of rich countries are taking easy entry into the market of poor countries while the poor countries aren’t getting access to the rich counties. Such discriminatory policies of WTO would hamper trade balance and generate dissatisfaction among the poor countries that ultimately drive the people of poor countries to be violent, the security issues of rich countries would be questioned, to avoid such risk WTO needed to honor the democratic values of people rather than serving the interest of the corporations of EU and US.

Actually, in this era of Information Technology, people live in a global village and the people of Saudi Arabia gained a large extent of democratic values by using the Internet and through social network sites. They do not deserve to be uniting with any undemocratic organization that would align with the monarchy to suppress people’s democratic and human rights, but they look for a democratic authority aimed at global trade regulation based on equality and global justice.

Moreover, WTO regulations centered on the scope of profit generation rather than democracy, human rights, and labor rights; to ensure profit maximization, it allows lower wages than the standard and does not bother to engage child labor. WTO urged the governments not to take into account the ‘non-commercial values’ like human rights and democratic values, even it demonstrated a more forceful attitude to ignore the United Nation’s declarations and sanctions in every sector of the political economy. It also inspired to privatize the state-owned organizations including the pubic services that people get in exchange for their tax paying, for instance in many countries WTO prescriptions made the government bound to privatize education, sanitation, and water supply and the commercialization of public services would seriously hamper the livelihood of the working class of the developing countries.

Being WTO membership, Saudi monarchy conducting inhuman behavior with the working class and women, the world has evidenced last year how the Saudi monarchy is cutting necks of the Bangladeshi expatriate labor or cutting women’s hands in the street publicly. The brutal behavior of the Saudi monarchy has opened its nasty face to the world and it is evidenced that the WTO and ‘Saud’ dynasty is conducting un-Islamic rule in the name of Islam the most pragmatic terror Usama Bin Laden was a member of the Saudi royal family. The WTO and ‘Saud’ dynasties have been degrading the environment of Saudi Arabia, most of the good governments are trying to ensure quality public health services for its citizens, but WTO and the existing Saudi government are jointly conducting initiatives to make profit from public health services without out bothering to the lives of the working class.

Conclusion

Recommendations

In the last decade, Saudi Arabia and other GCC countries under pressure to become a member of WTO, both the United States and Europe have a greater interest in this region for which they used WTO as an institution that makes a level field for Americanization and Europeanization. Following the terrorist attack of 11 September 2001, the American and European powers engaged to develop the global perception that GCC and other Arab nations in this region is the breeding field of terrorists, in the name of the fight against terrorism, they continued aggression in the Middle East counties violating human rights and sovereignty of the states.

The political economy of the United States and its foreign policy has officially outlined integrating with its national security strategy linking with trade and commerce where it conceded to confirm the interest of US companies through trade negotiations otherwise drive for war against terrorism and the scenario of US relation with the Middle East countries confirmed its particular relevance. In 2003 the failure of WTO ministerial negotiation at Doha trade round due to the protest of poor counties against WTO discriminatory policy, US moved from its attempt to uphold its interest by using WTO and imposed new strategy to make MEFTA (Middle East Free Trade Area) that would preserve the unquestionable interest of US business communities (Looney 2005, p.3).

At the same time, the European Union also conducting similar negotiation to ensure the interest of European business in GCC countries, the continuous pressure of big powers for trading liberalization made the GCC countries vulnerable and there is no other alternative for them to surrender the national to the US and European communities or to encounter such external pressure collectively. Thus, the author of this paper would recommend the GCC leaders to understand the changing dynamics of the global political economy and to take quick measures to strengthen GCC by establishing common customs and a single currency and monetary union with internal market reformation.

The political unrest in the GCC and Arab world is another threat to any trade liberalization and economic diversification, most of the GCC countries prolonged with traditional Arab monarchies that needed to understand that democracy is more powerful than religious radicalism, and there is no other alternative to sustain in the state power without democracy. The most recent ‘Arab Spring’ has presented some lesion for the leaders of GCC countries that the people of the Arab world are very much eager for democracy and if they get any external support for the other countries, they must turn to violent movement to descent the monarchy.

Thus, this paper would suggest the GCC concurrent leaders come out from the monarchism in a peaceful way by amending the constitutions where people would be a source of power and their elected government would administer the state. It is also recommended that the GCC could put into practice democracy in the form of British Democracy where the monarch could preserve a constitutional position like the British queen.

This paper also suggests not to compromise with the WTO negotiations without preserving the national interest of each at the first priority, obviously, the negotiation would be free from political pressure, fair dealings, and impartial to all the negotiating parties without any discrimination and based on equity. At the same time, the GCC governments should accelerate the establishment of the central bank of GCC along with a national center for the database to pay attention to the WTO affairs and make appropriate study in-depth related financial, legal, and technical aspects to assist the private sector with better understanding the WTO regulations for disputes settlement and dumping aspects.

It is also recommended that the internal reformation and legislative changing required for WTO integration, GCC countries may not endorse by the ministerial approval, but organize a referendum to consider people’s views and to ensure their participation in the decision-making process. To conduct a referendum connecting to the WTO trade regulations integration in GCC countries, it would be required to prepare a policy paper regarding the debates with WTO requirement and national interest and distribute them for a public hearing and better understanding.

The government should arrange an open discussion, workshop, and training program to train business communities, legal professionals, managers, and other consultants in order to assist the government organization and private sectors to comply with the WTO requirements and regulations at GCC.

In case of internal reformation, WTO supports SMEs, but the GCC countries have much negative impact in terms of the operation of local SMEs; the governments of GCC should emphasize the technological development of the local companies and they have to use comparative understanding to increase production while large-scale production would be more cost-effective than SME.

This paper also recommends having significant to develop the competence of national workers because the quality of the products and the future competitive position depend on the skills of the working for where general and technical education have a higher extent of contribution to develop human resources keeping attention to the industry needs. Moreover, the management team of industrial sectors in GCC countries should execute and develop the industrial integration idea where the large companies would support other small local companies in order to give production facilities, and the national companies in the service sectors would gear up their operating system to adjust with the new business environment without any border barrier in GCC.

Conclusion

The membership of GCC countries into WTO have supposed to promote the economy in many ways; industries like oil, petrochemical, and service, have proved to be possible areas of profit for the nations and proofed from significant contributions to GDP; additionally, the production capacity of petrochemicals is quite high owing to the activities of companies. At the same time, WTO regulations have seriously influenced with negative features in some of the areas like agriculture water resources and with less diversification in the non-oil sector while WTO urged to have cent percent ownership of the foreign companies in the service sector while it is emergence to strength GCC by establishing common custom and single currency.

Reference List

Alasfoor, R. (2007). The Gulf Cooperation Council: Its Nature and Achievements. Web.

Aljarallah, A. M. (2010). Analysing the Impact of the World Trade Organisation (WTO) on the Sustainability of Competitiveness of the Petrochemical Industry in Saudi Arabia. Web.

Al-Sadoun, A. (2008). The Impact of Saudi Arabia’s Accession to WTO on Petrochemical Industries. Web.

Al-Sultan, M. M. & Davies, D. (2005). The Impacts of WTO and Water Policy Changes on Saudi Arabian Agriculture: Results from an Equilibrium Displacement Model. Web.

Busch, M. L. & Reinhardt, E. (2003). Developing Countries and General Agreement on Tariffs and Trade/World Trade Organization Dispute Settlement. Journal of World Trade 37(4). Web.

Cohen, L., Manion, L. & Morrison, K. (2007). Research Methods in Education. (6th ed) New York: Routledge.

Grimmett, J. J. (2006). Dispute Settlement in the World Trade Organization: An Overview. Web.

Hertog, S. (2008). Two-level negotiations in a fragmented system: Saudi Arabia’s WTO accession. Web.

IMF (2003). GCC Countries: From Oil Dependence to Diversification. Web.

ITC (2012). WTO Trade Policy Review: Saudi Arabia. Web.

Looney, R. (2005). US Middle East Economic Policy: the Use of Free Trade Areas in the War on Terrorism. Web.

Malhotra, N. K. (2009). Marketing Research- An Applied Orientation. (5th ed) Prentice-Hall of India Private Limited.

Niblock, T & Ramady, M. (2011). WTO and Globalization: GCC impact. Web.

Pfitzer, J. H. & Sabune, S. (2009). Dispute Settlement and Legal Aspects of International Trade. Web.

SAMA. (2010). Forty Sixth Annual Report of Saudi Arabian Monetary Agency (SAMA). Web.

Saunders, M., Thornhill, A. & Lewis., P. (2006). Research Methods for Business Students. (4th ed) London: FT Prentice Hall.

Schreuer (2001). Sources of International Law: Scope and Application. Web.

SIDF. (2006). The Kingdoms Membership of the World Trade Organization Opportunities and Challenges. Web.

Sturm, M. & Siegfried, N. (2005). Regional Monetary Integration in the Member States of the Gulf Cooperation Council. Web.

The Al Watan Daily (2011). GCC Central Bank procedures in final phases. Web.

The World Bank (2010). Economic Integration in the GCC. Web.

WTO (2011). The Kingdom of Saudi Arabia. Web.