Introduction

In many countries around the globe, public-private partnerships (PPP) are becoming increasingly common to provide a wide range of public infrastructure. These include transport networks and public institutions. This study specifically explores the transport sector. This is the category of infrastructure that has received the highest number of ventures accomplished through PPPs (Osborne 2001). More than 1350 freeways, passages, standard line railways, shipment route, sea and airdromes have been constructed since 1986 with an investment cost of more than $660 billion. A huge percentage of this amount of investment has been funded through bonds.

In the prevailing market conditions, bond financing plays a central role in linking the monetary gap for infrastructure funding. Generally, project bonds are liability instruments issued by PPP project firms. They are sold to investors such as insurance companies and pension funds. The PPPs project delivery model illustrates a fundamental system of multi-level governance. It involves multifaceted rapport between diverse administration agencies and multiple private sector companies. The parties act as project consultants, building outworkers, machinists and underwriters (Garvin 2010).

The underlying standard in evaluating the financial benefits and costs of engineering projects is to get the comprehensive individual changes in the health, prosperity and safety of the players impacted by the project. On the financial perspective, shareholders in bond-financed projects can incur cost or benefit from investments unattached to the main parties involved. There are several aspects that influence whether or not the investors will incur loss or will profit. These include inflations, taxations, life of the facility

Public projects involving PPPs are typically funded through project finance provisions. In such situations, financiers and shareholders depend on either absolute (non-recourse) or mainly (limited recourse) financing on the cash created by the project to refund the loans and get return on investment (ROI). This is unlike corporate funding in which the financiers depend on the financial endowment of the debtor’s balance sheet to gauge the amount that can be given as a loan.

There are a variety of motivations that lead to PPPs. Among them is the increment of up-front financing. This is where the private investors lend their many to the government institution so that the amount required for the project is sufficiently met. Risk allocation is another fundamental incentive for public institutions to enter into PPPs. In this case, the public may be incapable or reluctant to undertake extra income risks particularly when such a deficit could negatively impact other public processes. Investors take into consideration the many factors that may impact the profitability of their investment.

The use of bonds to finance projects

Typically, construction projects are costly for governments as they are often large requiring enormous resources in terms of manpower and financial resources. There exists the notion that main public construction ventures have a tendency to be managed poorly. On the contrary, when managed via private finance initiative (PFI), they bring certainly higher returns to the financiers. At the scheduling stage, projections of costs and paybacks demonstrate absurd optimism once the actual construction begins. In such situations where the private sector is not involved, the community and the economy are negatively impacted irrespective of the advantages the project will give to the community once completed. This is brought about by lack of accountability (Hellowell 2012).

The costs and benefits incurred when undertaking a project

The changes in welfare arising from the construction of transportation infrastructure are assessed in monetary terms. However there are exceptions because some impacts cannot be evaluated openly through cash disbursements. These exceptions include the human lives protected by improvements in safety of the cost of ecological dilapidation. Additionally, revenues and expenses arising from monetary transactions ought to be put into consideration by private entities and government agencies.

Stakeholders in PPP concession for a transport infra-structure project

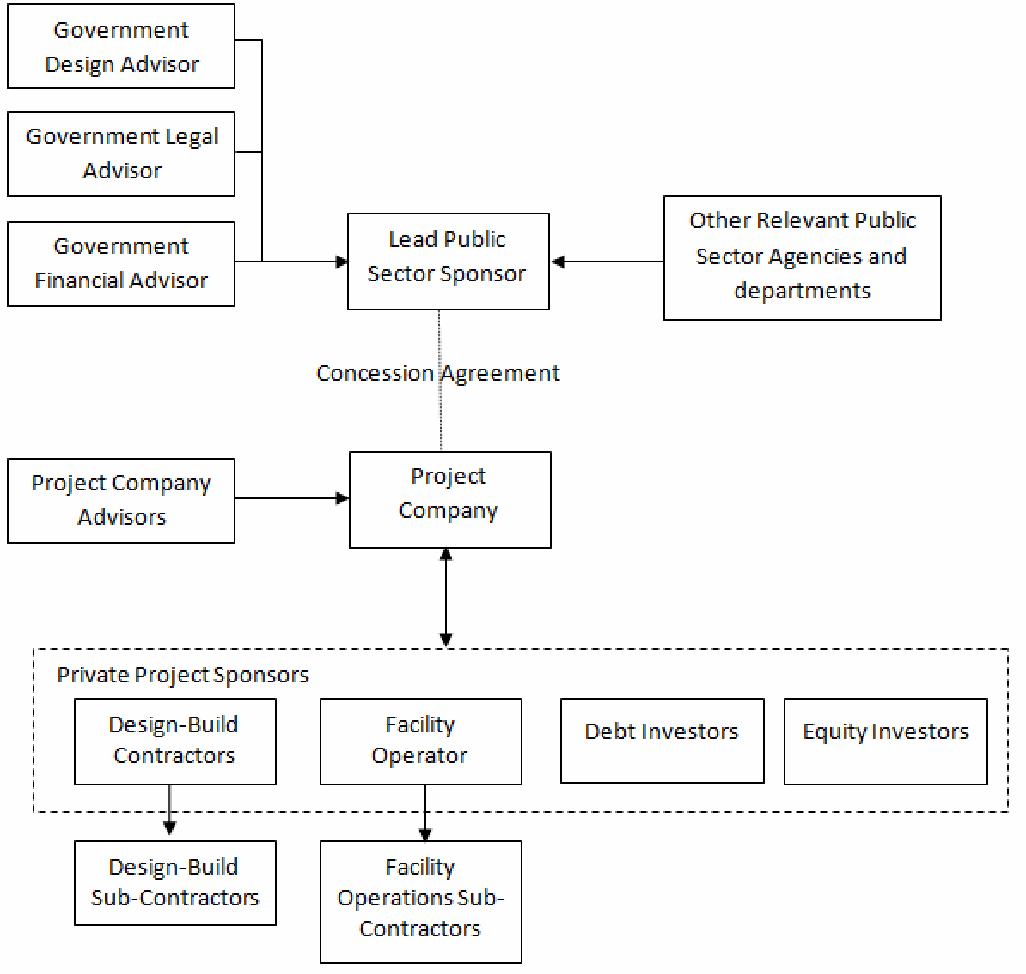

PPP concessions are typically complex arrangements that involve a wide range of players. The complex arrangements of project funding are reinforced by a comprehensive allocation of dangers between a variety of project stakeholders.

Sponsors

These are the capital owners and investors of the project. They can be a single party or more. Frequently, the sponsors of mega projects are consortium of sponsors. The consortium may have subsidiaries who may act as subcontractors. Since the financing is targeted at eventual profitability, the subsidiaries may also act as feedstock suppliers as well as off-taker to the project company. In PPP projects, the government is typically the buyer of the project. In some cases where the project is a PPP, the government may choose to retain some ownership stake in the project. This conveniently makes the government a sponsor (Hodge & Boardman 2010).

Procurer

The Purchaser or the buyer of the project in PPP arrangements may be the municipality, council or a government department bestowed with the powers to tender projects to private investors. The procurer is responsible for running the tendering process. Additional, the procurer is responsible for the evaluation of the project development proposal and the selection of the ideal sponsoring consortium for the implementation of the project.

Government

Under contract, the government may offer a variety of responsibilities to the project company, investors or the financiers. These undertakings may include credit provision in regard to the procurer’s imbursement commitments. These may be real or contingent under the concession project agreement.

How transportation Concessions works

Public agencies under traditional project development plan a project and eventually invite closed tenders from private investors for the development of the construction. The government department then selects the investor with the bottommost bid. The lowest bidder is granted the contract to execute the project. After the construction of the project, the government department is in charge of operations and maintenance of the project. Most debts in a PPP setting often vary to some degree. The variance depends on market development and the requirements of the project. A major challenge to bond financing of engineering projects arise from the diverse finance-raising procedures comparative to the procedures intrinsic in raising bank loans (Reichert-Facilides & Stein 2013).

Common Interests

The funding of engineering in many countries through corporations is not constrained by the position of the bondholders, executive officers or any specific individual. For decades, these institutions use the five principles (5p) of Person, purpose, payment, protection and perspective (Chen & Hsu 2008). In this view, PPPs are largely encouraged based on improved cooperation between the stakeholders and the management of the private company and the government. In private companies, the management often consults the stakeholders before entering into contract with the government in funding public engineering projects. Through the alignment of the interests of the diverse stakeholders to boost closer and meaningful operational relationships, PPPs support inventive projects. Consequently, there is delivery of value for financial investment through improved management of project risks. However, regardless of the promises made between the parties, some relationships change from cooperative to argumentative presenting a threat to the accomplishment of the project (Siemiatycki 2001). The confrontations often arise due to distortion of facts regarding the costs and benefits of such projects. In essence, the stakeholders whose finance is threatened by the failure of such projects funded through bonds may demand the withdrawal of their funding from such projects.

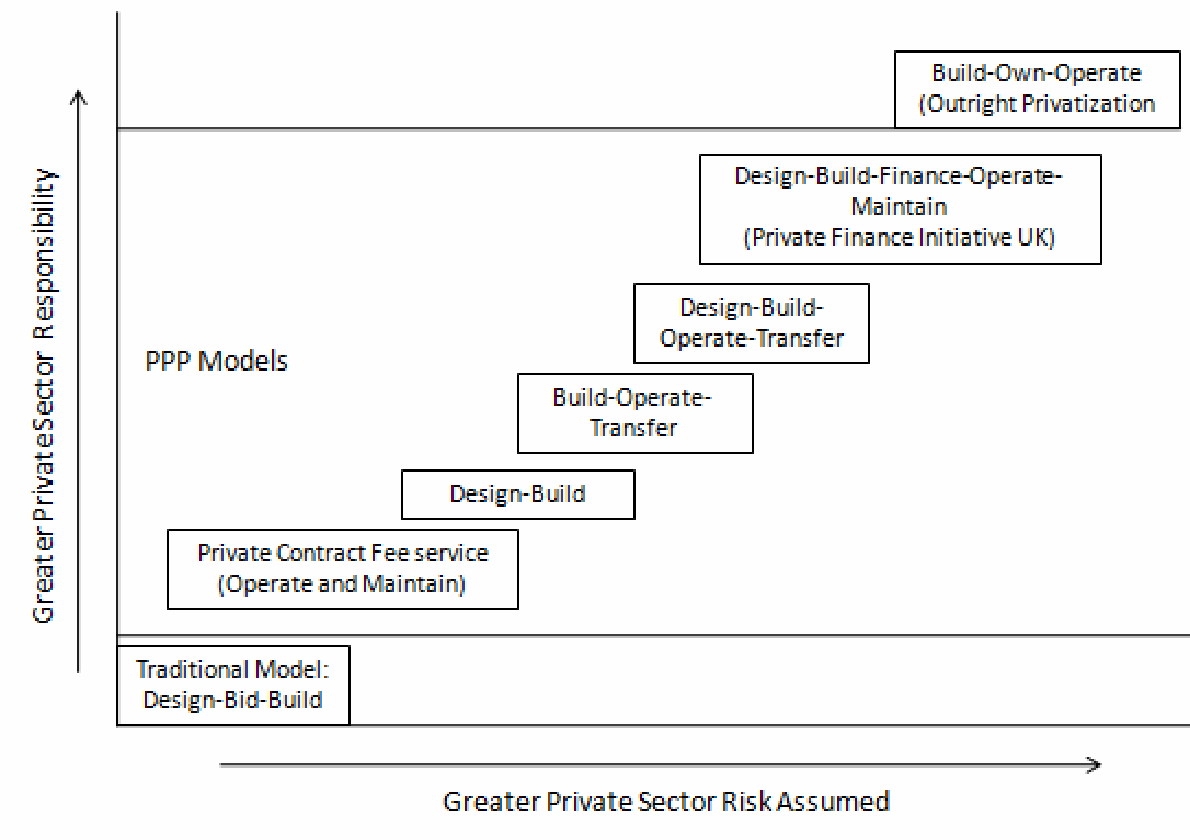

Risk assumption

The PPPs assumed in most countries involve the assumption of risk by shareholders in the private sector. The long-term PPPs are characteristically referred to as Design-Building-Finance-Operate (DBFO). The federal highway administration, in consideration that the private shareholders in PPPs setting shoulder the duty to design, construct, fund, control and uphold the project for a specific duration in exchange for the guarantee of compensation. Perhaps, a national unit of carriage may engage in a PPP agreement where the reserved individual may approve to plan, build, fund, and control an auxiliary conduit or passage in return to gaining a portion of taxes charged on the crossing for thirty years. The private partner takes up all the risks involved. These include expense overrun due to plan flaws, unforeseen earth conditions or disastrous happenings. Every PPPs planning outlines the threats that are taken up by the reserved individuals and those that continue within the civic segment.

Corporate financing

For decades, credit rating of companies has been used as the grounds for evaluating the capability of the company to give returns on investment to the financiers of engineering companies. Financiers in the private sector would utilize the 5P to evaluate the public projects they can effectively invest in through PPP to earn profits on their capital. Some research indicates that approval of financing a PPP project is dependent on the characteristics of the company, its business features and credit record. This scoring system acts as the foundation for evaluating the monetary parameters (Capon 1982).

The use of PPPs to substitute and supplement the public provision of infrastructure is a common occurrence in modern economies. Most of these mega projects demand a huge upfront investment that may not be readily available to the parties involved. Typically, PPP packages investment and service delivery of mega projects into one long-term indenture. Normally, a number of private financiers funds and manages the building of the envisaged project. Additionally, the investors in PPPs involving transportation concessions conserve and control the project for a long duration between 20 and 30 years. Once the contract period is over, the partners hands over the assets to the public company. During the period of the concession, the financiers collect a return on investment of the capital they invested through bonds. The returns cover the initial capital, operation costs and maintenance costs. Contingent to the nature of the project, concession terms and type of infrastructure, the returns are acquired from user charges. When the project involves transportation such as road, the charges to the users is in form of road toll. In other projects such as construction of correctional facilities, the government pays the financiers with revenues collected by procuring department.

Origin of project financing

According to Yescombe (2007), the development and prevalence of PPPs globally is closely associated to the growth of project financing. Project financing is a monetary system founded on loaning against the cash flow of an initiative that is lawfully and financially self-sufficient. The shareholders in these long-term financing projects face a variety of risks. The arrangement of financing the project is vastly leveraged and the financiers are not guaranteed past the right to receive money from the cash flows generated by the project. When financiers invest heavily on such projects through the purchase of bonds, they stand the risk of losing their investment if such projects fail. Despite the fact that infrastructure projects in transportation are specific assets, they turn out to be illiquid if such a project fails, costing the financiers huge sums of money.

A popular characteristic of PPP funding is that the source of funding varies through the project’s life cycle. At the beginning of the initiative, project costs are funded with the financiers’ equity. These may be complemented with bridge loans. In some situations, the project may receive government supports and/or least returns guarantees. When the project becomes operational, longstanding bonds substitute for the bank loans. The financier’s equity may be sold to the operator of the facility or third-party financiers in most case institutional financiers.

The changing sources of funding are designed to equal the progressing pattern of risks and inducements through the life-cycle of the PPPs (Wagenvoort 2010). When the 2008 global financial crisis occurred, most governments offered bonds to finance public projects. The government offered the public bonds in the aim of reviving the economy. The government sought to close the fiscal year with revenues to facilitate the many government activities that were aimed at facilitating the administration of the project. Apparently, the financiers of the project purchased cash flow insurance from a single-line. The issuance of the bonds was accompanied by guaranteeing from the government. The agencies that are involved with such contracts are given such an assurance that it becomes difficult for investors to ignore. Individuals and institutions that were financially endowed invested in the initial offer by the government. Apparently, when bonds are utilized by governments to finance long-term transportation projects, the financiers of such projects are faced by the risk of losing their financial investment.

Bond financing

Until in recent years, PPP markets depended largely on project financing debt given by commercial banks or public financial institutions. After the financial downturn, these financial institution debts became difficult to obtain. The lending terms such as pricing, tenors and quantities have rapidly deteriorated. The bankability and fiscal value for PPP projects have been negatively impacted. In this regard, bond financing has emerged as an alternative. Some of the characteristics of bond financing include:

Maturity/refinancing risk

Typically, bonds are long-term funding solutions. The institutions that invest in bonds pursue long-term assets to correspond the long-term liabilities. In view of PPPs, the assertion translates into funding answers that almost corresponds PPP contract maturities. It entails no refinancing risks.

Pricing

In the contemporary market environment, the ‘all-in’ price of bond funding frequently corresponds positively to that of bank funding. Such an advantage in price contributes to the improvement of value for money and the affordability for the pertinent authority.

Deliverability and pricing uncertainties

The deliverability and pricing of bonds is usually based on actual issuance. This means that there are uncertainties that are inevitable and they endure throughout the obtaining process.

Contemporary PPP models

In modern infrastructure projects, partnership arrangements of different kinds are still used. The arrangements are borrowed from models developed centuries ago. There is also a wide range of increased public sector obligation to increased private sector involvement. There are several dynamics in modern PPP arrangements. First, there is a long-term prescribed model between governments and the private sector in delivering a transportation facility with shared benefits. Second, the private sector is engaged in some arrangement of infrastructure designing, building, funding, management and upkeep. Finally each of the parties share in the prospective drawbacks and benefits related to the delivery of the transportation infrastructure. Bond financing plays an essential role in majority of PPP markets outside Europe in the development of infrastructures.

The above figure illustrates that PPPs are therefore official, bond-based approach to lasting partnerships. Despite the popular term ‘private-public partnership’, the term suggests that a permanent relation between one public sector unit and a private sector unit. In fact, neither the private nor the public sector is immovable. Both the private and the public segments comprise of compounded relations between a wide array of institutions and actors.

An emblematic PPP concession arrangement may be illustrated by the figure below.

For the government segment, a government department typically acts as the lead financier (commissioning agency). The agency receives contribution from other government levels interested in the transportation infrastructure. Furthermore, while a shared objective of the PPP model is raising private sector funding for the project, it is common for the public sector stakeholders to openly finance up to 2/3 of the capital expenses via public liability. In this regard, even though PPPs highlight the partnership between public and private sector, the shareholders who purchase bonds are impacted by key undercurrents of multi-level authority cooperation. The responsibility of public financiers hence effectively changes from a developer of the transportation infrastructure to a buyer of the services that meet premeditated set of productivity performance principles. When the concerns of the bond holders are not addressed in the contract agreements, they stand to lose the capital invested through initial financing and bonds purchased after the completion of the project.

Investing bonds on long term transportation infrastructure has significant impact on project cash flow. All cash flows ought to be reduced at the same cut-rate. In PPP, there are two kinds of cash flows. These are certain and uncertain cash flows. Definite currency flows are those which are fiscally countersigned and assured hence ought to draw a premium percentage equivalent to one-hundred percent. Uncertain cash flows are basically associated to 3rd party income, operator charges and distribution of gains. The government organization helps the sponsor in defining the suitable premium for utilization in assembling Public Sector Benchmark (PSB) as well as gauging submissions which reveal the intrinsic risk and doubts linked to every kind of currency flow. Whoever takes a tender ought to be knowledgeable that diverse monetary movements shall be considered contrarily prior to submitting the bids. This helps the tenderer in making critical decisions. When a firm makes an investment, the management anticipates the benefits over a planning horizon.

This is looked at against that which might have been gained if the amount was invested in another investment. Consequently, a smallest attractive rate of return on investment is accepted to replicate the opportunity cost of the investment. The smallest attractive rate of return is essential for compounding the projected cash flows or for discounting the flow to the present. Cost-effectiveness in this case is gauged by the net future value (NFV). This is the net revenue at the close of planning horizon over what could have been achieved by investing in alternative venture. An affirmative NPV for an investment shows the present value of the net profit consistent with the project cash flows. In this case, financing a transportation infrastructure through bonds does not guarantee a positive NPV particularly for long-term projects. When such a situation that does not favor the continued existence of the project arises, the shareholders are bound to lose part or all their investment. With the information gained prior to tendering, the tenderer will opt not to invest in such a project. By the time the shareholders are expecting to have the return on investment due to profitability of the completed project, the bond market may not be attractive despite the fact that the project may be generating revenue.

Return on investment (ROI)

Transportation infrastructures are typically long-term in nature. In this respect, they require the state agency to adequately prepare for possibilities which may emerge during the contract period. When accounting for every year of a long-term project, the chain of cash flows ought to be fragmented up into yearly rates of return for each year. The ROI as utilized in the records means that the annual rate of return of the project period is based on the annual income and the investment value for the corresponding year. Since these values are different for every year, ROI is also different for every year. In transportation infrastructure projects, it is expected that there should be small value in the initial years of the project and great value in the later years. In this case, funding a project through bonds is beneficial to the shareholders since the value of the bond will have appreciate given that the value of the project will also have appreciated. The reverse of this situation should be catered for by the discount rate selected by the state agency in readiness for any eventualities. This argument arises from the fact that the rate selected by the agency ought to comply with the rate policies with the determination by NDFA as the proxy of the government authority.

Discount Rates during the Life of the Project and Adjusted internal rate of return (AIRR)

Agreement regarding the suitable discount rates is usually essential before the closure of the contract in a) the recalculation of the fiscal model during the life of the project, b) reimbursement on closure, c) refinancing and d) where relevant, pre-payment of debt. Shareholders are bound to benefit more in the situation where bonds are used to finance the project and internal rate of return adjusted accordingly in line with the above situations. When the sponsoring and plowing-back procedures become integrated into the assessment of the venture, the AIRR that reveals these procedures becomes an essential gauge for the profitability under limited circumstances. It offers an estimated value of the gain on venture for which setbacks in the cash flows would produce multiple vales for IRR. Incorporating AIRR would therefore offer the financiers a rough estimate as to whether or not the venture would eventually be profitable.

A shortcoming that impact the shareholders arises from the fact that they have limited control over the specific infrastructure plan, building methods as long as the best quality bid meets the performance stipulations. Upon the completion of the construction of the transportation infrastructure, it is the prerogative of the concerned government department to maintain a considerable controlling mechanism over main project planning duties including the setting of service ranks, quality and safety procedures, expansion plans and fixing user fees. This way, the public interest in the transportation infrastructure is secured where the recouping of capital costs by fanciers is almost guaranteed.

Irrespective of the circumstance that may arise, diligent caution ought to certify that alterations to the fiscal model (part of project contract) protect value for currency for the exchequer. In a situation where an alteration to the unitary imbursement is considered, an assessment ought to be done between settling the entire upfront amount and repaying the expense gradually before the end of the contract life. In such a situation, the most cost-effective option should be chosen.

In case of any alterations to the financial model and in appropriate situation to the project contract, they must be handled in a way consistent with the method used in calculating the initial unitary imbursement.

Placement of public bond issue

In distinction to project loan, the issuance of public bond fundamentally depends on the fluidity of investment markets for ranked liability tools distributed on impartially ordinary expressions. In an emblematic situation, parties in PPP anticipate that issuing public bonds drops the delivery of lower interest rates. Additional, it is anticipated that there will be longer tendencies copied to those in project funding. In this case, the project to admit the presence of placement risk while the project lasts. In initiating a funding contribution, the prosperous purchaser starts with appointing an investment bank to act as the main manager of the project.

It is the responsibility of the selected bank to arrange and organize the underwriting of the binds. However, the lead financial institution does not offer the actual funding. Accordingly, the support letter given by the lead bank for procurement processes are characteristically based o best available efforts. The letter issued does not require the commitment of actual funding. The term sheet that is essential in authorizing the lead financier in a bank credit funding, the lead bank summarizes the projected bond stipulations. Apparently, the emphasis of the tenure sheet is usually on predetermined necessities and more on market deliberations particularly the objective investor bond markets such as cover establishments, the advertising approach, and target rating among many others.

Deflation and price increments

During the assessment of project plans, dual methods could be employed in order to reproduce the impact of impending bond value fluctuations arising from price rises and depreciation. They include constant dollar approach and inflated dollar approach. In long-term projects, inflation and deflation have negative impact on the value of the bond leading to loss on the capital investment.

The lead bank may approach prospective bond financiers at an early stage of the project. The price indication at the initial level is often subjected to ranking necessities and the general market enlargements. Generally, the investor does not apportion finances based on long-term relationship or project analysis based on inflation or deflations. However, the investors grab opportunities within the milieu of asset classes, income and ratings. The objective value of the bonds issued is typically regulated by orientation to interest level for a longstanding bond of comparable meaning and a valuing framework that reveal emblematic risk premiums.

In arranging for the bond advertising, the main bank contacts the main assessment agency to attain an indicative assessment for the bond to be offered by the project handler. This is with the assumption that all project agreements are fully executed. The financial model of the project determines the assessment of the rating agency. This explains the transaction structure to reflect risk allocation of the project the company is subject to. The term sheet of the entire project and all the legal documentation are also crucial for the consultants of the project. The agencies that rate the project in most cases may demand the bonds to be given by an organization with superior purpose. When these procedures are followed from communicating the assessment company to attaining a symbolic assessment, it usually takes between 6 and 8 weeks (Yescombe 2007).

Once the symbolic has been attained, the conscripting of the bond documents starts. In addition to the predetermined credit and security contracts, the documents include the bond brochure. The prospectus offers comprehensive statistics concerning all the features of the anticipated issue of bonds for prospective financiers. Founded on the draft document, the lead company eventually markets the bonds to prospective financiers in a publicity campaign and completes the pricing. The price at this point can be founded on the prevailing interest level for bonds with related asset class. The rating analysis is established as concluding upon the documentation of all records in the agreed arrangement. The issuance of the last rating creates the circumstance precedent to fiscal close.

The fiscal close normally takes place six to seven days after signing of all the documents involved. At this juncture, the seller of the bonds consequently receives the funding. The seller’s debt responsibility arises with the authentic issuance of the bonds. Upon the issuance of the bonds and reception of the funding, the company in charge of the project enters into an assured investment contract or similar financial arrangement. The objective of such an arrangement is to attain agreeable rates of return on investment. This enables the circumventing interest rate risk on money that is not instantly applied to project expenses enabling the minimization of ‘undesirable cost of carry’. This is the difference between interest owed under the bonds and the interest obtained on a time deposit pending the actual application of the funds to project expenses.

When the bonds are to be listed in public exchange, the prosperous purchasers require engaging a listing agency. In most cases, the listing agency is often the lead company. In this case, the lead company acts as the link point between the seller and the appropriate exchange. Every exchange has its unique listing rules. The seller is required to conform to the listing rules of the appropriate exchange. Among these rules is the degree of disclosure concerning the project in the brochure, risk issues, public exhibition of project and credit reports (Smith 2002).

Private placement of bonds

By placing bonds privately, the bonds present the likelihood of striking an important settlement between the corresponding advantages and drawbacks of a bank loan and a public bond issuance. Substance to the drawbacks that emerge from banking and capital exchange markets guideline, the issuance process is mainly designed to meet the necessities of the specific project and target financier base. The more suitable private employment procedure does, the lesser the fluidity when matched with an open bond issuance (Wettenhall 2010). The outcome is that there is increased interest rate. Additionally, prior pledges and funding will still be challenging to attain from distinctive bond financiers even in private allocation procedures. With such requirement, private allocation of bonds is much easier to apply than public bond issuance consequently favoring the financiers (shareholders).

Devaluation and Duty outcomes

In the case of any privately owned organization, the monetary stream summary of a shipping set-up project is impacted by the percentage of duty involved. In view of tax liability, depreciation refers to money allowed as a reduction owing to capital expenditure in calculating taxable income. It hence produces a reduction in levy liabilities. Bonds are affected by the projected valuable lifespan utilized in the devaluation calculations as well as the definite suitable lifespan of the infrastructure when viewed by a prospective purchaser of the bond. However, the depreciation allowance is simply an accounting item that does not entail cash flow.

It should be distinguished that the accomplishment of a bond procedure will normally demand more time compared to loan financing. At the inception of bond funding procedure, any bond lead company may vacillate to give secure guarantees regarding the deliverability of bond funding. These are among the viability issues that the procuring government authority ought to consider when analyzing the prospective financial benefits of bond funding as part of the obtaining approach.

Universal law issues and bonds

The authorities have to deliberate on a number of law issues. For example in Germany, law issues that are likely to emerge because of (a) the necessities of bond financier concerning a buyer’s credit-worthiness, (b) the advanced commitment of bond financiers in comparison to bank pledges under conservative bank loan and (c) the variances in prescribed terms between the dual forms of funding. These aspects relate equally to publicly listed bonds and private allocation in principle

Depending on the ability and nature of the banking connections, not all prospective buyers who can raise bank loans for a PPPs infrastructure project may have the capacity to organize bond funding. For lesser and middle business buyers lacking previous familiarity, they find it challenging to accomplish the governmental demands of the assessment and allocation procedures. Consequently, such shareholders may encounter negative pricing conditions. If the acquiring department anticipates to put bond funding ability into consideration during the pre-qualification procedure, the authority require the identification aptitude for the delivery of bond funding as a pre-qualification customary in the agreement notice as printed in the TED.

In considering pricing subject to placement, a construction will be allocated and assessed following the preliminary bid proposal must consider the anticipated value variances at the bond allocation stage unless the buyer assume complete allocation risk. Shareholders in such situations are required to engage price variances to the cost of debt arising from investment exchange market fluctuation over numerous months. This typically results in undue risk to the investment in bonds. In German, such an occurrence breaches the procurement regulations. Generally, the German laws forbid the acquiring department from loading the successful financier with immeasurable hazards especially for works agreements. The Germany law allows price adjustment sections as a way of addressing substantial but indeterminate variations in essential factors. In seeking to protect the financiers from financial risk, analysis of financial offers for bank loans in PPPs through a reference rate is typically tolerable.

In Germany, it is believed that rating should be anticipated by the selling authority to ensure comparison. However, arithmetical formula suggested by the prospective buyers may be utilized instead when the procuring authority has adequate expertise to analyze them. Furthermore, sharing risk between the buyer and the procuring authority is boosted if pricing is substance to market-motivated variations upon the preliminary proposal submission. When such a formula approach is embraced, the buyers endure the disadvantage of increased actual pricing through provision of supplementary equity. However, the approach benefits a positive placement at a reduced interest rate. For example, in the disadvantaged scenario, the winning buyer may have offered a proposal specifying a margin of three percent over the orientation basket return. If the authentic interest rate for the entire project at allocation surpasses the orientation basket return such as 3.1 %, the buyer would be required to absorb the extra costs via an inferior return in capital. Contrariwise, an allocation at 2.9% above the orientation basket return would mean the increment in the return on equity (Smith 2002).

While buyers will be unenthusiastic to absorb any noteworthy pricing risk on the bond funding, the probability of a financier describing the ‘basket’ itself may make the approach tolerable to market players.

Conclusion

As demonstrated in this study, PPPs are important forms of multi-level governance of public interests. The PPPs model consolidates partners from the public and private sector to establish mega-project infrastructures. The support for PPPs by governments and the private participants ensures that the public benefits from natural resources where the interest of bond holders is secured in providing the public with critical transportation services. PPPs have had diversified outcomes. In some situations, the risk posed by the failure of such projects to shareholders due to different factors results inn losses of capital costs invested by private financiers. The success of such projects ensures that the shareholders recoup their investment in the long-term. The incomplete release of crucial information to the shareholders and recurrent tensions between the partners results in lack of confidence in mega-project transportation infrastructure by key shareholders.

Apparently, shareholders are severely impacted by failure of mega-projects when the planning, construction, rating interest rates and collection of revenue are not streamlined to cater for the interest of the shareholders. When the interest of government agencies is placed before the interest of the entire public and the shareholders, the chances of shareholders losing the money invested as capital costs and bonds increase significantly. In many global locations, PPPs have been encouraged in providing the populations with transportation services to assist in developing the economies.

It is imperative for government authorities to assess a financier’s proposal. In this regard the agency should have the capability to evaluate the ability of the financier to deliver in view of prevailing market circumstances. It becomes a misappropriation of energy and funds for a government to award any tender to a financier and contractor who are incapable of funding the venture. In such circumstances, the shareholders responsible for meeting the capital costs at the start of the project construction are likely to lose their investment or be forced to purchase bonds to sufficiently fund the project. PPPs are steered by a modest conviction that public institutions and corporates operating in productive cooperation deliver super-projects with improved results compared to projects undertaken by a single party.

References

Capon, N 1982, ‘Credit scoring system: a critical analysis’, Journal of marketing, vol. 46. no. 1, pp. 82-91.

Chen, J & Hsu, S 2008, ‘Quantifying impact factors of corporate financing: engineering consulting firms’, Journal of Management in Engineering, vol. 24. no. 2, pp. 96-104.

Garvin, M. 2010, ‘Enabling development of the transportation public-private partnership market in the United States’, Journal of Construction Engineering and Management, vol. 136. no. 1, pp. 402-411.

Hellowell, M 2012, Investing in project bonds to support infrastructure development may help to return the Eurozone to growth, Web.

Hodge, G, Greve, C, & Boardman, E 2010, International handbook on public-private partnerships, Edward Elgar, Northampton: MA.

Osborne, S 2001, Public – private partnerships: theory and practice in international perspective, Routledge Publishers, New York: NY.

Siemiatycki, M 2006, ‘The theory and practice of infrastructure public-private partnerships revisited: the case of the transportation sector’, Public Management Review, vol. 11. no. 2, pp. 707-724.

Smith, J 2002, Engineering project management, Wiley Publishers, Hoboken: New Jersey.

Wettenhall, R 2010, Mixes and Partnerships through time. Edward Elgar, Northampton: MA.

Yescombe, E 2007, Public-private partnerships: principles of policy and finance, Butterworth-Heinemann, London: UK.