Introduction to Telvent and Smart City Software

Telvent is an information technology company that specialises in the distribution of real time information to various sectors of the economy. The sectors in this case include, among others, traffic management, agriculture, energy, and environment (Telvent 2012). The company is a subsidiary of Schneider Electric Company, one of the most popular companies in the global electronics industry.

According to the company’s website, Telvent intends to reduce traffic congestion, failures in the transportation system, delays in commuter services, as well as pollution of the environment. Smart City is one of the projects initiated by this company to meet these objectives. The project is based on the assumption that by 2050, 70% of the world’s total population will be residing in the urban areas (Telvent 2012). As a result of this, it is important to put in place an integrated city management system. The system will address issues affecting the transportation system. In addition, it will spur economic growth in the cities.

In this report, the author addresses the problems faced by a Euro zone company that has invested in countries outside Europe. The company selected in this case is Telvent, which is based in Spain. It is a key player in the road and traffic management industry. As already indicated, the company is a subsidiary of the larger Schneider Electric Company. In this report, the author addresses the challenges faced by Telvent in Senegal. In addition, the researcher analyses the plans proposed to address these problems. The plans are proposed to manage the risks encountered by the new venture in Senegal. The proposed ‘capital budgeting plan’ is also analysed in this report.

The State of Senegal’s Road Network and Traffic System: Regional Importance

According to Infrastructure Africa, the road network in Senegal measures about 18,063 kilometres. Infrastructure Africa notes that the network is adequate given that it provides basic national, regional, and international connectivity. The road network in Senegal is ranked average in terms of connectivity and standards. Infrastructure Africa notes that there is no indication of under- engineered or over- engineered roads in the country.

According to a trade logistics survey conducted by the World Bank in 2010, the country’s Logistic Performance Index is 2.86. The performance is above 2.46, which is the average Logistic Performance Index for Africa (World Bank 2010). It is an indication of the country’s capacity to provide an environment conducive for a robust global logistic network. The implication of this performance is that manufacturers and consumers in Senegal are adequately connected to the rest of the world. They can interact with consumers and suppliers from the local, regional, and global markets.

Though Senegal has one of the best road networks in Africa, the roads are not properly maintained. Most of the roads are dilapidated and eroded, creating a major hindrance to connectivity. The resources set aside to maintain and rehabilitate the road network are inadequate. In addition, the resources are poorly managed, which is largely blamed for the current state of roads in Senegal (Gwilliam et al. 2010). The poor management leads to traffic congestion in most parts of the country.

As a result of this realisation, the Senegalese government has formulated strategies and plans to modernise the country’s transport network. In addition, the government seeks to increase the resources allocated to the transport sector (Torres et al. 2011, 17). To this end, the government is encouraging private investors to invest in the road sector. The incentives have led to an increase in the number of private companies engaged in road construction and maintenance in the country. The government aims to adopt an efficient road funding system. It has established what Telvent (2012) refers to as ‘second generation road funds’ (p.34). In addition, the government has created an executive road maintenance agency. The government intends to improve the quality of the roads, enhance swift connectivity, and minimise traffic congestion. The government has entered into a concessional agreement with Telvent to solve some of these problems.

The Nature of the Project

The major objective of the project initiated by Telvent in collaboration with the Senegalese government is to improve the road network in the country. Telvent is expected to put in place an integrated ‘smart city solution concepts’ (Telvent 2012, p.3) to enhance the development of a sustainable road network.

To achieve the major objective of this concession, Telvent is tasked with the responsibility of repairing all the highways in the country. Restoring the condition of the roads will enhance the performance of the traffic management system introduced by Telvent. The company is expected to put in place a traffic management system to ease traffic congestion in the country.

The management system will make use of traffic updates and information provided by FM radios in the country. The system will help in reducing air pollution by minimising traffic jams. In addition, the economy is expected to improve given that no time is wasted in traffic jams (Varshney & Maheshwari 2010).

The project will make use of an electronic parking system. The system will direct drivers by giving them information on available parking spaces. The system will reduce the time wasted by drivers searching for a parking space. Through the Telvent Smart City Integration Management System, the government will effectively manage the public transport sector. The system will provide accurate information to the stakeholders. It will put in place a ‘seamless fare collection technology’. The system will improve accountability in the transport sector (Telvent 2012). In addition, the system will benefit commuters. They will use the information provided to avoid locations with traffic congestion. As a result, the amount of time wasted in traffic jams is significantly reduced.

Important Statistics

The roads in the country are mainly used by the middle class citizens. As a result, the government is unable to finance the project (Torres et al. 2011). It is one of the reasons why the government has opted for a concession. The project itself is expected to cost around €45 billion. The project will be funded by financial institutions based in Europe. As a result, Telvent expects to benefit from credit swaps and the flexibility of foreign exchange rates in the country.

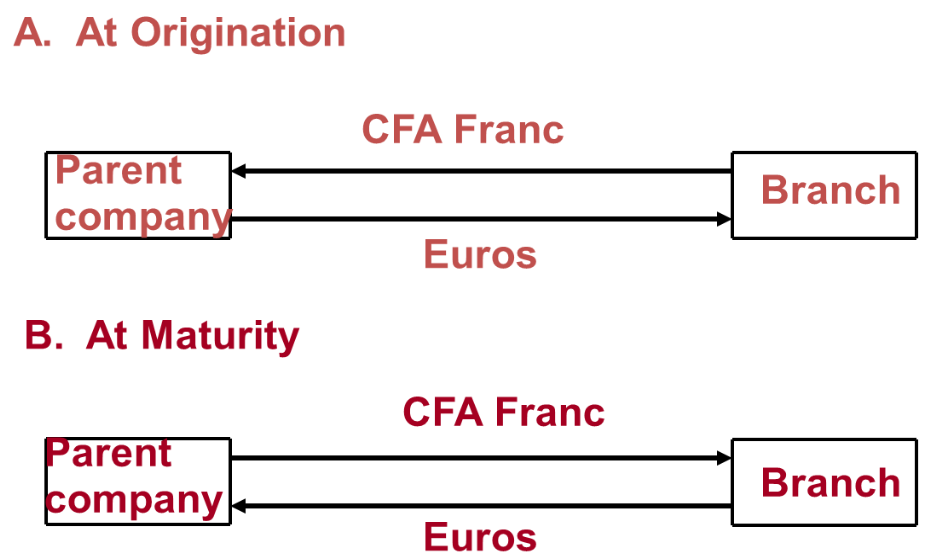

Due to the differences in the values of the two currencies, Telvent is exposed to foreign exchange market risks. The risk faced by Telvent is significant considering that the company is outsourcing its funding services. Currency swap is the preferred long term alternative to deal with such problems. Currency swap is a contractual agreement entered into using two different currencies. The parties in the agreement agree on a given principal amount for a given period of time, after which the original principal amount is paid back (Arthur & Sheffrin 2011). Interest in such cases is paid throughout the life of the exchange agreement. The figure below illustrates a current swap scenario:

The project’s capital budgeting plan will receive the total amount in three disbursements. Each of the disbursements is worth €15 billion. Subsequent disbursements are made only after the previous one is fully accounted for. With a hurdle rate of 14.2%, both the net present- value and internal rate of returns are positive, implying that the project will succeed. The company will export raw materials from the Europe. Exporting raw materials means that the company will maintain the quality of its products in the new market. A significant challenge in capital budgeting is the restrictions associated with fund-transfer. Another challenge involves fluctuations in exchange rates (Jorion 2009).

The company will maintain a sufficient working capital to avoid deficiencies in the project. It will help in managing the risks associated with the new venture. The company will use the working capital to settle current liabilities.

Risks Associated with the Project

The various risks are classified into three major categories. The categories include transactional risks, translational risks, and exposure risks. Transactional risks involve fluctuations in the contractual cash flow, which is brought about by unforeseen changes in the value of the currency and in exchange rates. The risks are handled by a re-invoicing centre (Varshney & Maheshwari 2010). According to Varshney Maheshwari (2010), a re-invoicing centre is a central financial subsidiary operated by a multinational. It helps in reducing transactional risks by ‘billing the home exports using the home currency’ (Jorion 2009, p.6). The centre re-invoices the imports using the affiliate currency within its area of operations.

Translation risk is brought about by changes in the corporation’s financial statements. It is characterised by fluctuations in the value of imports and exports as a result of changes in the value of currency value. There are various strategies used in managing the risk. One of the strategies involves hedging the company’s balance sheet. Jorion (2009) defines exposure risk as the ‘threat faced by a company when it changes its assets or liabilities’ (p.65). The threat is brought about by changes in the value of the currency.

Some of the risks analysed above are managed through hedging. Telvent will consider three types of hedging techniques available in the market. They include forward hedging, which is used to eliminate exchange risks by recording receivables using a foreign currency. The second is money market hedging, which is currently used by Telvent. It involves borrowing and lending money using foreign currency, especially when conducting international transactions. It helps the company to ‘lock-in’ the value of the home currency and evade foreign exchange risks.

Some risks are not hedgeable. They include those risks related to human resource. One of the challenges faced by Telvent in Senegal involves lack of a skilled workforce (Francesco & Gold 2010). The challenge is significant given that expatriates have failed the company in the past. When engaging in new ventures, many foreign companies are faced with the threat of industrial actions, especially when the labour laws are interfered with. Moreover, Telvent is faced with a hostile political environment.

Negative public opinion leads to opposition from political elites and from the general public. The opposition can lead to delays, interfering with the timely delivery of the project. The delays can lead to cancellation of the contract. It is important to note that a hostile political environment is a threat to the completion of the project.

The country has experienced a stable political environment for a long period. However, this can change any time due to disagreements between the various political demagogues in the country. The company needs political protection to survive in such situations. Seeking political favours raises important ethical issues concerning the operations of the company (Gwilliam et al. 2010).

Challenges Facing the Project

There are various challenges facing the implementation of this project. The company has decided to set up a subsidiary in Senegal to execute the project. Setting up a branch will promote the company’s brand. It will ensure that the traditions of the company are maintained. In addition, a subsidiary will enable the company to directly control its businesses in Senegal.

A subsidiary will ensure that the company is in a position to execute other contracts offered by the government. Considering that the company holds a permit issued by the government, the process of setting up a branch will be smooth. However, the process is likely to face various challenges related to human resource. For instance, acquiring talented and skilled labour force is difficult. Other challenges include social-cultural differences, compensation of benefits, and fears of expatriate failure (Noe et al. 2009).

A venture of this magnitude requires a significant amount of start-up capital, which is one of the greatest hurdles in the implementation of projects. Telvent is facing a similar challenge. To address the problem, Telvent has decided to source its capital from Europe. Securing capital from Europe will give Telvent the bargaining power with regard to interest rates and payment periods (Varshney & Maheshwari 2010). Another challenge is identifying an ‘admissible financier’ for the project. In addition, setting up an appropriate ‘hurdle rate’ is difficult since this is a new market.

Unfavourable government policies may hinder the implementation of this project. Policies touching on, among others, taxes imposed on foreign companies and importation of raw materials and labour may affect the project (World Bank 2010). In addition, cultural differences may undermine the operations of the company (Francesco & Gold 2010). It means that the traditions of the company are significantly distorted.

Plans to Overcome the Challenges

There are various reasons why Telvent opted for European financial institutions. One of them is the fact that most of the local financial institutions deal with international finance. It will help the company to overcome various challenges. Such financial arrangements will help the company in setting up an appropriate hurdle rate and formulating capital budgeting plans. An admissible financier should be selected based on the experience of the institution in the industry. If the selected financial organisation is unwilling to fund the project, Telvent plans to approach other financial institutions with the intention of forming a consortium (Torres et al. 2011).

An intensive feasibility study carried out by Telvent shows that several financial institutions are interested in this development project. Institutions interested in financing such projects range from development agencies in the Euro zone, multinational banks, and foreign governments through their respective central banks. A case in point is the European Central Bank. Telvent has decided to approach these financial institutions to secure funds required for the project.

Telvent will train the existing employees, who will be used by the company in the future. Currently, the company is obtaining its labour force from Senegal and the larger West African region. The West African region, through the regional development agency ECOWAS, has adopted a free labour movement policy. Telvent is planning to use this regional agreement to its benefit. The company will assemble a team of competent employees to work on the project (Noe et al. 2009). The employees will be drawn from various parts of the country.

In efforts to maintain the company’s winning culture, the top management will comprise of 75% expatriates and 25% locals. By using this formula, Telvent expects to impact positively on the local workforce. In addition, the company aims to improve the structure of the organisation. Newly recruited employees will be taken through an orientation program, which is expected to provide them with information on what is expected from them (Francesco & Gold 2010).

The Pros and Cons of the Senegalese Road Project

The project has various benefits. It will help the company to tap into the huge African economy. The project will serve as a promotion campaign for Telvent and the entire Schneider Electric Company. The success of this project is important to the future of the company.

With the help of the project, the company will effectively introduce an efficient traffic management system in the country. The project will provide the company with experience, which is important for future ventures. The significance of the experience is based on the fact that Senegal is categorised as a developing country. Telvent will make an impact in the country by improving its infrastructure and connectivity.

However, Telvent Company will have to bear with the high costs associated with the project, largely due to lack of modern technology in Senegal. Technological challenges will force the company to import most of the raw materials needed for this project. Considering that the government rarely gives tax rebates, the company will have to shoulder the entire tax burden. In addition, the company may be forced to take other austerity measures when the project is already underway.

Conclusion

The project is faced by various challenges. The challenges range from difficulties in raising the initial capital, unclear mode of entrance into the market, risks associated with foreign exchange rates, risks associated with human resource, cultural differences, unfavourable government policies, and ethical constraints.

The project gives the company an opportunity to tap into the unexploited African market, which has a significant growth potential. Currently, multinational corporations are scrambling for investment opportunities in Africa. The project serves as the first step into this challenging market. As a result of this, Telvent Company has decided to go ahead with the project, regardless of the attending risks. To begin with, Telvent will open a branch in the capital city of Senegal, Dakar.

References

Arthur, S & Sheffrin, M 2011, International economic principles in action, Pearson Prentice Hall, New Jersey.

Francesco, AM & Gold, BA 2010, International organizational behaviour, Pearson Prentice Hall, Hamilton.

Gwilliam, K Vivien, F Rodrigo, A Briceño-Garmendia, C Nogales, A & Kavita, S 2010, The burden of maintenance: roads in Sub-Saharan Africa: AICD Background Paper 14, World Bank, Washington DC.

Jorion, P 2009, Financial risk manager handbook, John Wiley and Sons, Illinois.

Noe, A Hollenbeck, JR Gerhart, B & Wright, PA 2009, Human resource management: gaining a competitive advantage, McGraw-Hill International Edition, New York.

Telvent, 2012, Smart cities-smart mobility, Web.

Torres, C Briceño-Garmendia, M & Dominguez, C 2011, Senegal’s infrastructure: a continent perspective, Web.

Varshney, R & Maheshwari, K 2010, International managerial skills and economics, Sultan Chand & Sons, New Delhi.

World Bank, 2010, Project information document, concept stage: Report AB3075, World Bank, Washington, DC.