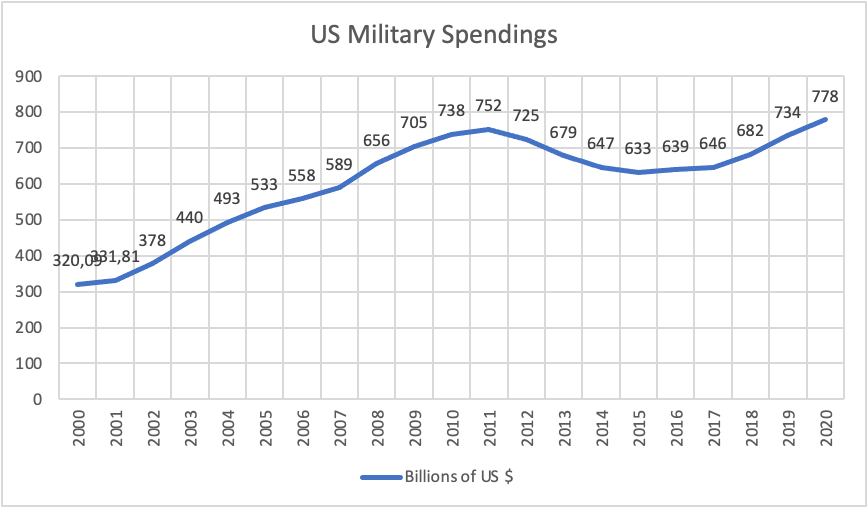

The immense quantity of dollars spent on the military is one of the most controversial topics in American public discourse. Figure 1 shows the stable growth of US military spending despite the worldwide preoccupation with globalization and demilitarization. It has been argued that military spending may also be employed as a kind of fiscal policy that benefits economic development. The alternative idea is that the cost of maintaining a military has a dampening effect on economic expansion. Inadequate military spending can be economically harmful due to increased incentives for government intervention, external factors, and impact on economic stability in society.

There are several ways in which military expenditure might impact the United States GDP growth. Increases in military spending often increase capacity utilization, earnings, investments, and total production when aggregate demand is low compared to potential supply (Miyamoto et al., 2019). The beneficial effect of military spending on national production is a central tenet of the Keynesian military perspective, and the results of much previous research have supported this view. As more money is funneled into the military, the government is forced to raise taxes or borrow from the international capital market, damping the economy. Since an increase in the interest rate discourages investment and consumer demand, slows economic development, and ultimately harms economic prosperity.

Another way to explain the bad effect of overspending on the military is to understand its externalities. According to Biswas (2019), military spending stunts economic development and causes less investment in the production of civilian goods, such as healthcare or infrastructure. As Manchanda et al. (2021) point out, “every extra dollar spent above the necessary level depicts the sectoral opportunity cost of public spending” (p. 171). As a result, spending on public goods may be more beneficial for society because they generate better well-being for people than the sense of security from military spending.

Increases in military expenditure, like those seen during the Afghanistan war, may strain a country’s budget. Watson Institute’s (2021) research shows that $2.313 trillion was spent on the entire Afghan military campaign. There has been a deficit in the government budget each year since then (Tian et al., 2020). When a country’s spending exceeds its income, a budget imbalance may cause economic instability in the form of inflation. In order to bring down a deficit, fiscal policy should be used to stimulate the economy, resulting in more tax income and less expenditure.

Looking from the other perspective on this issue, it seems that military spending significantly damages the well-being of working Americans. However, some scholars see the military as positive for the economy since it helps to generate employment (Nadeem et al., 2021). Recovery from the Great Depression in the United States during World War II and the subsequent rapid expansion of the economy after the war is often cited as an example. The alternative is that military spending will crowd out other expenditures, such as private investment, which might hinder development according to the basic idea of opportunity costs.

Germany, Japan, and Italy’s economic recoveries after World War II are typically held up as counterexamples (Auerbach, 2020). While it has generally been agreed that economies would gain from reduced military expenditure, there is debate about how much and where those advantages would be dispersed over time and across nations. Cuts in military spending will have wide-ranging macroeconomic repercussions, most notably on interest rates, currency rates, and trade patterns, all of which will affect the total and equitable distribution of savings.

In conclusion, cutting down on military spending might cause a temporary uptick in unemployment and a slowdown in economic development, which has been a source of widespread anxiety. It is often accepted that military contractors will lay off workers to compensate for lower government contracts when military spending decreases.

References

Auerbach, A., Gorodnichenko, Y., & Murphy, D. (2020). Local fiscal multipliers and fiscal spillovers in the USA. IMF Economic Review, 68(1), 195-229. Web.

Biswas, B. (2019). Defense spending and economic growth in developing countries. In J. E. Payne (Ed.), Defense spending and economic growth (pp. 223-235). Routledge.

Miyamoto, W., Nguyen, T. L., & Sheremirov, V. (2019). The effects of government spending on real exchange rates: Evidence from military spending panel data. Journal of International Economics, 116, 144-157. Web.

Manchanda, N., Kalra, A., Singh, H., & Padhi, S. (2021). Analysis of the global defence budget and its economic, social and environmental impacts. South Asian Research Journal of Humanities and Social Sciences, 3(4), 166-175. Web.

Nadeem, M. A., Liu, Z., Zulfiqar, S., Younis, A., & Xu, Y. (2021). Does corruption impede innovation in developing economies? Insights from Pakistan: a call for policies reforms. Crime, Law and Social Change, 75(2), 93-117. Web.

Tian, N., Kuimova, A., Da Silva, D. L., Wezeman, P. D., & Wezeman, S. T. (2020). Trends in World Military Expenditure, 2019. Stockholm International Peace Research Institute. Web.

Watson Institute. (2021). Human and budgetary costs to date of the US War in Afghanistan, 2001-2022. Web.

Appendix