Introduction

World Trade Organization (WTO) is a transformation of GATT (General Agreement on Trade and Tariffs (GATT). GATT was formed in the year 1947 for the promotion of world trade at the global level especially among the member countries. GATT is the result of restrictions imposed by countries on the products of their trading partners to protect one segment or sector of the economy (ICFAI Center for Management Research (ICMR), 2005). The agreement was signed by various countries to lessen or remove the trade barriers, which were damaging the international economy in general.

GATT was the foremost step towards liberalization of global trade. It was an important multilateral agreement which helped in liberalizing global trade by way of reducing tariffs, open markets and framing rules for free and fair trade. The primary objective of GATT is to liberalize and expand trade through negotiated reductions in trade barriers. It provided a forum in which countries could discuss and resolve trade problems and make available contractual rights and obligations for contracting parties to challenge formally other members’ trade practices. The articles of GATT dealt with commitments on tariffs. These depicted the rules and obligations to prevent nations from pursuing trade policies which would be self defeating, if emulated by other nations.

The following are the fundamental principles of GATT:

- Non-discrimination

- Reciprocity

- Prohibition of Quantitative Restrictions

- Dispute Settlement Mechanism

The institutions structure of GATT and its dispute settlement system were giving cause for concern. All these put together motivated the contracting parties of GATT to the initiation of the Uruguay Round which was the landmark trade negotiation round in the history of the World.

On the 1st of January, in the year 1995, the WTO was formed to replace GATT with increasing effectiveness. WTO members through the various agreements are bound to operate a non-discriminatory trading system (ICFAI Center for Management Research (ICMR), 2003). Furthermore, through these agreements each country receives guarantees that its exports will be treated fairly and consistently in other countries market. The proposals made in Uruguay Round are playing a significant role in the history of WTO.

WTO predominantly overseas the rules of trade between different countries in the world. It plays a plethora of roles. It advocates trade liberalization. It addresses the trade disputes that arise between trading partners and trading countries in the world. It is also a place where trading countries reach agreements at global level. Essentially WTO is a negotiating forum. Trading partners negotiate their problems at this forum. WTO as a body emerged after intense negotiation, and the role it is playing is also a result of long drawn out negotiations. WTO encourages trade liberalization but that does not mean that it accepts every form of trade. It advocates trade barriers as well- in circumstances when trade is harming the interests of customers or trade is leading to spread of disease such as SARS that created havoc in some of the Asian countries or mad cow disease that spread in some European nations.

WTO agreements are negotiated, and signed by the world’s trading partners. The agreements provide legal ground rules for international commerce. They open more avenues producers of goods and services, exporters, and importers to conduct business while meeting some social and environmental objectives. Though the agreements are a result of thorough negotiations, yet partners differ in their interpretation. WTO tries to solve these problems by taking a neutral stand based on a mutually agreed legal foundation. The WTO agreements deal mainly with agriculture, textiles and clothing, banking, telecommunications, government purchases, industrial standards and product safety, food sanitation regulations, and intellectual property. “The basic structure of the WTO agreements: how the six main areas fit together – the umbrella WTO Agreement, goods, services, intellectual property, disputes and trade policy reviews (World Trade Organization (WTO), 2009).”

Success of WTO

The WTO can be considered as the single most successful international agency of the globe. The WTO has been so victorious that several groups have appealed to Use the WTO to implement a variety of nontrade rules affecting labor, the environment, and competition policy. Furthermore, it can be stated that the WTO is barter. “The budget of the WTO is around $80 million a year, barely more than the rounding error in U.S. federal budgets (Building on the WTO’s Success, 2000).”

The reasons for the virtual success of the WTO are that it has been extremely alert on reticent and largely shared trade concerns—modest since the WTO, roughly alone amid global bureaucracies, has self-consciously opposed both internal and external demands to develop its mission.

The success of WTO can be attributed to various fronts. One is its effective non-discrimination policy (Moore, 2005). According to WTO agreements, no country can give special treatment to its trading partner. For instance, a country cannot reduce the customers’ duty rate for products coming from one country without giving the same treatment to other WTO members. This principle is known as Most-Favored-Nation treatment. This is the first article of GATT. This highlights the importance of this principle. The same principle should be followed in the case of foreign and domestic services, foreign and local trademarks, copyrights and patents.

There are nevertheless certain exceptions to this opinion. In rare cases, some WTO members can enter into free trade agreements among themselves and discriminate against the products coming from other member countries. Member countries also can give exclusive access to their markets to developing countries. They can also raise barriers against goods or services being imported traded from countries that are following unfair practices.

Another success front of the WTO is its predictability i.e. through obligatory agreements and lucidity.

Stability and predictability in the economy encourage investment, which further increases the number of jobs. In countries which are economically stable consumption will be high compared to unstable countries. By ensuring that countries will not increase the trade barriers. WTO brings stability into the global economy. This stability and predictability offers a much clear view of future opportunities and promotes growth.

Promoting fair competition is yet another area of specialization of the WTO. The WTO monitors the system of rules made to ensure open, fair, and undistorted competition. Through the rules of non-discrimination such as most favored nation, and national treatment it tries to establish fair conditions for trade. It discourages unfair practices like dumping and subsidies which give undue advantage to exports from some countries. Issues such as subsidies and dumping are complex to understand and address. Hence, WTO employs laid rules to differentiate what is fair from what is unfair, and what governments’ response should be. The WTO agreements, aimed at promoting fair competition, encompass fields such as agriculture, intellectual property, and services.

Moreover, world history shows that trade disputes have many a times degenerated into trade wars and World Wars. Two interesting developments after World War II show how addressing trade problems can lead to peaceful co-existence. Some countries in Europe entered into cooperation agreement to address problems concerning coal, iron, and steel. This cooperation finally blossomed into European Union. Same was the case with GATT. Countries from various parts of the globe came together to address their problems motivated them to create the WTO. The WTO system thus has an important role in maintaining peace. Peace is a result of international confidence and cooperation. The WTO is expected to promote smooth flow of trade. It is expected to offer a constructive and fair platform to address disputes over trade issues and promote peace.

Lastly, decisions at the WTO are made by consensus and this is a key success factor. Members negotiate, and their agreements have the backing of their parliaments. All the member countries irrespective of whether they are rich or poor can challenge the dispute settlement procedures. This is possibly only in a multilateral trading system such as the WTO. In the case of bilateral trading agreements a stronger partner naturally imposes it will on the weaker partner. Without a multilateral trading system like WTO, small and weak countries may have to enter into bilateral agreements with stronger countries and would be in a weaker position to bargain.

Failures of WTO

Needless to say, there are always two sides for a coin. All the above mentioned aspects cannot necessarily conclude that the WTO is a perfect system. There are quite a few challenges that are faced by the WTO. One such problem is that the system goes on to rely on most important new agreement rounds – and package deals –to create new set of rules or to elucidate the existing rules. This means that reforms to the existing system occur intermittently and occasionally. “Seven years elapsed between the end of the Tokyo Round and the beginning of the Uruguay Round; eight years between the Uruguay Round’s completion and the launch of the Doha Development Agenda in November 2001 (Moore, 2005).”

The same is the case with the ministerial conference held at Cancun, Mexico. The difficulty faced at the beginning of the conference was with regard to the basic text for discussion. The initial text was rejected by the developing countries as it was against their interest (The ICFAI University Press, 2005). A group of 21 countries including Brazil, South Africa and India had put forward a new text. However, none of the countries was satisfied with the draft proposal. There are numerous reasons for the failure:

A ‘pro-active’ approach as it is called will require the construction of coalitions of countries at the WTO, which will differ from issue to issue and will cut across developing and developed countries. Secondly, the negotiators’ hands are tied by the government which since the mid-1990s has been influenced, in turn, by the positions of all political parties and the interests they represent. Lastly, while it is perfectly appropriate to control access to the domestic market (the UK and the EU do so in many areas) it does not serve certain nation’s cause of the government engages in autonomous liberalization.

Findings

The Trading Pattern between England and South Africa: How Data Resemble the Theory: In the late part of the 20th Century there had been a trend for economic liberalization all over the world. The neoclassical neoliberal economists preached for the mutually beneficial pattern of international trade and the academicians and policymakers also expressed interest in favor of the economic liberalization to maximize the benefit of UK through the removal of trade barriers like tariff and non tariff barriers. UK was found to play a pivot role in the establishment in 1995 of the World Trade Organization that aimed to set up favorable policy making of different countries and dissolving the trade disputes. In that process South Africa was the most benefited nation. Gradually the South African exports found the American market to be a good destination. The Sino-UK trade gradually mounted the trade deficit of the United States. Mainly the low price South African products became the cause of UK deficit in the Balance of Trade.

Different researches have been made regarding the history of success of South Africa in capturing the UK market. According to many researchers South Africa policymaking is the major factor that has made it a great exporter in the market of UKA. It has been claimed in a survey article in “The Economist” that south Africa government has adopted the policies like export subsidies and pegging the exchange rate. The government is alleged to adopt the policy to restrict the south Africa currency from appreciating much. According to the author the accumulation of foreign exchange reserve in South Africa is the major proof of the government intervention in pegging the exchange rate. (Economist, June 25, p. 76)

According to some economists, the rise in supply of South African goods in the global market there is a decline in the global price of the goods in the market. The matter of fact is that South African policy is bringing about a decline in the price level of goods that make south Africa goods cheaper in the global market as well as UK market. That is certainly a reason for the increasing demand for South Africa goods. The business environment in South Africa is relatively more flexible. According to a report by the World Bank the cost of starting a business in South Africa is 9.3% of the average per capita income which is relatively much lower than that in other countries. Moreover, the huge supply of south Africa labor is a major cause of a declining cost of production. Moreover, the duty free import of raw materials and inputs causes a declining average and marginal cost of production. All these things together have made the south Africa myth successful. (Amiti and Freund 2007)

In an economic survey made by a committee of the Congress, UK has revealed that the south Africa policy of regulating the domestic economy towards an outward oriented path has been the major lynchpin of the success. There is a constellation of facts and reasons for the export boom faced by this country. The major contributory fact to the success of South Africa as a global player in the success of the authority to stabilize the price by lowering the cost through wage control and labor efficiency. By these facts the price level of South Africa is gradually declining to make its product more competitive in the global market.

The UNCTAD report in 2008 has mentioned the government policy of South Africa regarding the sterling pound value of Rand is responsible for the export boom of that country. The South African government is controlling the value of Rand through pegging it by the maintenance of the foreign exchange reserve. Along with the fact the wage of country is controlled through the government and the wage rate growth is considerably slow and the increased efficiency of the production process has caused declining price. That’s why the global competitiveness has been increased. That is causing threat to the import competing sector of many countries. (UNCTAD Report 2008)

The Theoretical Base

The policy for free trade was first pleaded by Adam Smith, the father of economics, in his book “An Inquiry into the Natural Causes of the Wealth of Nations”, by the establishment of the theory of ‘Absolute Advantage’. After that the logical justification of free trade as the best policy was provided by David Ricardo by his theory of ‘Comparative Cost Advantage’. Afterwards the neoclassical economics like Marshall, J. S. Mill, Meade etc represented the trading pattern by analyzing both demand and supply side and they established that a country would import any commodity from another country if it is obtained by importing at lower price than domestic market and similarly a country is exported if it commands higher price in the global market than that in the domestic market. (Salvatore 1995)

In the real life there is no barter exchange. When there is an inter country transaction of the commodities money is Used as a medium of exchange. So whenever we consider the import and export of the commodities we have to consider the conversion of currencies. In that case the concept of exchange rate is concerned. In general the UK £ is most accepted global currency for transaction so whenever we consider the Sino-American trading pattern the transaction should take place by the exchange of commodities for the UK £. Hence we have to consider the terms nominal and real exchange rates.

Nominal exchange rate is the amount of domestic currency that is required to exchange with one unit of foreign currency. In case of South Africa the exchange rate is expressed as Rand/ £ (e). The real exchange rate of South Africa is expressed as:

while the term e expresses the nominal exchange rate and

- Pu =

- Pu =

price level in UK and

- Pc =

- Pc =

price level of South Africa. That implies the amount of South Africa good that one unit of UK product commands.

The concept of trade balance can be given as:

- T = X -M

- T = X -M

while the X refers to the export and M refers to the import. On the other hand T can be expressed as a positive function of q. So trade balance can be reformulated as:

I.e. a rise in the nominal exchange rate makes the domestic commodity cheaper in the global market. Hence there would be a high demand for the product of domestic country in foreign country. Domestic exports would rise causing a favorable movement of the balance of trade.

Now, the change in the real exchange rate depends upon three factors; first is the change in the exchange rate second is the change in the foreign price rate and the third is the change in the price of domestic commodity. So by the help of hat exercise we can say that for South Africa the rate change in real exchange rate would be represented as:

While:

To be more precise we can say that the rate of real exchange rate depends upon the rate of change in the nominal exchange rate and the rate of change in relative price p,

and

Hence we can say that the rate of change in the real exchange rate is the sum of rate of change in nominal exchange rate and the rate of change in the relative price. Hence if there is a fall in the nominal exchange rate a higher rise in the relative price would cause a rise in the real exchange rate. (Rivera-Batiz, 1985)

South Africa became the member of WTO and initiated the trade liberalization process abiding by the WTO charter. Since the year 1995 the world witnessed the massive rise in the south African import in UK. In the year 2008 it was accounted for more than UK£337 million causing a balance of trade deficit to the extent of UK £ 226 billion.

What is the cause behind this galloping import of South African product by the Britons? Whenever an economy is liberalized the domestic market of that economy is integrated to the global market and the citizens get easy access to the foreign products without paying any extra charge for that. According to the theory of demand we know that other things remain unchanged the demand for any commodity is dependent upon the price of it, to be precise, the demand for any commodity is negatively related to its price. If we consider a South African product, the price of South African product in the UK £ would be measured as:

- Pc/e

- Pc/e

is the price of the South African commodity at Rand and e represents the Rand/£. What happened in the course the price level of South Africa has declined. In due course the South African currency has faced a continuous appreciation vis-a-vis the UK £. However, the rate of decline in the price level of South Africa was so strong that it offsets the effect of the appreciation of South Africa currency against UK £ and the demand for South African import has gradually mounted.

This paper has attempted to validate the above theory regarding the positive relationship between the real exchange rate of South Africa and the balance of trade surplus of South Africa in the UK Trading Relationship (which is the balance of trade deficit of UK in other words). Here we assume that the real exchange rate is the independent variable and the balance of trade is the dependent variable. We here Use the regression to prove the positive association between the dependent and independent variable and find out the standardized coefficient. Here we use the available data. The price level of South Africa is represented by the Consumer Price Index due to lack of available data of South Africa regarding the wholesale price index (normally the wholesale price index is very close to the consumer price index). Similarly the price level of UK is represented by the consumer price index. The data regarding nominal exchange rate is available and Using the nominal exchange rate, price level in South Africa and price level of UK we have derived the real exchange rate of the corresponding years. The regression is run by Using the Statistical Package for Social Scientists.

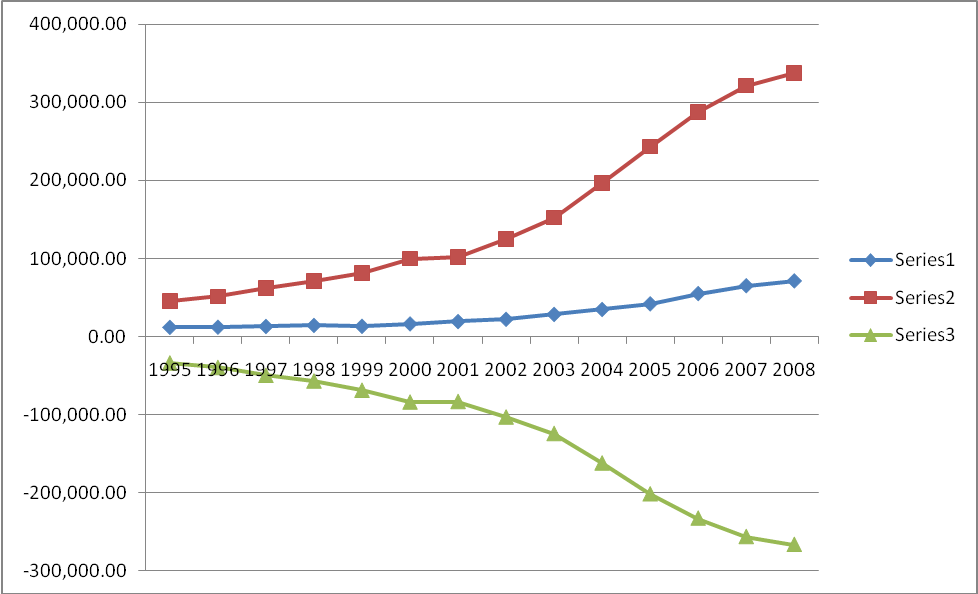

The following table represents the data of the trade between UK and South Africa for the time period 1995-2008. Here we find that there is a continuous growth in UK import from South Africa and Balance of Trade deficit in bilateral trade. In this partnership the Balance of Trade deficit of UK just declined mild in the year 2001.

The following diagram is the representation of the above table. The vertical axis measures the money value of trade in million UK £. Series-1 shows the trend of export by UK to South Africa and series-2 shows the import of UK from South Africa and series-3 shows the balance of trade of UK in the bilateral trade. The balance of trade is found to be deteriorating sharply over time. This is due to the widening gap between import and export.

The data available are given in the following table. The consumer price index of South Africa is obtained from various sources. The data of CPI of South Africa from 1995-99 are obtained from the South African government department of statistics. The data regarding the CPI of South Africa have been obtained from the South Africa Economic Indicators. The CIA fact book has provided the CPI inflation rate of South Africa in 2008. From that the CPI of South Africa in 2008 has been derived. By dividing the CPI of UKA by the CPI of South Africa for each year the relative price has been obtained. Then by multiplying the relative price with the corresponding nominal exchange rate the real exchange rate has been obtained for each year.

In the data sheet of Statistical Package for Social Scientist the data of the real exchange rate have been used as the independent variable as per the theoretical framework Used here. On the other hand the data regarding the balance of payment surplus in different years have been placed as dependent variable. The regression is run below 5% level of significance. The value of the standardized coefficient of the regression has been obtained to be.868 which shows a high degree of dependence of the trade balance surplus on the real exchange rate. The value of t statistics is 6.601 (which is greater than 2) that implying that regression is statistically significant.

Table 2

* Statistics: Government of South Africa, n.d.

- ** South Africa Economic Indicators, 2008

- *** Finance Department, Seattle Govt, 2009

- **** Economic Time Series Page, n.d.

There is sufficient indication that economic globalization has been there since the emergence of trans-national trade. As a result, it has been accounted by enhancing developed economies to integrate with less developed ones through foreign direct investment. This has reduced trade barriers and modernized the developing economies. Globalization is the rising interconnection of the different people and also places resulting from the advancement in the transport sector, communication sector and the information and technologies sector which further causes a convergence in the economic, political as well as the cultural dimensions. Consequently, economic globalization is referred to as the increase of integration between two or more countries which results in a single world market. Globalization can have both positive and negative impacts on the economy depending on the paradigm.

This paper is going to examine the various types of globalization and its effects, benefits of globalization to human mankind, globalization process, whether states should control globalization, and further point out methodologies used to measure globalization, and globalization institutions. The paper will also explain if Imperialism, Capitalism and Corporate Led to Globalization, and give conclusion based on whether globalization is in its current form and scrutinize how globalization has contributed to the prolonged and bitter conflicts of the world.

Types of Globalization

Globalization can be categorized as either being political, social, economical and cultural. Each community or country has its own unique culture, economic and social contexts thus each theory used in globalized education, is different from the other even if the theories can base freely in some culturally rich countries. Countries with less values and cultural aspects have a theory of fungus and amoeba which are appropriately used as choice for development. Localized globalization in education adds more principles for a nation’s developments if creativity and adaptation are introduced in cultural and operational change process. This creates scenarios that are isolated, totally globalized, totally localized and both highly localized and globalized. This scenarios do represents the efforts that pursue different sets of social values in education.

There various types of wisdom and local knowledge that is studied in global education these are: political knowledge, human and social knowledge, economic and technical knowledge, economic knowledge and cultural knowledge. These are applied in development of society, communities, school institutions and individuals. These types of local knowledge can be fostered by theories.

Positive effects of economic globalization

The most positive outcomes include eradication of inefficiency, elimination of local monopolies, citizens being aware of their rights, and fighting oppression by local rulers and political parties, and citizens being able to access opportunities that are available globally. Globalization is mainly characterized by economic flows that include goods and services, labour/people, capital and technology. The farmers are usually exposed to links of global markets, investment and technology, getting increased prices and their yields being improved.

Economic globalization has led to the following positive impacts:

- Nationalization of industrial: through surfacing of border access and world wide production markets to a variety of foreign goods and services that is of benefit to companies and consumers.

- Financial: through emergence of better access and financial markets to sub national, national and financial for corporate borrowers

- Economic: through realization of a common global market that is based on the free exchange of capital and products.

- Political: through formation of a world government that controls relationships between nations and guarantees social and economic globalization rights.

- Informational: through information flow increase among graphically remote locations

- Cultural: through expansion of cross-cultural contacts as a result of new categories of identities and awareness.

- Ecological: through the introduction of global environmental challenges which cannot be minimized in absence of international cooperation like water and air pollution, and climate change.

- Social: through achievement of people moving freely across all nations.

- Transportation: through incorporation of technology that reduces travel time and thus promotes cultural exchange internationally.

Economic globalization and its effects on poverty

Economic globalization has helped improve the standard of living of many in the world. On the other hand, it has also driven more people into poverty. Small scale businesses and most third world countries are not able to modernize their technology as frequent as their wealthier and larger counterparts. This makes them not able to compete with first world countries as they will be forced to carry out their business locally, which never grow and reach their full potential.

Technological advancements are a gradual process but implementing them globally is expensive which leads to high consumer prices. Many countries cannot afford those prices so only wealthy organizations and countries will benefit. Furthermore, currency traders can revise their exchange rates and inform the public. This enables companies to get competitive exchange rates. Considering Alexander Bell (1876) invention of telephone enabled exchange of information all over the world faster. Moreover, the global-market place applies the system of the winner takes all. This means that, poorer countries and small businesses limit themselves to only their local markets.

Living standards of people have been raised more by global capitalism thus increasing the number of ‘haves’ and ‘have-nots.’ The poor have been driven further into poverty thus it is unlikely for them to recover. The wealthy nations established internet while poor nations were not able to purchase and get connected to the internet. By the time poor nations benefited from the internet, wealthy countries had become wealthier. Poorer nations are forced to use horses and ships in comparison to airplanes and automobiles that are expensive. Furthermore, increase in computing speed in rich nations enhances fast transfer of documents in essence that faster machines can handle data.

Many wealthier countries are using the poverty of other countries to their advantage by creating jobs faster than the third world nations. This leads to increased levels of poverty in their country as the companies’ profits are not invested in their home country. The world’s poorest nations are not able to upgrade their technology often; more so, they have to work to increase transaction speed, production and investment. And finally, a company can be less competitive because of its low productivity because it cannot modernize its technology and goods thus economic globalization increases poverty in some nations as well as decreases poverty in other.

Conclusion

So far the analysis is concerned at the very beginning the main stress is given on the real exchange rate of South Africa in controlling the trading pattern. Many economists have argued on the ground of the control over nominal exchange rate and the control over price. However, all these things ultimately affect the real exchange rate. So the real exchange rate is the dominating factor and our data analysis proves the same. It has statistically been proved that UK gradually mounting trade deficit in the bilateral trade relationship is due to the movement of real exchange rate of South Africa whatever may be the cause behind that.

Works cited

Amiti, Mary. and Freund, Caroline, “South Africa’s Export Boom” Finance and Development, 2007), Volume 44, Number 3

Niskanen, William, “Building on the WTO’s Success”.. CATO Journal, 2000, Vol. 19.

ICFAI Center for Management Research (ICMR). “Economics for Managers”. Hyderabad: ICFAI Center for Management Research, 2003.

Moore, Mike, “WTO: A Success Story”. IPG. [Online] IPG, 2005. Web.

Rivera-Batiz, International finance and open economy macroeconomics, Macmillan, 1985.

South Africa Economic Indicators (n.d): (2009). Web.

World Trade Organization (WTO), “About the organization”. WTO. [Online] WTO, 2009.