Introduction

The purpose of this research paper is to analyze various aspects, including history and evolution; responsibilities and functions; and organizational structure of the Saudi Arabian Monetary Agency (SAMA). The government of the Kingdom of Saudi Arabia established SAMA in 1952 as its central bank.

History and Evolution of SAMA

In the year 1928, the first Saudi currency law known as the Hejazi– Najdi Currency Law was enacted by the then rulers (SAMA, 2015). Through this law, the Arabian Riyal was made into the preferred size, fitness and weight (SAMA, 2015). The Arabian Riyal replaced the Ottoman Riyal and by 1935, the government introduced a new silver Riyal referred to as the Kingdom of Saudi Arabia. The new currency was minted to match the specifications of the Indian silver rupee.

During the reign of King Abdulaziz, the government established the central bank through various Royal Decrees of 1952. The first Royal Decree was issued for a venue in “Jeddah while other branches were to be established in various cities and towns as considered necessary” (SAMA, 2015, p. 1). The second declaration contained the consent for the Charter of SAMA.

The first Governor of the central bank was a foreigner from the US, Mr. George A. Blowers while the Vice-Governor was Mr. Rasim Al-Khalidi. During this period, the government also established the first Board of Directors of SAMA. Consequently, the central bank of Saudi Arabia started its operations in 1925 in Jeddah.

In the same year, the government issued a Royal Decree that introduced and recognized the Saudi gold sovereign as the certified legal tender of the country. As a result, the first gold currency coin of the Kingdom was issued bearing the name of the King in October 1952.

In the year 1953, SAMA opened two more branches in Makkah and Al-Madinah. Following the resignation of the first Vice-Governor of the central bank, Mr. Ralph Standish was appointed to take over in the year 1954.

Between the year 1953 and 1956, the government of the Kingdom considered the use of “heavy metal coins for the convenience of pilgrims” (SAMA, 2015, p. 1). As a result, they were relieved from carrying more heavy coins when SAMA introduced the use of pilgrim receipts as the first edition with the value of ten riyals. In addition, SAMA also introduced pilgrim receipts with small values, including one and five riyal denominations.

The Agency also has witnessed the evolution of its Board of Directors. For instance, in 1954, the first Governor resigned following the approval of a Royal Decree. Mr. Standish took over as the next Governor while Mr. Ma’touk Hasanain took over the position of the Vice-Governor. Between the years 1954 and 1955, the central bank also opened additional branches in Al-Damam, Ta’if and Riyadh.

In 1957, SAMA enacted the Second Currency Law and further introduced the Second Currency Control Law. In addition, minted coins of various denominations, including one, two and four quirsh were also introduced.

In the same year, the Kingdom of Saudi Arabia experienced its first monetary and financial crisis. Consequently, SAMA reacted to the crisis by amending its Charter through the Royal Decree No. 23. This Charter specifically focused on the independence of SAMA and declared additional responsibilities of enhancing efficiency in administration through the work of the Board of Directors. The Board handled supervision and sound management of the central bank. The government provided the Board with adequate, necessary powers to attain all its goals.

In year 1957 and 1958, SAMA issued the Third Currency Law and the Saudi gold sovereign bearing the name of King Saud respectively. Following the resignation of Governor Standish in 1958, another Royal Decree was issued to pave the way for the appointment of the Vice-Governor, Mr. Abed Mohammed Saleh Sheikh. In addition, another Royal Decree was responsible for the appointment of Mr. Anwar Ali as the next Governor of the Bank in 1958.

SAMA issued the Fourth Currency Law (the present one) in 1959. This Law introduced new provisions with additional powers. For instance, SAMA was allowed to issue the legal paper currency, use the legal tender status, and it had complete autonomy to fulfill all public and private debts and obligations (SAMA, 2015). The new Law allowed solely SAMA to print and mint all currencies in the Kingdom. It also gave the central bank to track all gold and other exchangeable foreign currencies and other issued currencies in the Kingdom. Besides, the Law also had a provision for the decimal, which ensured that the Saudi Riyal could be subdivided into small units of 20 qirshes rather than 22 qirshes. At the same time, the new Law scraped all the pilgrims’ receipts and silver riyals.

In the year 1961, SAMA also introduced various official banknotes of the Kingdom and put them in circulation. In addition, the central bank also provided the first annual report of the fiscal year under review. SAMA also issued another Royal Decree appointing Mr. Juneid Abdul Qadir Bajuneid for the position of the Vice-Governor. In the subsequent year, the central bank also established SAMA’s Institute of Banking (IOB) in Jeddah, which was later on transferred to Riyadh in the following year.

In the year 1966, there was the Banking Control Law based on another Royal Decree. Further reforms were noted in the year 1972 when SAMA and the Council of Ministers provided a Resolution for the issuing of Saudi coins. Another Royal Decree of 1972 introduced His Excellency Mr. Khaled Al-Qusaibi as the new Vice-Governor.

A radical shift was noted in 1984 when the Council of Ministers gave out a new order to cancel the new issuance of business licenses for foreign exchange companies to audit the practice. It ensured that bodies that were more qualified could evaluate the status of foreign exchange practices in the Kingdom. Before then in the year 1981, the Minister of Finance had provided a resolution to control all foreign exchange practices. The responsibilities to supervise and regulate were given to SAMA. Under this resolution, SAMA had to suspend the provision of any new licenses and, therefore, the business was restricted to only operators who had already acquired their licenses from the central bank. SAMA also exempted other entities that had obtained valid licenses through other bodies. Further changes in foreign exchange business were observed later on nearly after two decades in the year 2009 to ensure that Saudi could meet its foreign currency market demands through buying and selling and meet the needs of “business heirs who would continue with the business practices and thus ensuring the continuation of the sector” (SAMA, 2015, p. 1). Through this new resolution, the Council of Ministers allowed SAMA to lift the ban on the issuance of new licenses for foreign exchange entities.

For the better part of the past decades, only foreign experts had occupied the position of the Governor at the central bank of the Kingdom. However, in 1974, a new Royal Decree was issued to ensure that the first Saudi becomes the Governor of SAMA, and Mr. Abdulaziz Al-Quraishi was appointed to this position. Several years later, SAMA headquarters was transferred to Riyadh from Jeddah. The Royal Decree of 1980 also ensured that Mr. Khaled Al-Qusaibi took his retirement as the SAMA’s Vice-Governor and was replaced by Mr. H. E. Mr. Hamad Bin Saud Al-Sayari through another Royal Decree issued on a similar day (SAMA, 2015).

In the year 1983, Mr. Abdulaziz Al-Quraishi requested to be retired from his duties at SAMA as the Governor. Consequently, a Royal Decree was provided while another Decree was given on the same day for Mr. Hamad Al-Sayari to take over immediately the position of the central bank Governor while still serving in his original position.

Further reforms were witnessed in the year 1984 when the Stock Market was introduced in Kingdom. A committee consisting of ministers and officials from SAMA, the Ministry of Finance and the Ministry of Commerce and Industry was established to control and develop the Stock Market. In addition, SAMA was also given the responsibility to regulate and operate all daily activities of the Stock Market. In the same period, SAMA issued an order to ensure that all banks conducting business in the country created a Saudi-based firm to register all Saudi shares and similar business transactions.

In the year 1985, two major initiatives were noted when the new SAMA headquarters at Riyadh was officially opened while a new Royal Decree was declared for H.E. Mr. Hamad Al-Sayari to become the next governor of the organization.

There was a Royal Decree in 1987 under which a new committee consisting of banking professionals from SAMA was established to focus on customer issues and improve customer service in the banking sector. This committee was referred to as the Committee for Settlement of Banking Disputes (SAMA, 2015). The government issued another Royal Decree that resulted in H.E. Dr. Ahmad Abdullah Al-Malek being the new Vice-Governor of SAMA in 1988.

Another important evolution of SAMA was observed in the year 1990 when it introduced the first e-transaction platform through the Saudi Payment Network (SPAN). The major role of SPAN was to encourage the use of e-transaction in the Saudi banking industry.

His Excellency Dr. Ibrahim Bin AbulAziz Al-Assaf became the next Vice-Governor following a Royal Decree of 1995. However, Al-Assaf had a short stint at SAMA because of another nomination as a state minister and a member of the Council of Ministers in the same year. Shortly after in the same year, another Royal Decree was provided for the next Vice-Governor, His Excellency Dr. Mohammad Bin Sulaiman Al-Jasser.

SAMA introduced the Saudi Arabian Riyal Interbank Express Electronic System (SARIE) in 1997 to facilitate banking processes in the country, and after two years, the then Minister for Finance provided a decree that ensured that SAMA would license, control and supervise financial lending institutions.

Further growth in the central bank was witnessed when SAMA was assigned the responsibility to endorse the Cooperative Insurance Companies Control Law through a Royal Decree of 2003 and oversee the insurance sector. Further, in the year 2004, SAMA was entrusted with the responsibility of the Stock Market that was later called the Capital Market Authority (CMA) through the Royal Decree. The central bank had the role of appointing all the board members of the CMA.

In the year 2004, SAMA launched SADAD Payments System (SADAD. The Payment System acts as a liaison system between billers and local financial institutions. In addition, it facilitates and enhances the e-payment process across various banks and channels within “the Kingdom, ATM networks, mobile banking and online banking” (SAMA, 2015, p. 1). The government issued another Royal Decree in the year 2009 for the new Governor of the institution, His Excellency Dr. Moharnmad Bin Sulaiman Al-Jasser (SAMA, 2015). During the same period, another Royal Decree was issued for the Vice-Governor, His Excellency Dr. Abdurrahman Bin Abdullah Al-Hamidy as the Vice-Governor. The final Royal Decree for the new Governor of SAMA was published in 2011 in which His Excellency Dr. Fahad Al-Mubarak became the beneficiary (SAMA, 2015).

SAMA’s Responsibilities and Functions

SAMA has been entrusted with critical roles and several functions based on the laws and regulations of the Kingdom regarding the banking sector and other related institutions and industries. Generally, the main roles and responsibilities of SAMA are mainly to control the Kingdom’s currency, supply of money and interest rates. In addition, it controls all financial affairs of commercial banks and other financial institutions, including the CMA. It is noteworthy that SAM has a monopoly influencing the monetary base in the Kingdom and is responsible for printing and minting the Saudi official currencies, which are recognized as genuine legal tenders.

Another primary function of the institution is to control the Kingdom’s money supply through “monetary policy, specific duties related to control influencing interest rates, determining the country’s reserve needs and serving the purpose of the last resort lender to other financial institutions, specifically during financial crisis and insolvency in the industry” (SAMA, 2015, p. 1). SAMA has core supervisory roles and powers over other financial institutions. These roles aim to prevent risky behaviors, fraudulent practices and recklessness in the banking sector. It is imperative for SAMA to be independent of political elites and their influences. SAMA, however, acts based on the Royal Decree and executive committees’ recommendations.

Specific roles and functions of SAMA include the following. First, SAMA must handle all banking issues of the Saudi government. These are mainly legislative issues and executing executive orders. Second, SAMA has the sole responsibility of printing and minting the Saudi Riyal, the national currency. It must strengthen Riyal, enhance its external and internal values, as well as strength its cover from external factors. Third, SAMA also governs the Kingdom’s foreign exchange reserves (SAMA, 2015). Fourth, SAMA also manages the Kingdom’s monetary policy to ensure that prices and exchange rates are stable. Fifth, the central bank enhances the growth of the Kingdom’s financial system. For instance, SAMA must continuously develop new models to ensure that the financial sector is sound. Sixth, it has the sole responsibility of supervising all other financial institutions, including foreign exchange dealers. Seventh, SAMA must also supervise activities of cooperative insurance firms and any other self-employment businesses that relate to the provision of insurance services. Finally, SAMA controls and oversees finance firms and credit information bureaus in the Kingdom.

It is imperative to note that the roles and functions of SAMA have continued to evolve with changes in the financial sector and the insurance sector. Hence, it is most likely that the institution will perhaps have new roles and functions in the future to enhance the development, sustainability and robustness of the Kingdom’s financial and insurance sectors.

Economic Policies

SAMA has been responsible for implementing the Kingdom’s preferred monetary policy. It is imperative to understand the role of these policies and their impacts on the public. At the most basic level, SAMA was responsible for introducing fiat currency to the Kingdom, and therefore, Saudi Riyal became the legal tender. Riyal was introduced under the monetary policy as a form of standardized currency for the Kingdom.

Some monetary policies in the Kingdom have resulted in a pegged dollar against the riyal. Hence, the local riyal cannot go beyond or lower than expected exchange rates. SAMA maintains this practice to stabilize its currency and control inflation that results from exchange rate fluctuations.

From a narrow point of view, many see monetary policies as tools for controlling interest rates and any other interventions SAMA takes to protect the Riyal. Nevertheless, such actions based on monetary policies have some effects on the economy. First, monetary policies are responsible for price stability in the Kingdom. They protect the Saudi Riyal from devaluation or increments of prices based on the value of the Riyal. The policy is mainly to protect the public from inflation. Inflation could affect incomes and wages. In addition, unexpected inflation may result in high costs of living and interest rates. Therefore, the overall aim of monetary policy in the Kingdom is to provide steady rates of interest and inflation.

Second, monetary policies are responsible for economic growth in the Kingdom. SAMA has achieved economic growth through policies that facilitate the growth of the financial sector in the Kingdom. With low interest rates, the cost of borrowing is relatively affordable and, therefore, investors have cheaper sources of capital. Such monetary policies stimulate economic growth, particularly during a financial crisis. SAMA may also adjust interest rates when the economy is strong to prevent potential market bubbles.

Finally, sound monetary policies in the Kingdom are responsible for creating favorable business environments and, therefore, resulting in more jobs for the public.

Internal Audit

Internal audit is extremely a critical function within SAMA. Internal Audit is an independent appraisal process, which ensures that the Kingdom’s central bank evaluates “all operations and services that relate to the management of financial institutions” (SAMA, 2015, p. 1).

SAMA uses the Internal Audit as a managerial tool for evaluating and assessing the relevance of its control measures. Internal Audit has become important with the introduction of electronic financial services in the Kingdom. Thus, all computer systems that relate to the works of SAMA must be evaluated to determine their effectiveness.

The major aim of the internal audit is to help all employees of the agency to conduct their works efficiently by providing the expected analysis, assessments, suggestions and comments that relate to the service reviewed. Audit for SAMA goes beyond normal accounting processes. It focuses on getting comprehensive data to comprehend the operations of the financial systems on review.

Therefore, SAMA must conduct its Internal Audit functions within some standards for professional excellence. First, it must be independent. It is expected that the auditors must be independent of their roles and systems under auditing. Second, SAMA must demonstrate professional proficiency during auditing. Third, it has a well-defined scope of work. That is, SAMA must evaluate and examine the efficacy and sufficiency of internal control systems and the quality of the process when conducting assigned roles. Fourth, the performance of audit work requires planning of the work, assessment of information, providing findings to relevant end users and management team and conducting follow-up reviews. Finally, SAMA’s Internal Audit has management activity that must ensure that the process adds value to the work of the central bank (SAMA, 2015).

Internal Audit has a defined scope of work. First, Internal Audit must ensure that it protects the Agency’s assets by conducting evaluations through accounting to determine the existence of the mentioned property. Second, the scope of work entails compliance assessment to ensure that all processes adhere to policies, guidelines, plans, the Agency’s internal regulations and laws, which have effects on its activities. In addition, the process must determine if the Agency’s operations adhere to expected standards. Third, it focuses on the reliability and integrity of the system and financial information. Fourth, the Agency uses the Internal Audit to evaluate the economical and effective use of its resources. Fifth, the scope of work also entails reviewing all activities to determine whether findings are reliable and consistent with the Agency’s set goals and objectives, and it must assess whether all operations are conducted as intended. Finally, the scope of work also accounts for SAMA information management platforms.

Organizational Structures

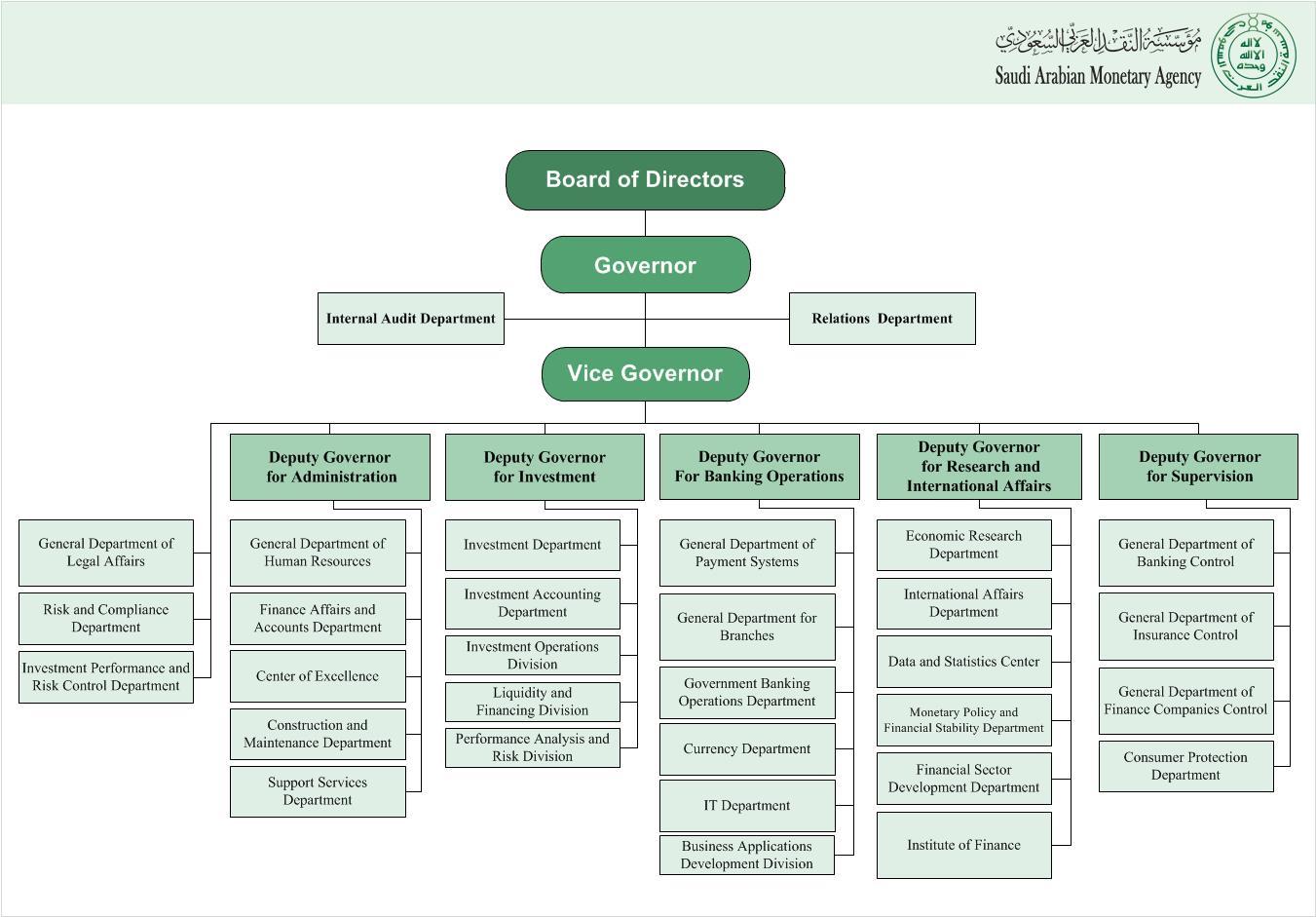

The Board of Directors of SAMA is responsible for” running all operations of the Agency” (SAMA, 2015, p. 1). The Board consists of the Governor, the Vice-Governor, and other selected members from the private sector. It is made up of five members, including the Chairman and Vice Chairman.

The Governor and the Vice-Governor have four years in the office, but the period can be increased based on an issued Royal Decree. Other members of the Agency serve for five years, but their stint is also subjected to a Royal Decree. It is noteworthy that members of the Board of the Agency cannot leave the office except under the Royal Decree.

The top executives of SAMA are mainly the Governor, the Vice-Governor and five Deputy Governors in addition to the Internal Audit department and relations department members (SAMA, 2015). The five Deputy Governors have diverse roles such as administration, investment, banking operations, internal affairs and supervision.

Conclusion

This research paper has reviewed the Saudi Arabian Monetary Agency (SAMA), specifically focusing on its history and evolution, roles and functions and its organizational structure.

From the history and evolution of SAMA, it is evident that Royal Decrees have played critical roles in shaping the leadership and management of the Agency. At the same time, SAMA has been able to formulate favorable monetary policies to facilitate economic growth, control interest rates and inflation and create employment. In addition, the Agency regulatory and supervisory roles have improved, and SAMA has been touted as the best central bank in the region (Hertog, 2007). The roles and functions of SAMA have continued to evolve in the past periods and are expected to change in the future to enhance monetary services in the Kingdom.

References

Hertog, S. (2007). Shaping the Saudi State: Human Agency’s Shifting Role in Rentier-State Formation. International Journal of Middle East Studies, 39(4), 539-563.

SAMA. (2015). Saudi Arabian Monetary Agency. Web.