Introduction

As a result of the prevailing global economic crisis, there was a resultant reduction in terms of the output growth in the world trade by a factor of 1.7 percent, down from a factor of 3.5 percent that was recorded in 2007 (The Economist 2009 p. 3).

Projections are that this growth could still fall in 2009, to range from 1 percent and 2 percent. For the first time since the recession of the 1930s, the overall world production has witnessed a decline, the consequences of which have today been well magnified in a reduction in international trade volume. A noteworthy characteristic of the prevailing deceleration in world trade has to do with its harmonized nature. Monthly imports as well as exports of leading developing and developed economies of the world have witnessed a harmonious decline ever since the global financial crisis worsened in September, 2008.

As a result, developing nations like China, India and Brazil amongst others continues to grab a larger pie of the global trade market, coupled with enhanced geographical multiplicity of the resultant flows. A number of economists harbour an assumption that if at all “decoupling” effect had occurred, this would have meant that the developing nations would not have been greatly exposed to the economic turmoil that was witnessed in a majority of the developed nations.

The preliminary forecast of the World Trade Organisation (WTO) in 2008 was that the world trade volume would witness a growth rate of 2 percent (WTO. 2009 p. 7). This was significantly less compared to the estimate that the WTO has made in 2007; a rate of growth in world trade of 4.5 percent. Over the last several decades, the world economy has witnessed enhanced integration, thanks to a rise in international trade. For the period between 1980 and 2002, there was a profound increase in terms of world trade, in comparison with world output, in part due to the fact that goods of trade have over time become quite affordable when compared with the non-traded goods. On the other hand, the ratio of the gross domestic product (GDP) of various countries of the world relative to world trade has witnessed a rise for the same period, an indication that additional factors could be at play, thus leading to the witnessed scenario. In light of this, it is the intention of this research study to explore the relationship between world output on the one hand, and international trade volume on the other hand. In this case, the factors that impact this relationship shall be assessed. Further, the study shall also endeavor to identify the overall patterns of trade, as these exist currently.

Relationship between world output and international trade volume

Even as world trade volumes have experienced a firm growing inclination for close to 60 years now, nevertheless a long-term outlook indicates that this kind of an increased integration is vital. In contrast, for the better part of the few years prior to, and after the First World War, a majority of the economies in the world witnessed a decline in growth. In addition, the world output share that found its way into the international trade market underwent a dramatic reduction. Therefore, most of the growth that was witnessed in the world trade prior to the 1950s was symbolic of former levels that were on their way to recovery (Helpman 1999 p. 123). Undoubtedly, in so far as there is the possibility of arriving at a comparison, the relationship between world output and world trade only managed to overcome the shortcomings of the post-First World War experiences after the end of the oil crisis in the mid-1970s. Accordingly, it may be insinuated here that since then, the rate of growth in terms of world trade is symbolic of a novel level of integration. For the past two decades, there has been a considerable increase in the world trade share, relative to the previous peaks.

On the other hand, it may be still difficult at this point to contend that the volume of world trade has attained a level that may be said to differ qualitatively in comparison to previous experiences. Specifically, the United States has remained significantly less trade-dependent relative to leading countries in Europe (The United Nations, 2007 p. 215). Would this be an indication of a lack of novel developments with respect to world trade growth for the past few generations? Even as the total trade volume may not have witnessed a commendable rate of growth according to expectations, the collective trade growth obscures new elements of the present-day international trade.

Novel trade aspects

Four novel elements may be attributed to the world trade of the modern world. These new elements have been labeled so considering that they were not present in the golden age of the yesteryears that characterized the world economy. Accordingly, these novel aspects include intra-trade, the act of the value chain being sliced up by producers, similar nations trading in goods that are related, the activity of segmenting the process of production into distinct steps separated geographically, the surfacing of super-trader countries (these are the nations that have significantly high GDP to trade ratios), and manufactured goods being exported in huge quantities to high-wage countries, from low-wage countries (Soo 2008 p. 5). Intra-trade levels have been on an upward increase. These, coupled with strategies on cost reduction have led to the emergence of super traders, as noted by Krugman and colleagues (1995 p. 274). This is a term used in reference to countries that are characterized by high trade-GDP ratios.

Value chain slicing up would significantly enhance international trade potential (Rana 2007 p. 711). Accordingly, it is possible to export a certain consumer good more than once, due to the added value to the product at the different production stages. Consequently, super trading economies have emerged in recent years. However, their emergence mainly hinges on the capability of the present-day economies to effect a value chain slice up, in order that exports value may be significantly larger compared with the value that the industry in the export market adds to a product. Such a trend has been demonstrated in both Hong Kong and Singapore, in which the GDP of the countries is less than the value of their exports.

There are three classes of trade that have been seen to have an impact on the relationship between world output and international trade. First, a reduction in trade costs shall impact trade. For example, transportation, currency exchange, as well as tariffs, represents good examples of the various costs that a trader may incur when goods being traded assumes an international perspective. In so far as the aforementioned costs have experienced a drastic reduction for more than two decades now, it may only be anticipated that this shall translate into increased international trade. Secondly, there is the issue of growth in productivity of the sector of tradable goods (Shin & Wang 2004 p. 8). Most of the research studies contend that productivity growth is usually higher within the sector of tradable goods, in comparison with the sector of non-tradable goods (for example, Markusen 2004 p. 193; Seyoum 2008 p. 311). The impact of this form of inclination is a resultant rise in the trade-output ratio. Finally, we have the issue of income per head increase. In this case, with a rise in the income of a country, there is usually a corresponding shift in terms of the spending habits of the consumers in such a country. Accordingly, whereas the previous consumer trends could have been concentrated spending on the basic human needs (that is, food, clothing and shelter) increased income means that the same consumers are now bets placed to afford manufacturing goods. What this means is that the product differentiation scope of the manufactured goods increases, followed by diversification in terms of the manufactured goods and ultimately, an increased scope in the international trade.

Various ways are available through which the international trade could incur additional costs, other than domestic trade costs. It is important to note that with improvements in technology, communication and transport costs are seen to reduce drastically. In the same way, non-tariff and tariffs trade barriers have also witnessed a drastic reduction, thanks to successive bilateral and multilateral trade agreements amongst nations (Hsing Jamal & Hsieh 2009 P. 2122). Transactions using foreign currency could also have become cheaper owing to the liberalization of capital markets, thereby making it possible for traders to hedge funds alongside the risk associated with the exchange rates. Owing to reduced trade costs, an increasing number of countries opt to specialize in certain areas of trade, thereby recouping the profit benefits associated with it.

Impacts on international trade

There are a number of economic theories and principles that have attempted to explore the relationship between world output and international trade volume. For example, such classic theories of trade as the comparative advantage principles as provided by Ricardian, and the Heckscher-Ohlin theorem, opine that it is possible for countries to benefit from trade should they opt to specialize in their production so that it acts as their competitive advantage. In this case, enhanced specialization amongst industries would result in a divergence of the trading countries’ industrial structures, in effect weakening their linkages with the rest of the world. On the other hand, international trade could also result in a spill-over of either supply or demand for goods from one country to the other (Hsing Jamal & Hsieh 2009 P. 2122).

At a time when investment booms or consumption patterns are driven by demand shocks experienced in one country, the consequences could very well spread out to the other partners with which such a country trades, via rising imports demands and consequently, improving the economy of other countries. Moreover, Shin and Wang (2004 p. 17) argue that such microeconomic policies as fiscal, exchange rates, as well as monetary policies, could have an impact on international trade. In particular, trade could result in the adoption of ‘beggar-thy-neighbour’ policies or policy coordination amongst the trading nations and this may consecutively have an impact on the world economic links. For example, in order to obtain a share for goods to be exported to the international market, those nations that normally export products that are similar find themselves having to compete amongst themselves through currencies depreciation.

Countries or trading partners within the chain of production could opt to synchronize their trading operations by way of establishing trade policies that are relevant (Hsing Jamal & Hsieh 2009 P. 2123). This is for purposes of fulfilling their mutual benefits. Even as a majority of the economists have the same opinion that trade does indeed play a significant function of connecting various economies and at the same time, passing on disturbances, nevertheless trade linkages impact with regard to various levels of business cycle harmonization still remains uncertain (Kose, Prasad & Terrones 2003 p. 59; Shin & Wang 2004 p. 11; Baxter & Kouparitsas 2005 p. 124; Rana 713). In contrast, specialization, in line with either Ricardian principles or the theorem supported by Heckscher-Ohlin could also reduce co-movements amongst various economies. At a time when we have nations with specialized industries that provide them with a comparative advantage in comparison with their trading partners, advanced openness in terms of trade could result in lowered business cycle association when shocks happen to be sector-specific.

Conversely, there is a chance that trade could be viewed as an opportunity for the diffusion of those shocks that are seen to have an impact on nearly all industries. Such shocks sequentially underpin associations amongst different economies, and also the associations amongst various cycles in business (Baxter and Kouparitsas 2005 p. 125). In addition, vertical specialization (otherwise known as intra-industry trade) the following outsourcing or sharing in production, could translate into increased co-movements with regard to the international business cycle (Shin & Wang 2004 p. 12; Burstein, Kurz, & Tesar 2008 p. 8). Ultimately, the spreading out of trade across nations, along with the ensuing competition or policy coordination, may lead to closer business cycles from one nation to the other.

Through the use of an international business cycle standard model, Kose and Yi (2006 p. 283) have demonstrated that the impact that trade normally has on the trade general association of the gross domestic product (GDP) across counties is quite small, on the basis of the fact that a majority of the countries only have minor trade shares relative to their GDP. However, owing to speedy trade growth, coupled with mild GDP growth for the last two decades, this has resulted in an enhanced openness in world trade, and more so in the European Union, and the developing countries in Asia. Consequently, the world economic interdependence has expanded, in addition to a likely rise in harmonized business cycles not just within regions, but also across them. Such a speedy growth in trade volume, in addition to the increased openness, has enhances the likelihood that trade could indeed play a fundamental function of conveying economic shocks. In reality, a majority of the experimental studies (for example, Frankel & Rose 1998 p. 1012; Shin & Wang 2004 p. 12; Rana 2008 p. 714) assert that with an increase in trade amongst countries, there has been a resultant rise in business cycles that are also highly associated. This is despite the fact that hypothetically, increased trade may very well result in looser or tighter correlations in terms of the business cycle between partners in trade.

Overall trade pattern exists in the world today

According to estimates by the World Trade Organisation (WTO), the prevailing global economic crisis has led to the global demand for imports and exports decline. Accordingly, the WTO anticipates a 9 percent reduction in exports demand. This is the largest contraction ever, since World War II (WTO Press Release 2009 p. 3). In the months that followed the culmination of the global financial crisis in September 2008, there has been an abrupt decline in global trade and production. This started in the developed countries first and then spread to the developing economies. The OECD (Organization for Economic Cooperation and Development), has computed indexes for different countries, showing how leading industrial countries have been drastically affected by the financial turmoil trade-wise.

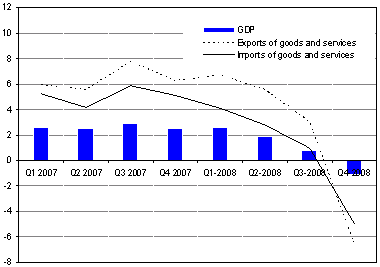

According to the monthly data for a majority of leading traders, there have been significant reductions in the imports and exports of merchandise in the months of January and February 2009. The only exclusion this declining pattern of flow of trade is noticeable amongst several Asian economies. For example, growth in monthly imports for China in the aforementioned months was recorded at 17 percent. Modest import and export growths were also recorded in Singapore and Vietnam. Although the data only points at a single month, hence calling for a cautious assessment, nevertheless the implication could be that a reducing decline in world trade could be imminent. Similar sentiments have also been echoed by a forecasting model that was developed by WTO Secretariat (WTO Press Release 2009 p. 3). According to this model, it is anticipated that for the economies that have developed (specifically, OECD members), their imports for goods and services is expected to reduce by a factor of 8.5 percent, as indicated by the chart below.

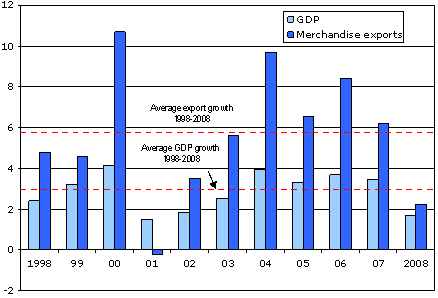

On the other hand, the trade volumes in terms of merchandise witnessed a 2 percent increase in 2008, having shed 4 points from the estimates of 2007. In 2008, the annual trade growth fell below the registered standard growth for the period between 1998 and 2008, which was 5.8 percent (Hsing, Jamal & Hsieh 2009 p. 2126). However, there was a close correlation between GDP and trade growth in the same year, relative to previous years that had recorded higher GDP compared to trade projections are that in 2009, trade growth shall be less than the growth in GDP, going by the chart below.

There are several factors that have contributed to the decline in trade growth as exhibited by the above chart. To start with, the demand for both imports and exports appears more rampant, compared to past data, seeing that all the various global trading economies are at the moment characterized by a slowdown in economic growth. Secondly, world trade has witnessed a rise in the global supply chains (Baier & Bergstrand 2001 p. 18). Accordingly, expansion in trade does not solely depend on the flow of trade between a consuming economy on the one hand, and a producing economy, on the other hand. The liberalization of trade has led to various trade barriers and tariffs being ratified, in effect making it easy for goods and services to cross from one country to the other. The prevailing reduction in trade has also been affected by trade finance deficiencies, prompting various government and international organizations to act swiftly, in a bid to arrest the situation. Finally, there is the issue of protection. An increase in protection has the potential to put pressure on projections that an economy on the road to recovery shall its trade growth.

Conclusion

For close to 60 years now, world trade volumes have experienced a firm growing inclination. Previously, and specifically immediately following the end of the First World War, a majority of the economies in the world witnessed a decline in growth. The same could be said of the international trade market. Following the end of the oil crisis in the mid-1970s, world trade experienced a modest rate of growth. The past two decades have been characterized by a considerable increase in the world trade share, in comparison with previous peaks (Herzberg, Sebastia-Barriel & Whitaker 2002 p. 208).

Although total trade volumes have increased, collective trade growth obscures novel aspects of international trade.

The present-day world trade is characterized by such elements as intra-trade, producers that slice up the value chain, similar nations trading in related goods, the geographical segmentation of the manufacturing processes, and the emergence of super trading nations. All these factors have played a significant role in enhancing not just the world output, but also the international trade volume. In terms of the prevailing global trade pattern today, the ongoing global economic crisis has led to the global demand for imports and exports to decline for the first time since World War II (WTO Press Release 2009 p. 3).

Imports and exports have significantly reduced for a majority of the economies in both the developed and the developing economies save for a few economies such as China, Singapore and Vietnam. Trade volumes for merchandise have also reduced. The expectation is that the growth in trade shall be less than GDP growth in 2009. Rampant exports and imports demand, coupled with the rise in the global supply chains have played a significant role in influencing the prevailing trend in world trade today.

Reference

Baier, S.L. & Bergstrand, J.H. 2001, ‘The growth of world trade: tariffs, transport costs, and income similarity’, Journal of International Economics, Vol. 53, pp. 1–27.

Baxter, M., & Kouparitsas, M. A. 2005. “Determinants of Business Cycle Comovement: A Robust Analysis.” Journal of Monetary Economics, Vol. 52, pp. 113–57.

Burstein, A, Kurz, C, & Tesar, L. 2008. Trade, Production Sharing, and the International Transmission of Business Cycles. NBER Working Paper No. 13731, National Bureau of Economic Research, Cambridge, MA.

Frankel, J. A, & Rose, A. K. 1998. “The Endogeneity of the Optimum Currency Area Criteria.” The Economic Journal, Vol. 108, pp. 1009–25.

Helpman, E. 1999. ‘The structure of foreign trade’, The Journal of Economic Perspectives, Vol. 13, No. 2, pp. 121–44.

Herzberg, V, Sebastia-Barriel, M, & Whitaker, S. 2002. ‘Why are UK imports so cyclical?’, Bank of England Quarterly Bulletin, Vol. 42, No. 2, pp. 203–09.

Hsing, Y, Jamal, A. M, & Hsieh, W. 2009. ”Application of the monetary policy function to output fluctuations in Bangladesh ”, Economics Bulletin, Vol. 29 No.3 pp. 2119-2128.

Kose, M. A., Prasad, E. S, & Terrones, M. E. 2003. “How Does Globalization Affect the Synchronization of Business Cycles?” American Economic Review, Vol. 93, pp. 57–62.

Kose, M. A., & Yi, K. M. 2006. “Can the Standard International Business Cycle Model Explain the Relation between Trade and Comovement?” Journal of International Economics, Vol. 68, pp. 267-95.

Krugman, P, Cooper, R.N. & Srinivasan, T.N. 1995. ‘Growing World Trade: Causes and Consequences’, Brookings Papers on Economic Activity, 25th Anniversary Issue, 327-377.

Markusen, J., 2004, Multinational firms and the theory of international trade. Massachusetts: The MIT Press.

Rana, P. B. 2007. “Economic Integration and Synchronization of Business Cycles in East Asia.” Journal of Asian Economics, Vol. 18, pp. 711–25.

Seyoum, B., 2008, Export-import theory, practices, and procedures (second edition). New York: Taylor & Francis.

Shin, K., & Wang, Y., 2004. “Trade Integration and Business Cycle Synchronization in East Asia.” Asian Economic Papers, Vol. 2, pp. 1–20.

Soo, K. 2008. “Trade volume and country size in the Heckscher-Ohlin model.” Economics Bulletin, Vol. 6, No. 1, pp. 1-7. Web.

The Economist. ‘Explaining the dramatic slump in world trade’. The Economist. (Online). 2009. Web.

The United Nations., 2007, World economic situation and prospects. Washington, DC: United Nations Publishers.

The United Nations., 2008, Economic situation and prospects. Washington, D C.: United Nations publishers

WTO. 2009. ‘WTO sees 9% global trade decline in 2009 as recession strikes’. Web.