Introduction

Economic development among societies is the single most important goal pursued by people across the world. Every individual, community, society and nation strives to achieve higher levels of development in order to avail higher and better living standards to the masses. The three most important parties in this development process are households, the firms and the government. Better economic performance is their common goal. Households strive to achieve better living standards; firms strive to achieve better profits while the government supports the achievement of these two goals. This is in a capitalist economy. In a bid to achieve these goals, the need to develop policies to harness the strengths of each of these economic units emerges.

There are numerous policies targeting different aspects of the economy. In this paper, focus is on how governments apply policies in the management of the financial sector in order to achieve growth and development. The main policies of focus here include: the stabilization policy, fiscal policy, open market operations, quantitative easing and monetary policy. Special emphasis will be laid on quantitative easing where an in-depth analysis will be conducted on its effectiveness as well as its historical successes or failure in nations where it has been tried.

Stabilization Policy

Before the 1930’s a majority of economists never thought that the government was in any position to offer viable solutions to problems facing the economy. Indeed they were very skeptical of any attempts by government or central banks to intervene as they believed that this would tamper with the self regulatory mechanisms in the market leading to irreparable instabilities. This long held view was upset by the great depression of the 1930’s. The sudden collapse of the US and consequently global economy showed signs indicating that the economy itself is inherently unstable. This inherent instability caused the collapse of the stock markets resulting in one of the most agonizing economic moments in the history of mankind.

Classical economists came to appreciate the cyclical nature of economic growth. Just like in many other aspects of life, the economy is characterized by periods of depressions and accelerated growth or a boom. Periods of depression are characterized by deflationary pressures; slowed productivity hence increased unemployment rates. This is definitely a concern for the authorities as it leads to diminished standard of living among the people threatening social stability (Willem, 2010, par4).

In times of economic boom, the economy is characterized by high inflationary pressures, high productivity hence high employment rates. Despite the fact that these are desirable attributes, when they happen in extreme measures, the economy undergoes what economists call “overheating”. This has negative effects on the long term health of the economy (Stabilization Policy, 2010, par5).

Consequently, economists agree that interventions by government are important in a bid to ensure a smoother trend of economic growth. Stabilization policy was accepted as it was clear that only the government had the ability to salvage the economy.

Stabilization policy includes strategies put in place by government and the central financial institutions with the aim of keeping growth levels, prices and levels of unemployment at desirable levels to avoid the ills associated with both extremes i.e. the depression and the boom. Stabilization policies are aimed at reducing cases of erratic fluctuations in prices, output and unemployment.

In addition to stabilizing, the policies are employed when economies are facing some specified shocks like the market crash and faults in sovereign debt. Under such circumstance, stabilization policies often come direct from the political class such as direct legislation and reforms in securities. It could also emanate from international players like the World Bank. Clearly, the aim is to apply all necessary measures to ensure that the economy adopts the smoothest trend possible.

In most cases, the stabilization policy entails a combination of fiscal and monetary policies as well as additional policies which are specific to the problem. Applying stabilization policies has its advantages and disadvantages. In models of imperfect competition, economists argue that most stabilization policies introduce new rigidities in cases where the market is imperfect making the economy even less efficient. However in cases where the markets are operating in perfect competition, then the rigidities introduced by the attempts to respond to economic phenomena do not considerably affect the efficiency of the economy (Stabilization Policy, 2010, par6).

Fiscal Policy

Fiscal policy is a tool used by governments in regulating the level of demand in the economy and hence regulates growth patterns. A recession presents a need for the government to explore ways of jumpstarting the economy. As mentioned above, a recession is characterized by low levels of production. A simple way of accelerating the production rate is through heightened demand. Bearing in mind the fact that the households are facing reduced incomes, the government has to come in and deploy money for various activities such as infrastructural development. This way, the government can accelerate growth rate or in the case of a boom, cut down the rate of growth. Consequently, fiscal policy basically entails expenditure by the government in goods and services but also the way in which the expenditure is financed. In reverse, fiscal policy can also be applied through reducing or increasing taxation or tax rates. This is because, the same way increased government spending seeks to raise the amount of money in the hands of the firms and consequently the households, a reduction in the tax rate enables firms and households to retain a bigger proportion of their incomes hence boost aggregate demand (CliffsNotes.com, par2).

There are two main ways in which financing of government expenditure is done. First is using tax money raised from the general public. Secondly, the government may finance through borrowing. In the end changes either upward or downward in government purchases affect in a direct way many macroeconomic variables. Some of the variables affected include the national demand, capital allocation and movement as well as equality patterns in income. In this case then the policy can be used to achieve socio-political goals in an economy (CliffsNotes.com, par5).

The budget is the single most important vehicle with which fiscal policy is implemented. It basically stipulates both the sources of government funds as well as the way in which the funds are allocated to the different areas of priority to government. This being the case the two main ways in which the fiscal policy can be applied is through the expansion or contraction of government spending. Expansionary fiscal policy entails expanding government spending with the aim of lifting the economy from a sluggish growth rate. Contractionary policy is applied when the economy is experiencing a boom as a way of slowing it down.

As concerns the funding mechanisms, the budget could be in three different stances. They include a budget deficit, a budget surplus and a balanced budget. A budget deficit stance means that the government spends more than it can raise through taxation hence requiring additional funds from borrowing. The most common borrowing instruments used by government include treasury bills and bonds which in most cases are called government papers. Borrowing locally or internationally has different repercussions for the economy. A balanced budget implies that the government spends as much as it is able to rise from taxation. This is a case of living within means. A budget surplus occurs when the government is raising more money through taxation than it is able to spend. The goal for most government is to achieve a balanced budget however in many cases the need to finance development projects pushes countries into perpetual budget deficits.

Keynesian economists are strong proponents of the application of fiscal policies in reducing the cyclical nature of economic growth however classical economists express some reservation to this route. They express two main defects with the policy. First, when an expansionary fiscal policy is applied to boost aggregate demand but it turns out that the funds applied are raised through domestic borrowing, then there is a likelihood of “the crowding out effect”. This is a situation where the gains made through the expansionary policy are offset by the resultant high interest rates. High interest rates result when the government borrows money locally hence diverting funds which would have been borrowed by firms for investments. Reduction in the supply of loanable funds definitely leads to a rise in interest rates. High interest rates raises the cost of financing for investors hence less investors are willing and able to take up loans to scale up production activities. Consequently, the positive effects of expanding the government spending to boost aggregate demand is weighed down by the limitation in access to funding for the firms (CliffsNotes.com, par8).

The second defect cited by classical economists is the fact expansionary fiscal policies decreases the net exports of a country which according to them is an important component of a country’s GDP. They argue that government borrowing increases interest rates in an economy hence attracting foreign investors who are in search of better returns. These foreign investors must first convert their funds from the foreign to local currency leading to a rise in demand for the country’s currency. An increase in demand for currency leads to a currency appreciation. The principles of international trade imply that an appreciation in local currency means that the cost of local goods in the foreign markets rises making them less affordable. The effect is a decrease in the level of exports. Again, the appreciation implies that foreign goods cost less in the domestic markets hence import levels rise. The overall effect then is a fall in the level of net exports for the country.

In recent times, expansionary fiscal policies have been employed across the globe in the backdrop of one of the greatest recession in modern economies. The US leads with the injection of about 600 billion dollars in to the economy to jumpstart demand in different sectors of the economy. Other countries in Europe, Asia and Africa followed suite and about two years later, it appears that the global economy is coming out of the recession.

Open Market Operations (OMO)

In an attempt to either control the liquidity levels in an economy as well as interest rates, central banks have a few options to consider. Top on those options is the open market operations. These operations fundamentally are government involvement through the central bank in the open market for treasury securities. Government securities are issued in exchange of specific amounts of money and mature after a specified period when the money is refunded with some earnings. The two main government securities are treasury bills and treasury bonds (Akhtar, 1997, par5).

When the liquidity levels in the economy is high, interest rates are low consequently firms are able to borrow more for production activities. However, if the economy is already experiencing high growth rates, the central bank may opt to ‘mop up’ excess liquidity from circulation hence increasing interest rates which in turn reduce the ability of investors to borrow and consequently, the growth rate is managed. ‘Mopping up’ in this case means selling government securities to investors and holding on to the money realized. On the other hand when the liquidity levels are low interest rates are likely to be high as demand for money is higher than supply. The central bank may opt to boost the economy through reduction in interest rates as a result of increased liquidity. This would entail buying back the government securities hence releasing money (Acerbic, and Obstfeld, 2005, p115).

OMOs are highly effective in managing liquidity in the short run and medium term. Treasury bills last for periods as short as three weeks while bonds last much longer. In addition to managing interest rates, OMOs also help manage inflation as well as exchange rates. Inflation rates are high when liquidity is high as the ease with which money is available means that people may be willing to pay more for goods and services hence a rise in prices. When the excess liquidity is mopped up, there is less money available for spending hence limiting the ability of firms to hike prices. Effects on exchange rates occur due to the inflows and outflow of funds prompted by changes in interest rates as described earlier under fiscal policy. Notably, OMOs are part of monetary policy described below.

Quantitative Easing

Quantitative easing is an extreme form of monetary policy. It shall be discussed under the sub topic ‘monetary policies’ below, central banks have great influence on interest rates in the economy and they often use this influence to regulate the growth rates. For example in times of low growth interest rates can be lowered to stimulate investments. Likewise, in times of extremely high growth, interest rates can be increased to slow down the ability of producers to scale-up their production.

However, most developing countries are better placed to apply this tactic especially in periods of slowed growth because in these economies, interest rates are considerably high. In the developed world, the situation is different. Due to the high availability of capital, interest rates are at a very low level. Consequently, the flexibility is limited. Once the interest rate hits zero, it cannot be further reduced despite the fact that the economy may not yet be out of the recession. This problem has been addressed by developed countries like the US through the concept of quantitative easing.

Quantitative easing is a rather unconventional tool whose popularity appears to be improving by the day. It is mainly seen as attempts by the federal or central bank to increase liquidity in the market but at the same time ensure that interest rates remain low in the long run. Usually, when central banks inject money into the economy, two variables are expected to change. First inflation rate is expected to increase and secondly, the interest rates fall in the short run. According to economists, when inflation rates are too high, the economy suffers and in many cases, the gains made by the prevalence of low interest rate in accelerating investments are lost. Consequently, as a reactive measure, the central bank has to act in order to tame inflationary pressures. However, any attempts to tame the inflation level cause interest rates to rise. Therefore, the final result in the long-run is that interest rates will have to raise yet again hence lowered investment. This then makes this kind of policy approach unsustainable and irregular. Quantitative easing comes in to introduce some level of consistency and macroeconomic stability required to give investors some confidence on the long term viability of investing in the economy.

Monetary Policy

Just like fiscal policy, monetary policies are used by governments to regulate economic growth as well as achieve macro-economic stability in the economy. However, unlike the fiscal policy which is largely influenced by the political agenda, implementation of monetary policy is largely controlled by central banks which have the capacity to safely apply it. Just like the word monetary suggests, the policy targets the monetary aspect of the economy. The policy is actualized by the treasury controlling the volume of money, in its entire meaning, in the economy. The linkages between the monetary and the real economy give life to the effectiveness of the policy in influencing the real economy. The most important target variables for this policy are the interest rates, exchange rates and inflation.

As is the case with fiscal policies there are monetary policies intended to expand the economy and others meant to contract it. Expansionary fiscal regulations entail efforts put in escalating the supply of money in the financial system whilst contractionary regulations are geared toward reducing money supply in the economy. Reducing or increasing money supply in the economy works through the normal laws of demand and supply to vary the level of interest rate, which at this moment is the cost of accessing money. Increased supply implies reduced interest rates while reduced supply results in increased interest rates. For inflation, higher supply implies higher inflation while tightened supply cubs inflation (Galindev, 2010, par3).

There are three critical tools applied by central banks in implementation of monetary policy. They include Open Market Operations (OMO); discount window operations and Reserve requirements. OMO as described above involves the buying or selling of securities in the market and mainly to commercial financial institutions. The aim is to control the reserves held by commercial banks and hence determine their ability to issues loans to firms. When the central bank sells securities to the financial institutions, it drives down their reserves upon which they base their ability to issue loans. When the commercial bank’s ability to issue loans is curtailed, the money stock in the economy adjusts downwards to the levels desired. When the central bank buys back securities from these commercial institutions, it releases money and drives up their ability to lend. This builds on the money stock in the economy.

The second tool used by central banks is the Discount Window Operations. One of the most important roles of the central bank is “the lender of last resort’. Commercial banks borrow money among themselves to alter their lending capacities at different time periods. They charge each other some interest rate lower than the market rates. On the same breadth, the central bank which is endowed with significantly high state resources has an obligation to lend to commercial banks. Just the same way banks charge each other some interest rate, central banks charge commercial banks at a rate referred to as the ‘Bank rate”. This bank rate is an important tool for controlling the ability of banks to borrow from the central bank (Monetary policy, 2010, par5).

When the central bank wishes to tighten the money supply in the economy, it imposes some punitive rates on any bank wishing to obtain its funding. This discourages banks from accessing the funds hence reducing their ability to lend to their customers. This reduction in loanable funds constricts money supply. Interest rates rise as a result and inflation is also checked. When the central bank wants to loosen or expand money supply, it reduces the bank rate to levels which encourage commercial banks to access funds much easily. This boosts the ability of the banks to lend. At the same time, when the bank rate is low, the banks can lend out the funds got from central bank at much lower rates and still make some earnings (Stabilization Policy, 2010). These two factors lead to enhanced lending by banks at low interest rates hence increasing money circulation in the economy.

In addition to open market operations and the bank rates, central banks also use the reserve requirement rate to control money supply in the economy. Commercial banks are necessitated by decree to keep up to a certain percentage of the resources as deposits with the central bank. These deposits are known as reserves and do not attract any interest. The rationale of holding these deposits is to mitigate the risk on behalf of depositors who deposit their money with the commercial banks but have no control of how the money is lent out and how secure their deposits are in the hands of banks willing to lend as much as possible to increase their interest rates. It is a very important indicator of the regulator’s (central bank) wishes in matters relating to interest rates.

As a tool for financial regulation, the reserve prerequisite rate may be augmented or decreased by the central bank. When the reserve requirement rate is increased, the commercial banks have to divert more funds to the central bank as opposed to borrowers. As a result, their ability to expand credit offering is highly restricted. This means fewer amounts of loanable funds. Decreased supply of loanable funds attracts higher interest rates through the usual laws of demand and supply. At the same time inflation is reduced. This tool is however less often used by central banks because unlike the OMO and bank rates which are used to influence variables in the short term, this tool has more drastic effects on money supply and effects are largely long-term.

In many cases, the tools are applied each at a time but for purposes of better understanding, an all inclusive expansionary monetary policy would constitute; the buying of government securities by the central bank; a reduction in the bank rate and; a reduction in the reserve requirement rate. The reverse would be true for a contractionary monetary policy; government securities would be sold to the commercial banks; the bank rate would be increased and the reserve requirement would be heightened.

Of great importance is the link between the monetary aspect of the economy and the real economy. This link is established through the interest rates. Interest rates affect the investment levels in the economy which have a direct impact on the growth of the productive capacity of the economy and hence the growth levels of important variables such as output and employment rates. Therefore, the central bank seeks to use this link to influence economic growth in the economy.

This process of employing the bank rate, retention rate and reserve ratio is called money creation. One coefficient combining all these rates is called “the money multiplier” and it measures the extent to which the money creation process is able to grow money supply. The coefficient is the multiple by which the supply of money is greater than the actual existing monetary base. As a result, the implementation of the monetary policy has to be in consideration of the money multiplier (Money multiplier, 2010, par3-7).

In combating the irregularities in the economic growth rate, both monetary and fiscal policies are applied in tandem so as to realize the targeted goals. Depending on the economic environment in question, it may be necessary to apply say an expansionary fiscal policy and a contractionary monetary policy to take care of important issues such as inflation.

Quantitative Easing (Qe)

Motivation of this research

As mentioned above, the concept of QE has attracted much wider debate in recent times. This is because QE has largely been applied by different countries in dealing with the recent economic recession triggered by the financial crisis in the US. The US government has led the way in applying QE as a measure to get banks lending yet again. It passed a 900 billion dollar package to buy securities and even lend to some of the commercial banks in a bid to revive their activities. Even as the American economy recovers from the recession, questions are emerging on both the viability of the policy as well as its long-term effects on variables such as inflation and interest rates.

It is therefore important that the concept is well understood, its history reviewed and its risks analyzed in order to either avert unnecessary fears or indeed reaffirm some notions already held by the public as concerns qualitative easing. This is the total motivation for this research paper.

Objectives of the research

The most important areas of emphasis include defining QE and its closely related policies; establishing the environments requiring its application; assessing its successes and demerits as well as looking at the history of its application with special focus on Japan and the US. In doing these the paper seeks to establish:

- The suitability of Quantitative Easing as a tool for managing money supply

- The situations or environment requiring application of QE

- Historical successes or failures of the policy with special focus on Japan and the US

Through this analysis, effectiveness of QE as implied by central banks in the recent actions is put to test. The effectiveness of the policy is of enormous interest for the entire world as it offers a great experiment of monetary policy in the face of low interest rate which is the case in most developed nations.

The overall objective is to improve the understanding of quantitative easing as a concept and ensure that a larger pool of citizens especially investors understand the possible implications of the policy on the economy. The paper seeks to complete insufficient literature on QE.

Feasibility

This analysis demands substantial investments in terms of time as it is clear that the concept of Quantitative easing has not been widely acknowledged hence requiring more deeper investigations so as to unearth the reality. Again, the policy is currently in operation in the US and Japan is just emerging from its process, hence the data available for the US is not complete. Completeness will be achieved years after the economy exits from the policy.

More importantly, due to the fact that the concept is still considered new, much less scholarly article have been written to shed light on the academic base. As a result a significant part of the information available will be obtained from sources such as media commentaries and expert opinions on the subject. However, there is sufficient information on the definition as well as the risks associated to the policy.

There are also constraints related to availability of time as the two months available to comprehensively explore the topic is not adequate. However, I plan to ensure that I secure the required information early enough to have enough time to do the compilation.

Definition

As alluded to earlier, Quantitative easing is an extreme form of monetary policy which seeks to increase liquidity in the market even when the interest rates have already been reduced to almost zero and other expansionary monetary tools applied to the fullest. It is an unconventional monetary policy. Quantitative implies that a known amount of money is to be created through the QE process. Easing gives an indication that the policy is an attempt to ease the monetary limitations facing financial institutions like banks. The process is also at times referred to as “printing money” however, in reality; it amounts to shifting of money from financial instruments to the financial institutions. It starts with the central bank lowering the interest rate to as low as 0.5% or even 0%. This leaves no more room for application of expansionary monetary policy. The bank is then left with no choice but to create money out of nowhere, usually by just expanding the balance sheet and monetary base. The central bank then uses this money to buy government bonds from financial institutions (Dizikes, 2010, par1-6).

How Quantitative Easing works

Central Banks, or National Monetary Policy Regulatory Agencies have classically used interest rates to control unwanted increases in the general prices of products or inflation which is commonly measured using the Consumer Price Index. The Central Banks hopes to achieve control of inflation by establishing the rate at which it lends to the financial institutions in the economy that conduct lending to other players in the economy commonly referred to as the Bank Rate at a specific strategic level. The bank rate influences other rates in the economy which impact on the level of spending of the firms and households within an economy and therefore impacting on inflation. When the objective of the central bank is to lower inflation the process would be as follows: the central bank raises the bank rate, this implies that lending institutions get cash at a higher costs and therefore charge a higher cost to borrowers. Borrowers are mainly firms and households. When the cost of accessing finance is high the borrowers cut down their borrowing leading to a reduced spending power. Following the classical laws of supply and demand, when the demand falls, prices and thus inflation falls significantly. The theory appears straight forward but many complications exist within economies making the transfer process of bank rate and to inflation very uncertain and many cases very lengthy. It has been documented in many scenarios that the process can take up to two years to work. The implication of this is that monetary agencies have to carefully look ahead and always apply the policy if the future expectations warrant them (Wieland, 2009).

Sometimes the concern of the monetary agency is very low inflation. This is countered by lowering the bank rate and therefore reducing the cost of accessing funds for the major lending institutions, the banks. However it should be understood the bank rate can only fall to as low as zero and not beyond that. This is a critical limitation to the ability of the central banks to handle inflation, but it does not necessarily imply that there is not alternative. If the bank rate has been reduced to close to zero and the uncertainties brought about by low inflation still abound the central bank has to apply another method. The most popular method that has received considerable attention in the last few years is the direct increase of the quantity of money in circulation in the economy. This methods is in theory knows as Quantitative Easing. Monetary agencies in every country monitor inflation levels closely and meet regularly to discussion possible policy recommendations. In normal situations the volume of money in the economy is supposed to grow gradually and in pace with the general growth of the economy. This is usually intended to ensure that inflation remains close to the recommended target. Most of the agencies vote on whether to increase the volume of money beyond the normal level of growth in their economies in case the conditions seem to require that. This has happened in the recent past in the U.S, Japan and the United Kingdom.

Economies of most of the world countries have grown significantly in the last 100 years both in terms size and complexity. In such complex economies money hardly means just the cash. Checkable deposits and other liquid assets nowadays fall under the definition of money. As mentioned earlier, money is usually expected to grow from one year to another. Due to various challenges however there have been periods in the past when many economies have increased the money stock sharply. When the money in the hands of purchasers is high relative to available products, the tendency is usually for the prices to rise (Richard, 1991). This sometimes can be severe. In some other times the purchasing power of spenders is so low that deflation occurs. This poses a different problem. The prices have to be raised somehow, and the best known method is by making people have money. The existence of too little purchasing power poses the risk of breaking down production. This happened in the world economy in 2008 occasioned by the U.S private local debt crises.

The monetary agencies method of making people have money is not by ordering a printing of currencies. Although this can be a way, it is hardly the method applied in modern economies. The agencies create electronic money by expanding their balance sheets and goes to the markets to purchase securities that are held in lieu of money. These securities can be government bills and bonds or private debt issued by institutions like: pension funds, insurance companies, banks and other institutions involved in the intermediation between borrowers and savers. The result is that the sellers of such securities have more money in their hands. On the other hand, the seller’s bankers hold claims in the monetary agency. The end outcome is enhanced purchasing power in the entire economy. This is what is referred to as quantitative easing.

Increased spending power in the economy may have a number of results. The obvious one is that the sellers of securities who now have money in their hands will visit sellers of commodities and make purchases. This will improve the production of the desired products and therefore revive the economy. The same sellers may not opt for commodities and instead go other securities like equity stocks or more bonds. Investors in those securities will reap huge benefits and will therefore be richer and increase their spending. This has the same effect on the economy as that of direct purchase by the original sellers of securities to the government. In the financial markets when prices goes up yields come down. This decreased borrowing cost for households and firms who will then spend more on consumption and investment. This boosts the economy even further. The lending institutions will have bigger reserve which can support more lending. The expansion of the economy is further enhanced (Wieland, 2009).

In normal circumstances monetary agencies do not participate in the private debt markets. They usually concentrate on buying government debt when implementing quantitative easing. However in special situations that might be the only option to achieve the desired result. Sometimes the private debt market becomes chocked and incapable of getting themselves out. This was the scenario in the U.S in 2008 during the financial crises. In such cases the monetary agencies goes directly for private debt. This goes a long way into reviving confidence in investors since they now that incase they want to dispose their toxic securities there is a ready purchaser. This lowers the borrowing rates and therefore businesses and households can maintain or increase their level of investment or consumption. In another perspective the monetary agencies purchase of government and private debt increases their demand relative to supply. This raises the prices and the process follows the same steps as when investors go for the same securities. The economy inflates as an outcome. This provides an alternative route to achieve the same objective of increasing investments.

Although the theory appears very easy to implement, the concerns of the monetary authorities do not end immediately the quantitative easing has been rolled out. There lies ahead the problem of monitoring the economy to ensure that the transmission is occurring as expected. The monetary authorizes have to check what the investors who have sold their assets to the central banks are doing with the newly acquired liquidity and the impact of such activities to the economy and inflation. Another important aspect will be the impact on the lending conditions (Okina, and Shigneori, 2004). The authorities will have to check on the costs and amounts of funds being borrowed. The impact on the capital markets will need to be checked to ensure that the markets are functioning in an even better way increasing the rate of access of capital through the markets for investments. The monetary authorities will therefore have to keep in check the movement in prices of the various assets and commodities, lending patterns of banks, costs of borrowing and availability of funds in the economy. The changes in lending rates are not the only indicator of improving conditions. The authorities will also have to check if there is new growth in production and investments as well as consumption by members of the public.

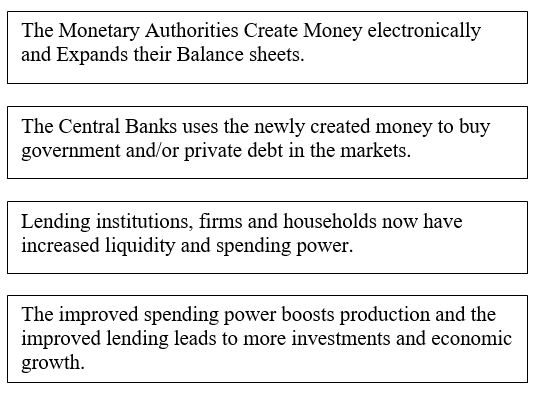

The following is a brief summary of how the process works:

As has been mentioned earlier, QE is applied mainly in the developed world with minimal interest rates. The concept is largely new but gaining popularity in modern day management of monetary policy. Due to the abundance of credit coupled with political pressure at play in many democracies, interest rates have been maintained at very low levels and justified by the need to increase access to funding hence increased productivity which leads to lower unemployment rates. Low unemployment rate is an important ingredient for social stability.

Consequently, when such economies are hit by some economic shocks requiring the application of expansionary monetary policies, the flexibility required to effectively apply the policy is highly limited. Sometimes the central bank is sometimes left with a chance to reduce the interest rates to as low as 0.5%. In many cases, this is not adequate to trigger adequate increases in money supply required to trigger a correction of the economic shock being faced by the economy (Wieland, 2009).

Economists argue that QE works in two main ways. The first is the direct effect described above. It entails a direct surge in the bank’s accounts which avails more funds for lending (Oda and Kazuo, 2005). The second way is through using the cost of finance. After expanding its monetary base, the central bank is in a position to buy an incredible amount of bonds hence reducing the availability in the market. This then creates additional demands for new bonds and interest rates being low, the borrowing process for firms is made much easier. This then increases economic activity in the economy.

Since it is clear that the short term interest rates are at the lowest points possible, it becomes important to project further and address the long-term rates of interest. QE addresses such problems. QE is currently in operations in several countries including the U.S, U.K, Japan and many more seem likely to adopt it especially in the European Union due to the existing credit shortage.

Risks

QE has attracted a huge debate in recent years. Economists are sharply divided on the feasibility of applying QE as well as its ability to lift the economy from recession. Some only associate the concept to the olden day’s practice of simply printing more currency with the aim of expanding money supply but resulting in less significant impact on the real economy. Several risks are associated with the concept of QE as applied to date.

The most obvious risk associated with QE is devaluation of currency. Economic principles dictate that any time an extra dollar is introduced in the economy, and then the value of the existing dollar is decreased. This is in line with the normal laws of demand and supply. This being the case then, action by government to pump huge sums of money into the economy through banking institutions which engage the money multiplier is bound to result in massive devaluation of local currency against foreign currencies. While this may be good news to exporters, it can very well spell doom for the currency’s value in international trade. Today, it is estimated that due to the application of QE by the US, the value of the dollar could decline by about 20%. Such sentiments have made countries such as China question the feasibility of using the US dollar as the world’s major reserve currency.

The second but equally important risk associated with QE is inflation. Economists argue that QE has the potential to trigger high inflation, even hyper inflation especially if improperly applied. This is likely to happen if the central bank employed QE and created too much money. High inflation can be catastrophic for a population already struggling with lowered incomes caused by an economic phenomenon such as a recession. This implies that application of this policy has to be done in a very controlled and monitored environment in order to spot any signs of excessive money creation.

In addition, if the QE was to trigger some form of hyper inflation, it would be difficult to stop it. This is because many times, inflation is driven by perceptions which may remain unchanged when there is proof that QE could be a trigger. The effects of such scale of inflation would be disastrous to the economy (Money multiplier, 2010). Remember, inflation is some form of hidden tax especially on people’s savings. This is because, overtime the value of money decreases marginally hence watering down the real values of savings including retirement benefits.

When the recession starts from within the financial sector, it is difficult to trust the same industry with the recovery process. In the US, the recent economic recession started off within the financial sector which acted overzealously in extending credit hence pushing up housing prices unrealistically. Feeding the same financial institutions with the sums proposed under the QE policy so as to re-ignite credit uptake, in all manner of practice could lead to a similar case of over pricing in future. This means moving from one problem right to another one.

As has been mentioned above, injecting more money in to the economy waters down the value of the currency. This according to economists could destabilize the entire globe’s financial system (Monetary policy, 2010). Financial institutions start engaging in speculations hence increasing instability in the global systems. This could hurt many other countries in the process triggering diplomatic rows.

In addition, QE has potential to introduce a currency war. This is because, the devaluation resulting would mean that local goods become cheaper in international markets while imports costly. The advantage here is for local manufacturers at the expense of foreigners. This could be viewed as a deliberate move causing other countries to start devaluing their currency as well hence the currency war as countries seek to expand exports.

Too much devaluation would mean that the rest of the world’s central banks would not be willing to lend to a seemingly unstable economy. In the long-run this would mean that the options left for the country are few. Any need to borrow would be resisted by other central banks or if accepted, the interest rates would be much higher due to the higher perceived risks.

According to analysts, the worst risk and which appears to manifest in the response to the financial crisis is a case where the banks even after having their loan issuance ability boosted, refuse to extend loans in tandem. Due to the high risk perception, they may deem it too risky to extend loans in an increasingly uncertain environment. The result of this is not only the failure of the economy to improve but also an elongated period of recovery (Kobayashi et al, 2006).

In general, the real risk of qualitative easing is not whether it works or not, rather the risk is seen in terms of the long-term risks it introduces and the fact that the length of time for which the policy holds determines the fatality of the risks involved.

History of Qualitative Easing

The term Quantitative Easing was first used in official publication by the Bank of Japan. On 19 March 2001 the central bank of Japan claims to have implemented a policy with the name quantitative easing. However this is not traceable to any official announcement by the bank in that period. The English version of the announcements and also the Japanese versions do not have any term directly related to quantitative easing. Over the years preceding 2001 the central bank of Japan had openly expressed its disapproval of the operations of such a policy as a method of easing the monetary systems. However the central bank of Japan has in the years following 2001 affirmed consistently that the bank adopted the p [policy of quantitative easing in responding to the tough monetary situation that held its economy in 2001. This is currently the position of the monetary authorities. The term however had been used as early as the beginning of 1990 many stakeholders who were criticizing the policies adopted by the Bank of Japan.

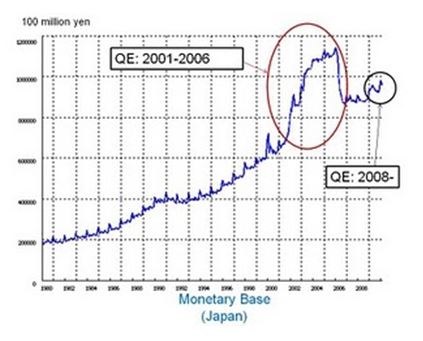

In 2001 the Bank of Japan implemented the policy of quantitative easing which did not yield the expected results. This has since received very harsh criticism from analysts who argue that it was not necessary and the system could have resolved itself even faster without the interference of the central bank. From 1999 the Japanese monetary authorities have maintained the interest rate at a very low level of close to zero. When the policy was implemented in 2001, the Japanese banks were flooded with money. This increased their lending capacity and reserves greatly. The monetary authority purchased government stock from financial institutions to an extent that was not necessary to just make interest rates fall to zero but to beyond that level. This phenomenon is looked in detail later.

During the 2008 world financial crisis that originated in the U.S many economies found themselves in the same position Japan was in 2001. The U.S, UK and the European Union adopted Quantitative easing. The interest rates between banks in these economies had fallen to near zero without much improvement in the economic status if their participants. An alternative policy had to be sought.

Dr. Richard Werner, University of Southampton, School of Management’s Professor of International Banking is usually recognized as having written the phrase, quantitative easing, for the first time and explained the concept in 1994. He was working as chief economist of Jardine Fleming Securities (Asia) Ltd in Tokyo at that time of his writing. He is also recognized for his 1991 alert of the imminent breakdown of the Japanese banking system and economy (Richard 1991).

Dr. Richard Werner in using the phrase quantitative easing he was trying to argue for an alternative form of implementing policies aimed at stimulating the economy by monetary authorities that did not have to go through the often uncertain interest rate method or the overused method of expanding the stock of money in the economy preferred by monetarists. Both these methods Dr. Richard argued were ineffective. Dr. Werner offered instead method that was to work through credit creation employing several techniques to achieve that. He argued that the method was more effective than the other historical ones whose empirical evidence is highly contested (Galindev, 2010). The Dr. had even put a figure on the debt burden of the Japanese financial system. The figure was quiet scaring at 20 % of the country’s GDP. This he argued made Japanese banks very cautious in their lending procedures starving the economy of the much needed lending. Commercial banks in all economies of the world are the most significant lenders. Through the technique of credit creation they avail funds to investors promoting growth. In Japan this had severely been undermined and it was thus the problem confronting the authorities. To resolve the problem his prescription was far reaching. It involved the monetary authority offloading the bad debts in the books of commercial banks, participating in equities market as a buyer giving loans directly to banks purchasing government securities in the markets and dropping the tendency by the central bank to issue bonds to fund its deficits to borrowing from financial institutions in normal loan procedures. Similar measures to what Dr. Werner proposed for the Japanese economy have in the last few years been taken and worked with by other economies in the world notably the U.S to try and boost economic growth.

Dr. Werner did not at first use the term in his many presentations explaining the processes of creating credit in troubled economies. This is probably because during this time a great part of his audience was not being well acquainted with the term quantitative easing. The available term that are closely associated with it had a bad history and would not have been welcome. Dr. Werner decided to make a whole new term for his theory. In his later works and in his famous book on Japanese central bank (Princes of the Yen, M. E. Sharpe, and his 2005 book New Paradigm in Macroeconomics: Solving the Riddle of Japanese Macroeconomic Performance, Palgrave Macmillan), the Dr. proposes that the application of the term quantitative easing may be wrong. The central bank implemented the historical monetary method of expanding the monetary stock while saying that it was implementing the policy recommendations he had put forward. This he had argued would not be effective. It remains to be understood as to why the central bank while having more accurate terms to describe the policy they implemented opted to use Dr. Werner’s, quantitative easing.

Quantitative Easing in application is a very old idea. The oldest traceable application of the method goes back two centuries in the United Kingdom during the reign of Troy. The banks were in trouble and without much sophisticated models or technology the authorities decided to flood banks with liquidity by printing money. QE in modern terms can be inferred to be that same process applied in a situation where the models are sophisticated and the technology very much advanced. In history there have been cases of the use of the policy on several occasions. In the United Kingdom the following periods are easily identifiable.

During the Restriction Period

This was in 1797, a time commonly referred to as the Restriction Period. Money was printed to boost lending by banks. In the February of 1797 the French made the final entrance into Britain using a troop of a couple of thousands men. The place was Pembrokeshire in the United Kingdom the financial system was in a quagmire at the time, this was as a result of constant government borrowing from the Bank of England to finance the expenses of the war between Britain and France and also to extend to ailing governments of its supporters in the war. This last offensive dealt a serious blow to the already ailing financial system. Despite the fact that the French encountered an invincible opponent in form of the Welsh brigade, that event caused an unexpected run on the banks, starting with county institutions and quickly reaching the London city. No bank was prepared for what happened (Dizikes, 2010). The British premier at the time, Mr. William Pitt acted promptly on the strong propositions of a couple of directors from the British central bank to issue an official order demanding the central bank to withhold from accepting bank issued notes for gold. The period of restriction in the authorities mind was supposed to last for very short period. However putting into consideration the measures put to ensure it work it lasted for well over two decades and can be credited as the beginning of the Kingdom’s fiat money system. Later the government was to express displeasure with the policy that largely brought about rising prices and not conclusive evidence of improving the economy.

The 1825Loss of confidence

It did not take long for another episode of quantitative easing to be experienced. In 1825 the policy was used again. The rates if interest, the authorities believed had to maintained low in the period succeeding the restriction period. Investors gained new interest in the Latin American debt markets and equities began to be issued. The government traded a section of its debts accumulated during the battle and lowered the rate of interest on them to 4 % from 5 %. This made speculators loaded with cash which they had to invest. They started looking for new exiting opportunities. The year became one awash with speculation and unjustified returns were promised, bordering on con schemes. Mr. Gregor MacGregor a con master exploited the madness and sold a debt security and real estate for a South American nation with the name Poyais. This was an imaginary country that does not exist but the investors were too greedy to notice. The fraud was later exposed and the casualties were many. The events that followed the exposition of the fraud were dire on banks. Many were caught unprepared and that is when the British central bank invoked its lender of last resort strategy. The administration was under pressure to stop the gold redemption but that was not easy to implement. Instead it is believed by many that the central bank was allowed to make money from nothing. Basically, issuing new money from its vaults. The whole mess was over in less than a year.

The period of the First World War

The last of quantitative easing policy to be applied in historical times in Britain was in 1914. London and especially big investors response to the governments stands on war with Germany was not favorable at all. The capital markets were shut down for many days and on resumption the government declared consecutive controls on investments in an effort believed necessary to divert capital to the battle that was ahead. In desperate efforts to make sure investors were not hurt the government and not the central bank issued new money and put a close on gold redemption. Inflation followed in the years up to 1917. There was a brief reversion to the commodity standard in 1925 and back to fiat money in 1931. Until now the British central bank has never gone back to the commodity standard.

The Effects of quantitative policies

There is no much objective evaluation on the operation of the quantitative policies and the attendant effects. The only reliable work and this is only relatively was done by the International Monetary Fund (IMF). IMF holds that quantitative easing policies have lowered the decade interest rate spot on the Government of Britain borrowing or the yield on the government debt to 3.5 %. This is lowering it by between 0.4 percent -1 percent for the ten year debt. This however can only be a lower estimation from the actual results of the policies. By late 2008 the British governments cost of borrowing was between 2.5 percent and 3 percent. For a two year debt and for a 20 year debt the cost was 5 percent. This was quantitative easing methods were seriously considered by the government. After the quantitative easing techniques were applied the governments cost of borrowing fell by a whole percentage point for the same periods. The fall in the interest rate on government securities are in a low not witnessed for along time. Actually for the time government activities in terms of monetary policies are recorded, there is no lower record. This goes back for 300 years. Interestingly investors who have disposed government securities have shifted to equity markets for alternative investments. The yields on the equity markets in response have gone to almost the same level of return as those offered by government securities notably immediately before the quantitative easing policies were implemented.

The renewed growth in the capital markets have given many companies a positive outlook. Many have even exploited the confidence by expanding their capital bases through equity to offload the bad debt they have been unable to pay for a long time. Some new issuance of equity has also happened in the markets and other companies have issued long term debts under the new terms. In the year ending 2009 capital markets have seen a rise of 150 percent in new capital issued compared to 2008 levels. Many investors in the economy rely on the ten year government debt interest rate as the benchmark. This makes it a very important statistic and tool in the economy. The rate is the lowest investors expected to realize from any investment and therefore every investment proposed is assessed on this rate and is expected to return something higher commensurate with its specific risk. This is assuming the government security is risk free (Creane et al, 2009).

Investors looking for alternative investments in diverse industries are obviously encouraged by the low yield on government securities. The rate is low even by historical comparison. Investments in other vehicles appears quiet good to them. There is however a downside on the continued use of the government rate as the benchmark. This rate is used by actuaries in identifying the position of funds managing pensions. When this rate is too low the measure indicates that the funds performance is bad compared to the years in the past. The pension funds returns therefore at least in theory decline significantly. This undesirable side effect the authorities would want to eliminate. Actuaries have actually made a record estimate of the deficits in returns at a staggering amount of close to 100 billion pounds. Quantitative easing has therefore reminded authorities that there are costs to be taken care of. Many companies have considered rolling up their schemes due to the huge deficits. The annuities have also been negatively affected. Those on annuities are receiving the lowest returns over along time.

Lastly it must be mentioned that the good tidings have not been received by all the players. Big corporations who access the capital markets have a reason to be happy, after all their balance sheets are better now. However for the small businesses whose only source of credit is the banks and other lenders, things are yet to loosen in the manner expected. The reason behind this phenomenon may be because the banks were also adversely affected and when conditions improve the first move is to work on their standing before looking outside for more customers. The umbrella lenders institutions have actually disclosed that lending has fell continuously over the last year especially to private companies without public accountability. This has taken analyst back to the Japan situation that was extremely worrying and would not be desired any other time. The financial system in Japan was in a dire situation and the central banks attempt to jumpstart the lending process by injecting the banks with new liquidity did not have much effect. Analysts and monetary experts described the process as the central bank pushing something that would not move without bending like a string. Although it has been disputed by many economists the central bank of Japan regards its policy as having been successful due to the improvement of the lending conditions that happened 10 years later.

The quantitative easing model has been regarded as successful, however thee exist a couple of easily noticeable areas of uncertainty. Following reason the uncertainty increases the longer the period it takes to implement the policy or the longer the policy remains in force. It would be impossible for central banks to take over the entire debt held by the economic agents and fit it within its books. In the beginning of its implementation the policy gives a signal to the economy that the authorities have no other alternatives and the economy is in a bad shape. Investors are known the world over to react in such situations by disposing off their holdings in government securities in haste. This lowers their prices raising their yields. The yield on government securities as explained earlier is used by economic agents in evaluating other investments. The inevitable result therefore is an increase in interest rate across many sectors hurting lending that the policy is supposed to be rectifying.

Investors usually do this at once making the problem even more dramatic. When the response takes place at the same time there is a pressure for prices to rise as a result of the increased liquidity brought about by quantitative easing, the problem is compounded again (CliffsNotes, 2010). Fortunately in the British case this has not happened. In fact the tendency has been for the prices to decrease bringing in the exact opposite problem of deflation. The central bank however has a reputation of overdoing it and ending up with more liquidity than required for the lending institutions to function properly. The indications from the markets show that the investors fear of an inflation in the British economy than in other major economies currently. The second risk of quantitative easing is that it might lead into a soaring national debt. The relationship is a follows: the central bank is an agent of the state and the government has to take any bad asset held by the bank if it jeopardizes its operations. The volume of the amounts involved is quiet significant. Many believe this has already started taking shape and are very skeptical of the government’s ability to refinance the debt. In the British scenario the quantitative easing debt is held separately from the main books of the central bank. This gives the illusion of stability in the Bank of England which is essentially not the case given the amounts runs into hundreds of billions of pounds. The approach is usually for the central bank to pay above the market levels for the government securities in an attempt to restore confidence. This brings in losses which have to be accounted for somehow. Amounts going up to more than 14 billion pounds have gone to the government as debt through this mechanism. Some officials of the bank of England has stated that the losses have to be absorbed by the government since the agency used to purchase the securities is paid interest by the government.

The third uncertainty about the model of quantitative easing is that despite the relief the policy seems to bring about in the short term, the uncertainties over what usually happens over the medium to long term is substantial and the effects on public finance are highly inconclusive. This most of the times negatively affect the currency involved. In the British scenario experts are postulating that the pound could come down to the level of the euro in the next few years. A depreciating currency obviously hurts national creditworthiness and the cost of capital for the economy in foreign markets rises. This is extremely undesirable as economies try to boost their investment following the 2008 world financial crises.

The last risk which can very easily be downplayed despite it holding significant potency is political risks. Quantitative easing increases the powers of the central bank well into the areas usually left for the government. Of special interest is the area of the influence on government spending. To monetarists this is a good thing since they have never trusted the politicians with the management of public finances. However development experts argue that the power of a state lies in its democratic institutions and the monetary authorities should not be allowed to usurp such powers. The quantitative easing model is usually able to go around the normal procedure of approval of public spending and expenditure through legislative institutions like parliaments pleading that the method is straight forward, necessary and is actually intended to redeem the image of the government.

Examples of Qualitative Easing

Japan

This section analyses Japan’s application of quantitative easing policy in its economy and the effects. This was done over a period of fives years from the begging of the twenty first century. During this period Japanese financial system experienced extreme difficulties despite the bank of japans attempts to lower the bank lending rate. The policy has been operation until fairly recently and therefore the data that would be required for a comprehensive evaluation is not yet available. However that available data indicates some effects that are worth evaluating. The Bank of Japan rolled out the quantitative easing policy in three aspects: one, changing the Bank of Japan’s major working object from the unsecured bank to bank overnight interest rate charge to balances held by the banks on a day to day basis in the current accounts this was to be strengthened by a direct increase of money held by the banks to levels way over the minimum required levels by regulations (Baba et al, 2005). Two, make sure the QE policy is in force until the Consumer Price Index stops changing or inflation stabilizes going forward. Three, raise the amount of Japanese Governments Bond purchase from the banks to ensure the cash balances are at the level desired and objective one. The Bank of Japan argues that as the QE policy was implemented the interbank rate of interest for one day borrowings declined to zero fro unsecured borings. This was obviously remarkable. This achievement however can not be attributed to QE policy solely since it can be achieved by other monetary policies like interest rate targeting. A definite method of separating the effects of QE policy on the zero interbank interest rate and those of zero interest rates during other policy situations would need to be utilized for further analysis of the effects of QE to be possible. For the QE policy since it was a relatively new policy the implications would need to be carefully evaluated and the attendant consequences compared with expectations. There are several ways in which the QE policy effects can be transmitted through they economy and in the Japanese case they all seem to have had an operational effect. In Japan the outcome of the dedication that reduced expected short term rates of interest happened by a channel that was as follows: the markets realized that the zero interest rates were going to remain that low for an extended period than earlier expected. This led investor and analysts to discount the future rates offered on many other financial assets to take into consideration this fact. The coupon rates offered on these other securities therefore fell. The existing quantitative data seem to back this argument for the period of the period of the policy since the decline in the financial assets yield decline over the same period.

The outcome of increasing the volume of money by expanding the Bank of Japan’s books and the cash held by banks can be broken down into two aspects. On one hand this can be as a result of the rearrangement in the proportions of financial portfolios that mainly affects the part of the investments that are based on returns for assets that could not easily be traded for monetary base items. On the other hand it can have resulted from the information content of the policy on the expected rates of interest that investors and markets rapidly factors in the yields of assets traded. There is no much evidence to back the fist hypothesis in the available data. The little effects alleged by a few analysts are so little to be relied upon fro conclusions. The signal effect is however easily backed by the changes that happened on asset yields in the markets for the period.

The effect on expected interest rates in the short term is the strongest effect backed by the QE policy when the past years data is put into consideration. This leads to the conclusion that central banks can not assume the information content of policies if their effects are to be evaluated conclusively. Also monetary authorities should consider carefully the information transmission channels of their policies.

The operation of the QE policy in Japan can be summarized in the following points: First it has previously through experts analysis been demonstrated that maintaining the bank rates at zero over some time have an impact on the expected short and medium interest rates. This happens in efficient economies where the information is factored into the market prices of assets whose market values and yields rely heavily on the general rates of interest. The effect on long term interest rates is however uncertain. This gives mixed policy guidelines when the authorities want to boots investment in production capacities that require long term funds and capital commitments. The effect on investor confidence is also usually established in the short term. In the Japanese case the easing policy that focused on holding the price levels at a stable and low level had greater impact on the interest rates and financial asset prices than the Quantitative Easing policies that focused on working on expected depreciation in the prices of commodities.

Second, the impact of increasing the money held by banks and increasing the size of the Bank of Japan’s books are more uncertain and the conclusions made depends on the transmission method argued for. There are several channels as discussed earlier. The rearrangement of the portfolio compositions are not believed to have had any significant effect on the lending patterns and the interest rates and yield levels. The little effects found are attributable more to the targeting strategies than to the rebalancing effect. However the information effect is not disputed much and is believed to have been the major cause of the observable effects.

Third, the authorities believe that the Quantitative easing policies had an impact on the general macro economic conditions in Japan since the financial system became more bearable later. This however as argued earlier is contested by some economists. In the very least the policies eased the conditions for banks. The channels through which this worked may be disputed but the improvement in the banks reserves can not be rejected as a cause to renewed interest in lending although this happened much later. Confidence in the economy was restored and many corporations as a result stopped worrying about financing their activities as the Bank of Japan had demonstrated that it was ready to maintain stability whatever the costs.

Fourth, the expanded monetary supply did not have recognizable impact on the interest rates in the environment of zero interest rates, and if the was an impact it was not attributable to the money supply. In general the QE policies do not appear to have major impact on demand and investment as well as inflation in an environment of zero interest rates. However it seems to have some impact on keeping the inter bank rates at zero. The more notable reasons for the un-eased economy is the breakdown of the transmission of money from savers to borrowers through banks. This was largely due to the non-performing assets held by the bank making them to be extremely risk averse.

The evaluation of the Japanese situation therefore shows that the strongest connection between QE polices and economic easing is through the impact on the expected interest rates. The implication of this is that in easing an economy that is experiencing the conditions of almost zero interest rates the most critical factor in the operation of the policy would be how the central bank communicates the policy to the stakeholders in the economy. And mostly the response elicited in the financial assets markets.

Historically the empirical data available on the operation of QE policies is very limited and central banks mostly give different terms to the policies they implement even when they are largely similar depending on the transmission mechanism that the central bank hopes will work. This further increases the uncertainties of assessing the results of such policies. Monetary policies have been shown to work in many and often unexpected ways. The results poses even more challenges in quantifying many related variable changes. Obviously as more evidence surfaces on the operations of the policies the conclusions made here will be subjected to evaluation and may even be overturned. However the factors in play are not likely to change much.

The following areas demand more evidence than the currently available data provides and therefore pose more challenges in the evaluation of the policy effects. The rearrangement of the portfolio composition aspect of the policy can not easily be associated with the expected interest rate changes and easing in terms of lending. This area needs more analysis to verify whether the changes in the compositions of investments have a direct impact on macroeconomic variables.

Another issue is the multidimensional targeting of some variable like the inter bank interest rate. In the categorization structure of Eggertsson and Woodford (2003), it does not matter whether the economy has gone into a liquidity trap, it has been observed that the monetary authority’s reliable dedication to boost the economy in the coming years when interest rates in their un-interfered form goes above zero, in theory supposed to be followed by increased national demand and inflation. The process is expected to go through the following paths.

- By increasing the buying volume currently despite the existing interest rates being forced to remain low in line with the overall objective of close to zero long term interest rates.

- By increasing the buying volume through lowered real interest rates. This is achieved through targeted inflation.

- By increasing the buying volume through promised higher incomes in the future.

- When future prices are expected to be high, there is a tendency for current prices to also remain high. This is also another channel.

Existing analysis on the time it takes a policy to realize expected results have focused mainly on the transmission channels. There is no research that has produced conclusive figures on how other paths that do not work through financial markets have performed. Also of importance would be the assessment of the divergence of the stated dedication from the actual dedication to the policy, this would be derived from the changes in demand and inflation in relation to the Japanese economic realities. This would obviously affect the nature of debate on the effectiveness of policies. The number three concern is the proportion to which the quantitative easing policy could have worked were the Japanese economy not have experienced significant reduction in the prices of assets and the reduced capital conditions which were tempered by risk aversion by the Japanese companies and financial intermediaries in the period between 1990 and 2000. When evaluating the impact of policies in an environment of low interest rates in the conventional cycles of business activity, it would be important to clearly identify the impact of the policy coming from the QE policy, structural changes, and the limitation put on the short term interest rates. In 2005 the expenses and profits of sustaining a low interest rate by targeting price levels was evaluated in relation to the size of national demand and inflation changes. The number four concern is the fall in the margin of conventional transactions in financial services as a result of the QE policy. In this respect stakeholder in the market as the past shows usually conclude that reduction in the activity in the short term securities market and reduction in the spread of credit in private debt impacts on the optimization of resource allocation. In an alternative view others take this kind of situation as temporary adjustment expenses that occur when financial model tests fail to work with a interest rate of zero situation. (Bernanke and Reinhart (2004). No experimental analysis with reliable statistical data is available for these approaches and the findings of analysis that will be done in the future are required.

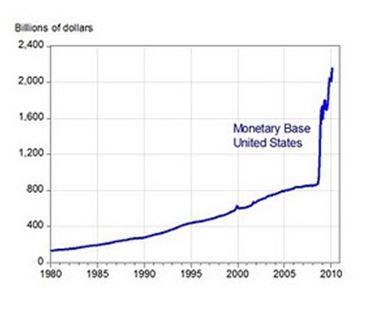

USA

Within the last three years, the US has faced the worst recession since the great depression. It all started with the burst of the housing bubble which saw the prices of overpriced houses plummet at an alarming rate. The prices had risen to unrealistic levels due to a largely unchecked credit market which ballooned demand to enormous heights. The crisis then spread to the rest of the financial sector before spreading to other sectors resulting in a global recession.

According to the Federal Reserve chairman response to the crisis required a similar but adapted quantity easing policy. He stated that the QE would involve expanding the central bank’s balance sheet. However he was quick to state that the US response would be more comprehensive as it would focus on not only expanding the current account balances but also on the security markets as well as loans and their effect on businesses and households in terms of improving credit access.

Despite the successes already being witnessed in terms of economic growth, the effectiveness of QE in the US is yet to be comprehensively determined. Indeed, the policy has attracted wide critics from analysts. Some argue that the policy has led to a deep devaluation of the dollar to the extent of upsetting the global economy and the repercussions may not favor the US. Others have observed that instead of lending locally, American banks are transferring the almost free huge amounts to other countries. Though the banks may benefit due to improved margins, effects on local industries and unemployment in the US are minimal.