Introduction

Government officials, including Congress employees, have access to information they can exploit for their interests. Although several laws obligate Congressmen and other government employees from pursuing personal interests at the expense of the public, the Stop Trading on Congressional Knowledge (STOCK) Act of 2012 is the most outstanding. The legislation aims to prevent insider trading by officials with access to information on market performance and other stock market-related data. The STOCK Act of 2012 has various strengths, making it impactful on American society, government, and businesses.

Events Before Enaction

The U.S. is considered one of the most democratic nations due to its approaches to public grievances. Various events necessitated the formulation of the STOCK Act of 2012. In 2011, CBS’s 60 Minutes program reported that some U.S. Congress members exploited non-public information to invest in the stock markets (Huang & Xuan, 2021). The suspected members were believed to have reaped many profits in the market since they knew how companies would perform before making personal trades (Goodell & Huynh, 2020). The report caused public outrage, calling for a policy to prevent Congressmen from insider trading.

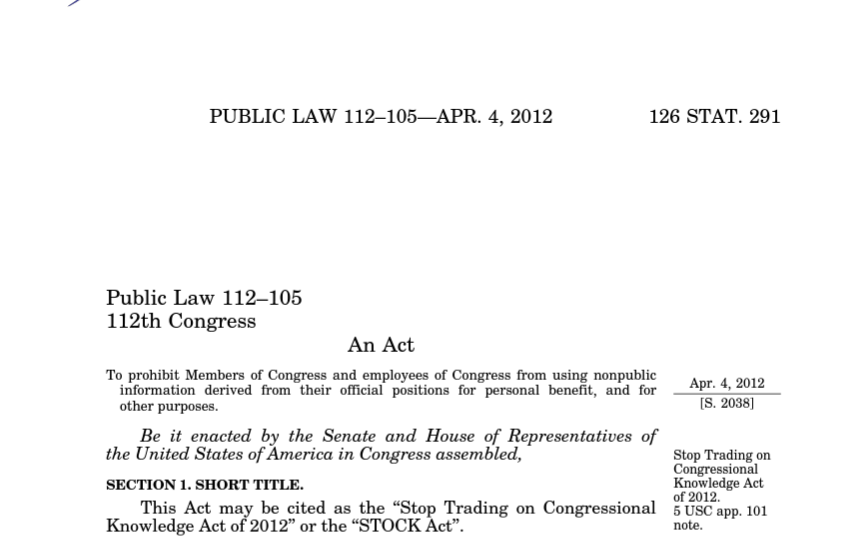

Enactment and Application

Following some Congressmen’s revelations of unethical practices, the STOCK Act was tabled for a motion. The Act was written and introduced by Brian Norton Baird, the then Congressman for Washington (Goodell & Huynh, 2020). Republican Senator Scott Brown and Democratic Senator Kirsten Gillibrand reintroduced the bill following an increasing public outrage.

The STOCK Act was passed in February 2012 in the Senate with only three no votes, marking a step in the U.S. determination to fight insider trading among Congressmen. The Act’s enactment was aimed at promoting transparency and accountability in Congress. Therefore, lawmakers and their staff must disclose their stock trades to counter insider trading.

Current Status of the Policy

While the STOCK Act has been associated with various loopholes, it has played a crucial role in preventing insider trading by Congressmen. The Act underwent some amendments in 2013, in which section 716 was introduced. The amendments prevented online disclosure of stock purchases by government officials so that their information is not publicly accessed (Goodell & Huynh, 2020).

Consequently, the policy has continued to limit insider trading while protecting the privacy of government officials. However, there are some cases of insider trading even after the enactment of the policy. Therefore, there is a need to amend and adopt effective enforcement mechanisms to ensure the STOCK Act is effective.

The Rationale for the STOCK Act 2012: Policies and Social Contract

Governments use policies as tools to counter and avoid unethical market behaviors. Various theories and political philosophies explain the need to regulate behaviors and actions in the private sector. According to the social contract theory, members of society surrender some of their freedoms by submitting to governments.

In return, the members expect the governments to protect their remaining rights while maintaining social order (Umeh, 2021). Policy formulation is one way governments protect their citizens’ interests for social order (Campos & Reich, 2019, p.225). In meeting its obligations under the social contract, the government formulates policies due to government or market failure.

Government Failure

Although the government plays a vital role in representing the citizens, some actions can necessitate a new policy. In public economics, government failure occurs when an economic inefficiency is caused by public officials, such as Congressmen (Campos & Reich, 2019, p.234). In such a scenario, the absence of government intervention would lead to more benefits than harm in the free market (Campos & Reich, 2019, p.227). The STOCK Act of 2012 was necessitated by Congressmen’s involvement in insider trading, which was detrimental to the free market, as manifested in stock trading. Therefore, government failure as a rationale for the STOCK Act of 2012 manifested itself in various ways, as discussed below.

Regulatory Capture

Various public institutions are charged with regulating behaviors and actions in a society. For instance, the U.S. Congress plays a crucial role in checks and balances on the executive branch of the government. Additionally, the institution formulates regulatory policies that ensure public officers act acceptably. The regulatory capture involves public agencies such as Congress becoming dominated by the interests they regulate and not the public (Hehenberger et al., 2019, p.1680). Some U.S. Congressmen involved in insider trading were overpowered by their desire to accumulate wealth rather than encumber such actions for public interests.

Lack of Transparency and Accountability

Transparency and accountability are some of the principles of good governance, especially in managing public resources. As an ethical concept, transparency means operating in such a manner that it is easy for others to see what actions are performed and why (Cumming et al., 2019). For instance, Congressmen exercise delegated powers from the American people, and their actions must be seen. Meanwhile, accountability is accepting responsibility for honest and ethical actions in the interest of others (Hehenberger et al., 2019, p.1682). The report by CBS revealed that some of the Congressmen made stock purchases so that no one could see them, making their actions unethical and dishonest.

Conflicts of Interest

Although public officials have duties and responsibilities to represent Americans, they have personal interests. For instance, a Congressperson may have to balance promoting their private business with the government. Conflicts of interest occur when duties and responsibilities clash with personal interests, making an individual unreliable (Hehenberger et al., 2019, p.1678). While insider trading is criminalized in the U.S., the congresspersons became unreliable by failing to balance their responsibilities in encumbering the crime and their interests in trading in the stock market (Peterson, 2021). Consequently, the STOCK Act of 2012 provided strict measures favoring public interests.

Inadequate Legal Framework

The U.S. has one of the strongest legal systems that sufficiently addresses societal issues. However, the legal framework is vulnerable to changing social needs, so it can inadequately address some issues in society. Before the introduction of the STOCK Act of 2012, stock market activities were regulated by the Securities and Exchange Act of 1933 (Cumming et al., 2019). In collaboration with other company laws, the Act only prohibited insider trading among business leaders such as CEOs.

Meanwhile, the behaviors of Congresspersons were regulated by the Ethics in Government Act of 1978, which encouraged political representatives to act in the interest of Americans. However, the legal framework did not specifically prohibit insider trading by Congress members and their staff. Therefore, the STOCK Act was enacted to address the inadequacy of the existing legal framework.

Public Outrage

The public has the moral authority to ensure that political officials act in a manner that is under the law. The U.S. Constitution permits the public to demonstrate against actions that violate their rights peacefully. Insider trading by some of the Congress members was detrimental to Americans’ investment in the stock market.

Unfair competition and denial of economic rights were associated with insider trading (Cumming et al., 2019). Consequently, public outrage was increased, pressuring the U.S. government to do the right thing. Passing the STOCK Act of 2012 solved the outrage that encumbered social development.

Strengthening Existing Laws

The U.S. has a Common law legal system guided by judicial precedents and statutory laws. While there were many cases of unethical behavior by Congress members, there was no specific case law dealing with insider trading in the context of a CBS report. Also, the Securities and Exchange Act (SEA) of 1933 and the Ethics in Government Act of 1978 proved weak in addressing insider trading among lawmakers. Consequently, the STOCK Act of 2012 was formulated to strengthen the existing laws.

The STOCK Act 2012 Efficacy

Policy effectiveness is measured by its positive impacts on social institutions such as government agencies, businesses, and society. According to the public interest theory, a policy must act to protect the public’s interest (Roestamy et al., 2022). A policy is termed either effective or ineffective through the protection of such interests. In simple terms, public interest means the welfare of the citizens and society (Luscombe et al., 2021). The theory is consistent with Thomas Hobbes’s social contract that justifies political and public arrangements.

Another way of measuring a policy’s efficacy is how it deals with externalities. In political economics, externalities arise when an actor in production makes another actor bear indirect costs (Roestamy et al., 2022). For instance, the involvement of government officials in insider trading causes indirect costs to investors in the stock market. Consequently, the 2012 STOCK Act addressed the adverse effects of insider trading by members of Congress (Luscombe et al., 2021). Understanding the impact of the policy on government, businesses, and society helps in understanding its efficacy in building social trust and protecting public interests.

Impacts on Government

The U.S. government, especially Congress, is one of the institutions that have been impacted by the STOCK Act of 2012. The policy prohibits members of Congress and their staff from using their positions to gain insights for insider trading. The Act brings Congress persons equal to anyone else (Kelly & Crandall, 2022). Insider trading is illegal in the U.S., and no one is exempt from the law.

According to Aristotle, politics is not just about self-interest but also recognizing the state as a community (Luscombe et al., 2021). Consequently, the political representatives should always be ready to be treated equally to other community members. Therefore, the policy is consistent with the philosophical principles of equality and progressive politics.

Another impact of the STOCK Act of 2012 on the government is increased public trust. Politicians are obligated to observe ethical behaviors when acting and representing their people. Section 8 of the Act requires the Secretary of the Senate, the Sergeant at Arms, and the Clerk to develop an electronic system through which the members of Congress can disclose their stock trades (Roestamy et al., 2022). Such a requirement ensures transparency and accountability, which are moral fabrics for public trust in government institutions. Therefore, the STOCK Act of 2012 promotes equality and public trust in the government.

Impact on Society

The U.S. is a democratic society that promotes social, political, and economic equality. The enactment of the STOCK Act of 2012 impacted American society in various ways. The policy promoted public trust and confidence in the stock market (Kelly & Crandall, 2022). The Act set a level ground for all key players in the financial market.

Consequently, there is an increased number of investors in the U.S. financial market since none is allowed to exercise insider trading (Kelly & Crandall, 2022). Moreover, there is a reduced perception of corruption among the members of Congress. The disclosure requirements promote transparency and a consequent positive attitude toward political leaders.

Public engagement is crucial in identifying the problems that are bedeviling a society. The historical background of the STOCK policy shows how the public played a crucial role in promoting the integrity of public offices (Kelly & Crandall, 2022). The passage of the policy had a positive reception from the public since it aimed to provide a solution to problems faced by Americans. Insider trading by government officials was detrimental to economic growth since most investors shunned the financial market. The STOCK Act of 2012 was a clear sign of the public’s importance in solving problems societies face.

Impact on Businesses

Utilitarianism is an ethical philosophy that requires maximizing the well-being and happiness of the affected individuals. According to John Stuart Mill, utility, happiness for the general population, results from good action (Roestamy et al., 2022). In the STOCK Act 2012 context, utility is achieved when businesses enjoy trading freedom in the financial market without restraint. In such a scenario, the happiness of the businesses is being enjoyed at the expense of government officials. Therefore, business entities can make strategic business choices without fear of being exploited by members of Congress who have insider information.

Another impact of the STOCK Act on businesses is increased scrutiny and lobbying limitations. One of the significant characteristics of a free market is a level playing field for fair competition. Trade information disclosure can lead to illegal businesses that promote unfair market competition.

Moreover, lobbyists relying on insider information are limited, making it fair for market participants (Kelly & Crandall, 2022). The STOCK Act serves the public good by addressing the adverse effects linked to insider trading. Consequently, the policy is effective in promoting U.S. social needs.

Policy Analysis and Evaluation

Effective policy implementation requires the effort of all stakeholders, including the government and the public. The implementation of the STOCK Act of 2012 started after it was signed into law by President Barack Obama. The policy requires the intervention of the Secretary of the Senate, Sargent at Arms, and Clerk of the Senate.

The implementors ensure that all members of Congress disclose their financial transactions within 45 days of making them (Samarbakhsh & Shah, 2021). The Securities Exchange Commission and the Department of Justice are responsible for ensuring that the policy’s provisions are adhered to and that any violation is subject to fines, imprisonment, or any other necessary penalty.

Policy Performance and Evaluation

While the STOCK Act has positively impacted U.S. businesses, government, and society, it has a limited scope. The policy requires the members of Congress to disclose only financial transactions made in stock markets. The Act does not require disclosing shares earned through loans, gifts, or investments in private companies not listed on some U.S. public stock markets. Consequently, there are possibilities of conflict of interest for the members investing in private companies based on insider information gained through their public positions (Gleason et al., 2022). The STOCK Act’s limited scope makes it vulnerable to abuse by public officials.

Enforcement Challenges

As with any other policy, enforcing the STOCK Act is associated with several enforcement challenges. There are insufficient funds to promote the enforcement of the policy. While the U.S. is a developed nation with enough resources to enforce policies, it has prioritized some Acts over others (Samarbakhsh & Shah, 2021).

The STOCK Act is an underprioritized policy, and limited resources are allocated to it. Therefore, the insider traders in Congress can easily escape the crime since little effort is made to investigate any potential culprit. Moreover, setting up the reporting system requires human, financial, and technical resources. Therefore, the lack of enough enforcement resources has encumbered the objectives and purpose of the STOCK Act 2012.

Ambiguous Provisions

While the STOCK Act of 2012 is easy to interpret and apply, some provisions are ambiguous. The policy prohibits sharing non-public information for personal gain and insider trading. Such a provision can be hard to prove before a court of law since the accused may have made a trade decision based on their knowledge (Bitan et al., 2022). Additionally, there is no case law or provision within the policy that helps the court determine how non-public information can be said to have been shared for selfish gain by a suspected member of Congress. The ambiguity in law is detrimental to its implementation and application by scholars and legal experts.

Exemptions

Insider trading is a crime that any public official with conflicting interests can commit. Therefore, subjecting all the political representatives to the Act is essential. However, the policy has outrightly excluded the executive: the president and the vice president (Gleason et al., 2022).

Exemption of the executive from the Act presents a lacuna in the law. It raises the question of how public agencies ensure that the president and their vice presidents do not engage in insider trading. While it is argued that including the president may violate their immunity when in office, the exemptions create an unfair ground for the government leaders.

Policy Strengths

Before the enactment of the STOCK Act of 2012, the SEA and the Ethics in Government Act of 1978 were mainly used to counter insider trading among government officials. However, the laws’ indirect provisions allowed most culprits to escape the crime (Bitan et al., 2022). The policy has overt provisions and deals explicitly with insider trading and financial market manipulations by the members of Congress through non-public information. Therefore, the courts of law and other relevant judicial bodies use the Act to strengthen their precedents on insider trading by members of Congress.

Promote Public Morals

The U.S. is a diverse society with citizens of different cultural backgrounds and traditions. However, the community is tied to the unified public morals promoted by the Constitution and the rule of law. The STOCK Act 2012 upholds the principles of natural justice, which prohibit unfair treatment and other forms of discrimination.

The Act treats both sides of the U.S. political realm equally before the law. Moreover, the policy’s discouragement of dishonesty among politicians benefits U.S. social and economic growth (Gleason et al., 2022). Promotion of public morality distinguishes the STOCK Act from some biased and inconsistent with the Constitution.

Public Trust Restoration

The events that culminated in the formulation of the STOCK Act had increased mistrust in the government among the public. Additionally, most financial market investors feared investing in various public entities due to unfair competition (Bitan et al., 2022). However, with the enactment of the STOCK Act, public trust has been restored. Consequently, the U.S. is experiencing social and economic growth in equal measure since the public is ready to collaborate with its representatives in Congress to achieve national objectives. Furthermore, there is increased competition in the stock market, which is healthy for U.S. society.

Disclosure Requirements Modernization

Disclosure of information by members of Congress can be detrimental to the reputation of the companies they have invested in. Initially, the STOCK Act required Congress members to disclose the information on a public portal. However, in 2013, the policy was amended so that Congress members’ information is not made available to the public. Such amendments contributed to the Act’s strength since they promote the privacy of information while discouraging insider trading. Given the strengths of the STOCK Act of 2012, the policy effectively accomplishes its mission of encouraging transparency and accountability among members of Congress.

Recommendations

The STOCK Act’s main challenge is limited and insufficient resources for enforcement and implementation. Future policy formulation should consider including sufficient funds for the implementation and formulation. Resource mobilization can be done by inviting interested parties such as non-governmental organizations and other private bodies. For instance, human rights organizations such as the United Nations can be involved in resource mobilization. Moreover, professionals such as lawyers and technocrats can be encouraged to offer their services for policy formulation. While over-involvement of the private sector may interfere with smooth enforcement activities, parameters can be set to limit their interference.

Intensive Research to Seal all Loop Holes

The STOCK Act has some ambiguous parts that are difficult for legal scholars and judicial officers to interpret. Intensive legal research can help avoid such situations in the future. The policymaker can take various actions to ensure that the policies are well-researched. Legal scholars, including lawyers and educators, can be involved in policy formulation (Kotzé et al., 2022). Involving them will help set clear, straightforward procedures for determining and defining various legal situations. Moreover, there should be an exhaustive comparison of the new policy with the old one, addressing a similar issue to avoid conflict among the existing laws (Li et al., 2022). Policy research is central to avoiding ambiguity and unintended consequences.

Public and Stakeholders Engagement

Policies impact various stakeholders, including public and private organizations. While the STOCK Act targeted Congress members, it significantly impacted business activities and social welfare. Future policy formulations should prioritize engaging the stakeholders for effective enactment and implementation.

The involved stakeholders can give recommendations on how the policies will work effectively. Additionally, involving the stakeholders invites them to collaborate in any activity related to the policy in question (Li et al., 2022). The collaboration may lead to increased resources for policy formulation and implementation. Furthermore, working with the public and private stakeholders improves public trust in the formulation process.

Conclusion

Insider trading among government officials is against the public interest theory. The U.S. is one of the countries that has experienced insider trading, which is unethical behavior among Congress members. The STOCK Act of 2012 was enacted to counter the crime since the existing laws did not directly provide for the crime. Since its formulation, the policy has positively impacted the U.S. government, businesses, and society.

The policy is consistent with Thomas Hobbes’ social contract theory. As an effective policy, the STOCK Act of 2012 has promoted public interest by prohibiting insider trading among members of Congress. Involving stakeholders, intensive research, and sufficient resources can help avoid challenges associated with future policy formulations.

References

Bitan, D., Canetti, R., Goldwasser, S., & Wexler, R. (2022). Using zero-knowledge to reconcile law enforcement secrecy and fair trial rights in criminal cases. Proceedings of the 2022 Symposium on Computer Science and Law. Web.

Campos, P. A., & Reich, M. R. (2019). Political analysis for health policy implementation. Health Systems & Reform, 5(3), 224–235. Web.

Cumming, D. J., Johan, S., & Pant, A. (2019). Regulation of the crypto-economy: Managing risks, challenges, and regulatory uncertainty. Journal of Risk and Financial Management, 12(3), 126. Web.

Gleason, K., Kannan, Y. H., & Rauch, C. (2022). Fraud in startups: what stakeholders need to know. Journal of Financial Crime, 49(4). Web.

Goodell, J. W., & Huynh, T. L. D. (2020). Did Congress trade ahead? Considering the reaction of US industries to COVID-19. Finance Research Letters, 36, 101578. Web.

Hehenberger, L., Mair, J., & Metz, A. (2019). The assembly of a field ideology: An idea-centric perspective on systemic power in impact investing. Academy of Management Journal, 62(6), 1672–1704. Web.

Huang, R., & Xuan, Y. (2021). “Trading” political favors: Evidence from the impact of the STOCK Act. Papers SSRN. Web.

Jagolinzer, A. D., Larcker, D. F., Ormazabal, G., & Taylor, D. J. (2020). Political connections and the informativeness of insider trades. The Journal of Finance, 75(4), 1833–1876. Web.

Kelly, E. C., & Crandall, M. S. (2022). State-level forestry policies across the US: Discourses reflecting the tension between private property rights and public trust resources. Forest Policy and Economics, 141, 102757. Web.

Kotzé, L. J., Kim, R. E., Blanchard, C., Gellers, J. C., Holley, C., Petersmann, M., van Asselt, H., Biermann, F., & Hurlbert, M. (2022). Earth system law: Exploring new frontiers in legal science. Earth System Governance, 11, 100126. Web.

Li, V. Q. T., Ma, L., & Wu, X. (2022). COVID-19, policy change, and post-pandemic data governance: A case analysis of contact tracing applications in East Asia. Policy and Society, 41(1), 129–142. Web.

Luscombe, A., Dick, K., & Walby, K. (2021). Algorithmic thinking in the public interest: navigating technical, legal, and ethical hurdles to web scraping in the social sciences. Quality & Quantity, 56. Web.

Peterson, J. C. (2021). Serving two masters? Public ethics and the regulation of financial conflicts of interest in the administrative state. Albany Law Review, Forthcoming. Web.

Roestamy, M., Martin, A. Y., Rusli, R. K., & Fulazzaky, M. A. (2022). A review of the reliability of land bank institution in Indonesia for effective land management of public interest. Land Use Policy, 120, 106275. Web.

Samarbakhsh, L., & Shah, M. (2021). Did the STOCK Act impact the performance, risk and flow of hedge funds? International Journal of Managerial Finance, 18(5). Web.

Umeh, G.-F. (2021). The social contracts of Thomas Hobbes and John Locke: A comparative analysis. AMAMIHE Journal of Applied Philosophy, 19(2). Web.

Appendix