Introduction

A financial market is a market for funds; an organizational device that brings sellers and buyers together. The parties in a financial market are lenders and borrowers, who come together to meet their financial needs. The operations of the financial markets of any country govern its economic development in its bid to move surplus funds that would lead to inflation, from specific economic units, which include corporate and individuals to those economic units in need of funds Kidwell, Peterson, Whidbee, Blackwell, and Thompson (2010). Financial Markets use different currencies, which calls for different exchange rates.

Exchange Rate

An exchange rate refers to the current market price, which the currency of one country exchanges with another country’s currency. Government involvement in the financial market determines the exchange rate systems used. Governments can influence the extent to which private transactions affect the exchange rate of their domestic currency by applying different exchange rate regimes. The effectiveness of these systems is in the promotion of competitiveness in trade and their impact on the macroeconomic stability of a country Klein and Shambaugh (2009).

Exchange rate regime

- flexible exchange rate regime.

- Fixed exchange rate regime.

Flexible exchange rate regime

In a flexible exchange rate regime, the determination of the exchange rate is by the forces of demand and supply in the market without the intervention of the central bank or the government. In this regime, the market is self-regulating Burton, Nesiba, and Brown (2009).

How it works

The supply and demand forces in the financial market bring under control the forward and backward supply and demand of currencies. For instance, if the world’s preference for motor vehicles increased suddenly, it would lead to Japan producing more vehicles. This leads to high demand for the Japanese Yen. Consequently, it makes Japanese vehicles expensive to foreigners. This will make the Japanese Yen appreciate. This regime insulates an economy from external shock, which would otherwise have led to inflation (Wang, 2009). This is as follows;

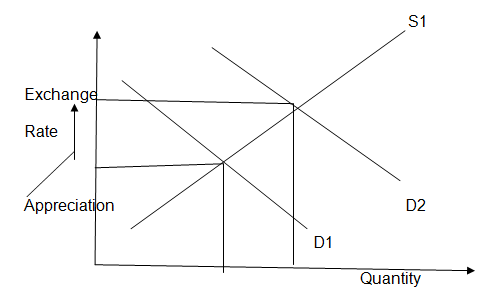

A rise in currency demand from D1 to D2 leads to an appreciation in the market value of the currency.

A change in the supply of money in the financial market affects its supply as follows;

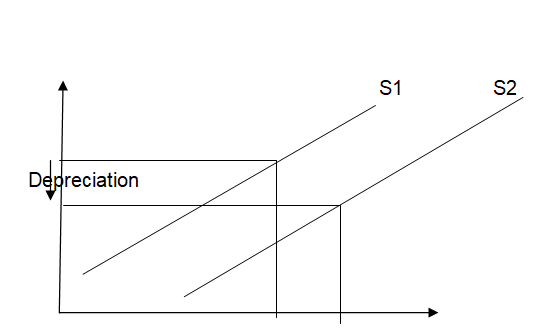

An increase in the supply of currencies in the financial market from S1 to S2 as shown in the graph causes a downward pressure on the market value of the currency. An increase in the supply of money leads to inflation in the economy since it will reduce the purchasing power of consumers and at the same time, there will be a lot of money chasing after a few goods in the market Ghosh and Wolf (2006).

Advantages of a flexible system

- The fluctuations provide automatic adjustment to economies with a huge balance of payments.

- It enables the monetary authority the flexibility to determine interest rates. This is because of the interest rates not requiring being set to maintain the value of the exchange rate Kidwell et al (2010).

Fixed exchange rate regime

The government through the central bank sets the exchange rate. When the government sets the rate, it either appreciates or depreciates the currency. Governments allow for a free flow of investment and trade relations amongst nations by having a fixed rate thus reducing uncertainty Klein and Shambaugh (2009).

How it works

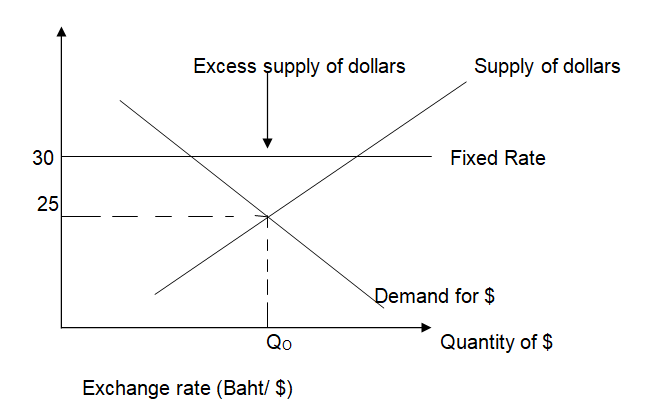

The central bank exchanges the local currency at a predetermined rate. The rate fixed by the central bank is different from the rate in the market. This causes an excess demand or supply of the foreign currency depending on where the market rate is. This system does not give room for the adjustment of the rate by market forces. To do this, the central bank absorbs the excess demand or supply as below Wang (2009). Suppose the Thai government fixes the value of the Baht at 30 Baht/dollar. Suppose that the market rate is 25 Baht/dollar. This is as follows;

When the exchange rate in the financial market is 30 Baht/$, it translates to the fact that there is a high supply of dollars. The government in turn absorbs the economic shock by selling out more Baht. In this case, the government devalues the Baht by making it artificially less valuable. When the Baht is less valuable, imports become expensive while exports become cheaper. This gives exporters an edge against importers and consumers. This acts as an inflationary approach by the government.

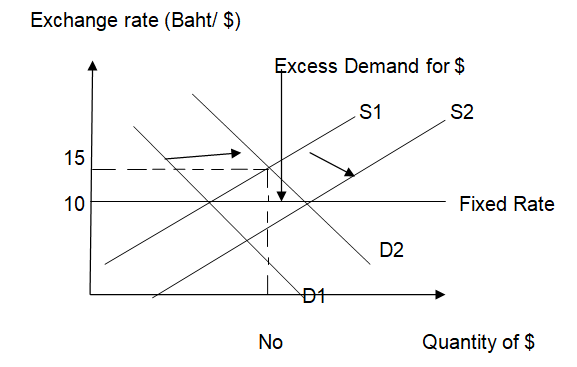

If the government fixes the rate at 10 Baht/dollar when the market rate is 15 Baht/dollar, there will be an excess demand for dollars as shown below;

At this rate, there is an excess demand for dollars and people exchange Baht for dollars. The government absorbs the excess demand by selling dollars. When the Baht is more valuable, imports become cheaper while exports are expensive. This gives consumers and importers an advantage against exporters. This is good as an anti-inflationary measure by the government Burton, Nesiba, and Brown (2009.

References

Burton, M., Nesiba, R & Brown, B. (2009). An Introduction to Financial Markets and Institutions. Sydney: M.E. Sharpe.

Ghosh, A.R., & Wolf, H.C. (2006 ). Does the Exchange Rate Regime Matter for Inflation and Growth? Web.

Kidwell, D.S., Peterson, R.L., Whidbee, D.A., Blackwell, D.W., & Thompson, D. (2010). Financial Markets, Institutions and Money. Boston: John Wiley.

Klein, M.W., & Shambaugh , J.C(2009). Exchange Rate Regimes in the Modern Era. New York: MIT Press,.

Wang, P. (2009). The Economics of Foreign Exchange and Global Finance. Mumbai: Springer.